Brace for historically high inflation, warns Jarden analyst

Price hikes from suppliers passed on to shoppers could see supermarket price tag inflation spike at more than 12 per cent, an analyst warns.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Food price inflation is primed to accelerate this year, with suppliers approaching the biggest retailers, such as Woolworths and Coles with multiple requests for price rises that could push shelf prices to an annual rate of more than 12 per cent.

Australian consumers are now facing similar challenges to those playing out in the US and Britain, albeit with a few months delay, according to Jarden retail analyst Ben Gilbert, who warns price increases are “coming now and are large” to threaten a reduction in shoppers’ spending power.

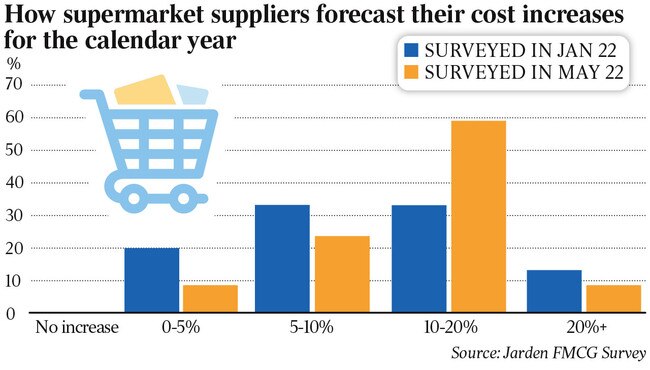

In his latest survey of fast-moving consumer goods suppliers, Mr Gilbert said a survey of 45 suppliers revealed plans for about 6.8 per cent year-on-year price increases to place further pressure on food inflation, which is already hovering at above 5 per cent.

“Price increases are significantly larger than we expected,” Mr Gilbert noted in his survey of key retail suppliers.

“Of suppliers, 66 per cent have already taken price increases — with a further around 20 per cent in negotiations — at a weighted-average increase of 8.6 per cent or 6.8 per cent across the whole sample.

“Further increases are planned — either a second (50 per cent of respondents) or a first at a planned weighted rate of 7.4 per cent. This paints a scenario whereby we could see an annualised run-rate of more than 12 per cent through 2022.”

The forecast will likely send a shiver down the spine of consumers as they face soaring inflation this year, especially across the supermarket aisles where food inflation is leading the pack in terms of recent price increases. Last month the ABS released its latest inflation figures for the March quarter that showed grocery inflation running at 5.3 per cent, which contributed to a breakaway overall inflation rate for the quarter and spurred the Reserve Bank to lift official interest rates last week.

The supermarkets have already begun to pass on price hikes from suppliers to customers, with Woolworths recently reporting shelf price inflation of 2.7 per cent and Coles 3.3 per cent.

Last week the boss of Woolworths’ Australian supermarkets arm, Natalie Davis, noted that around 160 of the top 200 suppliers put in a request for a cost rise, and that the supermarket expected many suppliers to knock on its door for a follow-up price hike within the next 12 months.

Mr Gilbert said, however, the expected price rises of more than 6 per cent at leading retailers would not be enough to offset the estimated 11.3 per cent average cost inflation for suppliers.

“Roughly 90 per cent of suppliers planning to take price increases, with around 70 per cent of price increases planned in the first half of 2022. Our channel checks suggest this began in December 2021, with material price increases forecast from February onwards.”

These price increases, when waved through by retailers, will be historically large, the analyst warned.

“Of those taking price increases, the weighted average forecast price increase was around 6.8 per cent which, if it was to occur, would be in the top quartile range of historical inflation. This, however, will not likely be enough to fully offset supply cost pressures, suggesting margin contraction at the supplier level.”

And shoppers hoping for special sales or promotions when they walk in the store could be disappointed as the promotional spend by suppliers and retailers is wound back.

“Despite retailers and suppliers actively pulling promotions through January, reflecting supply chain issues, not all suppliers are able to concurrently or are planning to reduce promotions,” he said. “We found 49 per cent expect to reduce promotions, while 11 per cent are unsure.”

Originally published as Brace for historically high inflation, warns Jarden analyst