Inflation hits highest since 2001, rising to 5.1pc and threatening a RBA rate hike next week

Economists predict the RBA will raise rates by 0.15 next Tuesday as the largest rise in inflation in 21 years ignites an election battle over economic management.

Home buyers face higher mortgage payments on top of surging grocery prices as the largest rise in inflation in 21 years increased the chances of a Reserve Bank interest rate hike next week and ignited an election campaign battle over economic management.

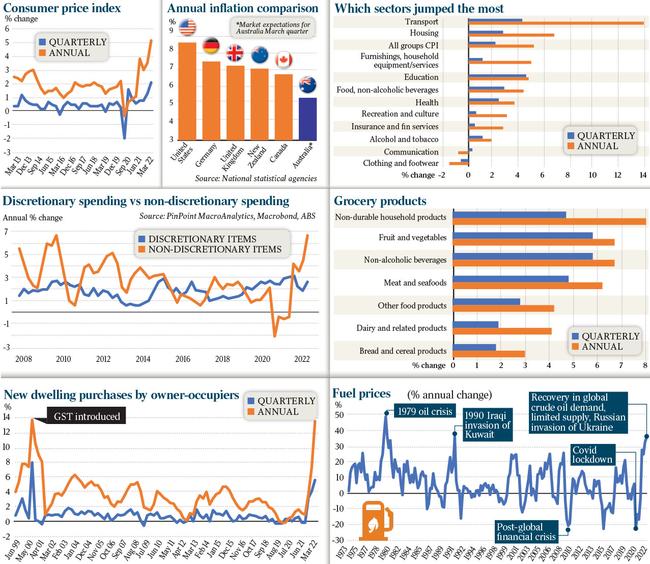

As surging petrol and building costs pushed inflation to 5.1 per cent in the March quarter, the largest increase since the introduction of the GST, market economists predicted the RBA would raise rates by 0.15 per cent next Tuesday adding about $50 monthly to a mortgage of $600,000 if fully passed on by the banks.

Josh Frydenberg laid the blame on international forces, saying the world was witnessing a “time of great international volatility” due to the impact of the war in Ukraine. The opposition seized on the figures with Treasury spokesman Jim Chalmers declaring: “This is the triple whammy that Scott Morrison has presided over: wages going backwards in real terms, cost of living going through the roof and interest rate rises as well.’’

Unions said higher inflation had delivered the biggest cut in real wages this century.

National leaders of the United Workers Union and the Australian Workers Union said they would pursue larger pay claims to account for the higher CPI rate. ACTU president Michele O’Neil said the average worker was on track to be almost $4000 worse off by the end of 2022.

Australia’s inflation rate at 5.1 per cent remains lower than in the US (8.5 per cent), the UK (7 per cent), the euro area (7.4 per cent), Canada (6.7 per cent) and NewZealand (6.9 per cent).

An RBA rate rise would echo the 2007 election campaign and represent the first interest rate rise in a decade.

The government announced an $8.6bn cost-of-living package in the March 29 budget, including tax breaks for low and middle-income earners, $250 payments for seniors and a petrol excise cut of 22c a litre.

But the lift in borrowing costs would increase pressure on households already facing increases in rent, petrol — up 11 per cent in the March quarter alone — and groceries.

Consumer price data from the Australian Bureau of Statistics showed inflation had increased from 3.5 per cent to 5.1 per cent over the 12 months to March, far outstripping economists’ forecasts. Cost-of-living pressures were even more severe than the headline figures suggested. Prices for essential goods and services – such as food and petrol – jumped by 6.6 per cent over the year, more than double the 2.7 per cent increase in discretionary prices.

The RBA targets core inflation of between 2 and 3 per cent over the medium term. The latest figures show the central bank now risks letting inflationary pressures get out of control if it does not move early.

The central bank’s preferred measure of underlying inflation – the trimmed mean, which excludes the most volatile price moves at either end – jumped from 1 per cent to 1.4 per cent over the quarter.

That was the strongest result since the ABS began producing the figure in 2002. The annual rate surged from 2.6 per cent to 3.7 per cent, the highest since 2009.

The consumer price index lifted by 2.1 per cent over the first three months of the year, from 1.3 per cent in the previous quarter.

Economists at ANZ, NAB, JP Morgan, UBS, RBC Capital and Deutsche Bank said on Wednesday the CPI numbers justified a cash rate hike from 0.1 per cent to 0.25 per cent next week, while AMP Capital predicted a 0.4 percentage point lift to 0.5 per cent at the RBA board meeting.

Citi chief economist Josh Williamson pulled forward his call for a 0.15 percentage point hike from August to next week, and said inflation would reach 6.2 per cent by June.

ABS head of prices statistics Michelle Marquardt said the lift in the consumer price index in the quarter and over the year was the biggest since the introduction of the goods and services tax in 2000.

Mr Frydenberg said a tight labour market was pushing wages up, “but what we are seeing is higher inflation”. “That is why we have been providing cost of living relief,” the Treasurer said.

The Covid-19 pandemic had led to major supply chain disruptions that were leading to freight cost increases, in some cases, of five-fold or more. he said.

Dr Chalmers said: “If you think about all the challenges we are facing, groceries are going up, childcare is expensive, power bills are expensive, and to add to that pain, we will have an interest rate rise.”

The Opposition has said that, if elected, it will push the Fair Work Commission to hand down more generous increases to the minimum wage, but the Prime Minister reaffirmed it was not the government’s role to intervene in the independent wage-setting process.

Mr Morrison said Anthony Albanese had “no magic pen that makes your wages go up”. “He’s just not that influential, Mr Albanese,” the Prime Minister said. “It is a con. He’s running around telling everybody he can lift their wages. He can’t do that. He knows he can’t do that. And it’s a false promise.”

Australian Industry Group chief executive Innes Willox warned that pushing through wage rises could add fuel to the inflationary fire and ultimately prove counter-productive.

“While some sustainable adjustments in wages are clearly warranted, excessive wage adjustments will trigger a more decisive increase in interest rates and will constrain the further expansion of domestic activity before it has fully recovered the ground lost over the past two years,” Mr Willox said.

Australian Chamber of Commerce and Industry chief executive Andrew McKellar said the inflation figures confirmed that businesses were being squeezed by rapidly increasing costs while they had a limited ability to pass on these costs to customers.

“International trade bottlenecks are producing supply constraints on a scale not seen in almost 50 years,” Mr McKellar said. “Businesses will undoubtedly face further pressure if the cost of inputs continues to increase at a much faster rate than prices.”

Building a new home cost 5.7 per cent more by March than it did three months earlier, while tertiary education fees climbed by 6.3 per cent. Those, alongside the 11 per cent jump in petrol prices, were the main contributors to the quarterly CPI number.

“Continued shortages of building supplies and labour, heightened freight costs and ongoing strong demand contributed to price rises for newly built dwellings,” Ms Marquardt said.

“Fewer grant payments made this quarter from the federal government’s HomeBuilder program and similar state-based housing construction programs also contributed to the rise.

“The CPI’s automotive fuel series reached a record level for the third consecutive quarter.”

Additional reporting: Ewin Hannan

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout