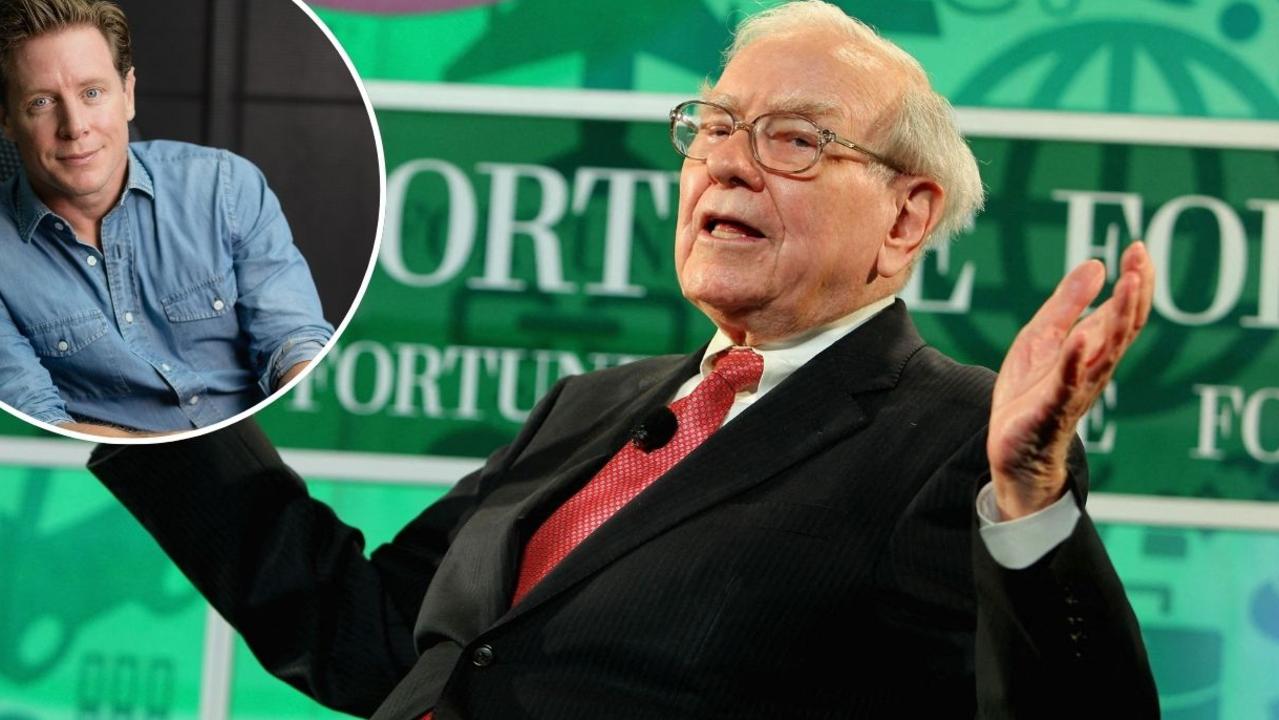

Why Scott Pape is cheering on higher interest rates

Scott Pape likes higher interest rates, which may put him at odds with most other financial commentators. This is Barefoot’s advice on how to get the best deal for your savings.

Barefoot Investor

Don't miss out on the headlines from Barefoot Investor. Followed categories will be added to My News.

A word of warning: what I’m about to say is going to trigger a lot of people.

I’m actually cheering on higher interest rates.

That puts me at odds with practically every other financial commentator … yet I couldn’t care less.

There’s a lot to like about higher interest rates:

They give people an incentive to save money. They discourage people speculating on dumb things. They bring down house prices and give first home buyers a fighting chance to get in. And they help pensioners earn a few crumbs without risking all their money in the share market.

So let’s take a look at how you can get a higher rate on your savings.

Now it’s true for the past few years that rates on savings accounts have just totally sucked. However, over the past few months the banks have really been stepping up their game. You can now earn as much as 4.45 per cent for locking your money away in a two-year term deposit with mainstream finance outfits ‒ known as authorised deposit institutions (ADIs).

Still, I wouldn’t be rushing to lock my money away at the moment. That’s because our old friends, the humble online savings accounts, are now much less sucky. Some online savers are paying as much as 3.6 per cent without having to lock your money away … which gives you the ability to switch if there’s a higher deal somewhere else. So unlike the rest of the media, I’m not going to pander to the postcode panics with every 0.25 per cent rate increase. However as a financial counsellor I do understand that higher interest rates are really hurting those who have borrowed too much. If that’s you, review your finances. Call 1800 007 007 and speak to a free financial counsellor like me.

Tread Your Own Path!

Barefoot Dreams of Ronald McDonald

Hi Scott,

I was listening to the ABC radio this morning. They said the Government is banning payday lenders, and I thought of you. Is this true, and did you have a hand in it? If so, well done!

Megs

Hi Megs

No, it’s not true.

Only in my dreams are they banning predatory payday lending. (In fact, it seems we’re becoming like America … where there are more payday lender shops than there are Starbucks and McDonald’s.)

I’m afraid you got your wires a bit crossed. What you heard on the radio was that Stephen Jones, the Financial Services Minister, is announcing reforms to overhaul these sharks. The plan is to cap a borrower’s repayments at 10 per cent of their income, and stop these sharks from spruiking unsolicited offers.

It’s been a long time coming – people like me have been campaigning about this for years. And while I’m high up on my horse, I have another suggestion for the Minister:

Why not take a leaf out of the cigarette packaging crackdown and make these sharks put warning labels on their payday lending products?

Heck I’ve even had a go at writing it for him (no charge!):

“Dear consumer. This loan is as addictive as heroin. We have designed it this way. (It’s not even risky for us – we’ll just take your Centrelink the instant it hits your account). However, you don’t need to take out this loan. There are interest-free loans available from the likes of NILS (google them, their motto is ‘no interest, no fees, no charges, ever’). And there are even free financial counsellors who can organise payment plans for your utilities and other bills ‒ call them on 1800 007 007”.

And while I’m at it, well done Small Business Minister Julie Collins for funding for free financial counselling specifically for Small Business in the upcoming federal Budget. If you’re a small business owner and you’re struggling, call the Small Business Debt Helpline on 1800 413 828 (sbdh.org.au). They’re bloody good at what they do, and they’ll provide you with expert, independent help with your debts.

How I Screwed My Bank

Hi Scott,

I have had my home loan with HSBC bank for five years. I was shocked when I saw an ad for the same home loan, with the same bank, that was 1 per cent cheaper than I was paying. So I got out my Barefoot bible, read them the script and threatened to switch, and they offered me an even better deal than their advertised rate!

Megan

Hi Megan,

Good on you for calling it out!

Right now most banks are passing on the interest rate hikes in full … yet offering better deals to new customers. Which is kind of like the married dude on Tinder who buys his fling flowers.

None of these dirtbags deserve your loyalty.

The best home loan deals are still with non-bank lenders. The Big Four’s variable rates are all now well over 5 per cent (and 6 per cent in the case of Commbank), whereas the sharpest deals from the online players still have a 3 in front of them (check out comparison site Mozo, which has a list of them).

Here’s another way to think about it: if you switched from a bank to the cheapest online home loan it’s like all the rate hikes this year never happened.

Get Your Money Out of the Banks

Hi Scott,

I have managed to save almost $100,000 for a deposit and am hoping to buy a home on the Gold Coast in the next 12 months. A friend of mine who knows a bank manager of 35 years said the manager has real concerns about what will unfold soon, with talk of banks collapsing. My friend is buying gold and crypto now so that his savings won’t be held in cash. I’m concerned as well but don’t want to invest in gold or crypto as I really want to buy a home soon and will need that cash. What are your thoughts on this?

Dina

Hi Dina

Holy Moly! It’s started again, Ma!

I just know things are heating up when I start getting cray-cray emails like this.

Dina, your source for this salty macroeconomic forecast is ... “a friend of mine who knows a bank manager?”

Really?

If this ‘bank manager’ has stood behind the perspex for 35 years, he should have told your friend – who then should have then told you – that the first $250,000 you have with a bank is covered by the Government Deposit Guarantee (and if you have more than that, you should spread it across multiple banks, not multiple accounts with the same bank).

And if your friend’s friend’s answer to that is “Yeah, but what if the Australian Government goes broke?”, then I’m sorry but I cannot help you.

My advice?

Choose better friends who choose more reliable sources.

Doing It for My Kids

Hi Scott,

I just pre-ordered three copies of your new book for my children. I was recently diagnosed with stage 4 metastasis pancreatic cancer. I may win this battle with cancer, but I may not. I know it’s a long shot, but would you be kind enough to sign and put a message in each book so they know that not only mummy wants them to read it, but also Scott Pape! I want them to read it when they are ready.

Samantha

Hi Samanatha,

You are facing every parent’s worst nightmare.

We all want to know our kids are going to be okay. And if I can help in a small way, consider it done.

Best of luck with your fight. You Got This.

DISCLAIMER: Information and opinions provided in this column are general in nature and have been prepared for educational purposes only. Always seek personal financial advice tailored to your specific needs before making financial and investment decisions.

More Coverage

Originally published as Why Scott Pape is cheering on higher interest rates