Scott Pape’s advice for rich woman who is stuck working

Scott Pape shares TV and podcast picks from his sick bed, plus a message for a wealthy woman whose husband doesn’t want her to retire.

Barefoot Investor

Don't miss out on the headlines from Barefoot Investor. Followed categories will be added to My News.

I’m writing this to you from my bed, where I have been holed up for the past three days.

No, I don’t have the bat-flu … I have the man flu.

Unfortunately this slight variation in virus delivers 75% less sympathy from my wife:

“Oh, so you’re still negative? It’s just a sniffle then? Can you still take the boys to Scouts tonight?”

Anyway, I’m so high on Sudafed right now that I have no idea whether any of this is making sense (though my editor would argue that’s never really worried me before).

To help pass the time, I’ve been going through a lot of podcasts and watched a lot of dodgy TV (I’m looking at you, Larry Emdur). Here are my top picks:

The Coming Recession – The Economist

You think the last few years were crazy?

Just wait till you see what 2023 has in store for us.

We’re heading into a global economic slowdown, and central banks are raising interest rates.

That’s like handing a marathon runner two shopping bags full of groceries to carry for the last 5km.

This year’s hikes have added $900 a month to the average $500,000 mortgage.

And there’s more to come.

The Economist produces long, meaty, rigorously researched articles on the world economy. And, while an annual magazine subscription costs more than my first car, their podcasts are free!

Mirror Mirror (Series 2: Love and Hate) – Channel 10

For Christmas this year my nine-year-old son has asked Santa for a book on quantum physics.

Ho! Ho! Ho!-wever, when my wife leaves the room he puts down the book he’s reading, slyly picks up her phone and starts playing some version of Candy Crush.

It’s like the engineers on the other side of the screen are saying, “Hey kid, don’t bother learning all that hard stuff, just come here and press flashing buttons for hours on end.”

If you want to do hard stuff in 2023, you need to watch Todd Sampson’s Mirror Mirror. It’s a frightening doco on the way that screens are rewiring our brains.

Australia’s Health Revolution – SBS

This show is life changing.

Dr Michael Mosley is a very healthy dude and skinny as a rake, yet for the doco he began

following an average Aussie diet.

The result?

In just two weeks his blood sugar levels became pre-diabetic and his blood pressure became worryingly high. Australia is one of the fattest nations on earth, and it’s killing us.

Thankfully, Mosley believes you can reverse type 2 diabetes, and in this series he shows you how to do it. As I sniffled through this three-parter it scared the hell out of me. Health is wealth, and there are a lot of poor people eating very rich foods. Cough! Cough!

Tread Your Own Path!

My Husband Won’t Let me Stop Working, Even Though We’re Worth $7 Million

Dear Scott,

My husband is in his 60s and happily retired. I am in my mid-50s and still working. We are childless. We have nearly $7 million in assets (including a paid-off house worth about $1.5 million), our dividends are about $500,000 a year gross, and I want out. He is concerned that we’ll run out of money if I stop working. I just don’t know how to sit down and work out when ‘enough is enough’? How do I get my husband to see my point of view?

Christina

Hi Christina,

Your question reminds me of a legendary story by John Bogle:

“At a party given by a billionaire, author Kurt Vonnegut informs his pal, Joseph Heller, that their host, a hedge fund manager, had made more money in a single day than Heller had earned from his wildly popular novel Catch-22 over its whole history. Heller responds: “Yes, but I have something he will never have – ENOUGH”.’

The same could be said for your husband. You could stop working today! With no debts, and $500,000 passive income a year, you have more than ENOUGH.

It sounds like you need a Barefoot Date Night. And if he still doesn’t listen to your concerns, you could gently tell him you could live off $250,000 a year … which is what you’d get if you divorced him. Not that you ever would, of course.

Barefoot Fight Night

Hi Scott,

During lockdown my hubby started a small hobby business to “keep him busy”. It has now taken over, and not in a good way. He runs it with its own account, separate from our family. I didn’t mind this arrangement as, initially, he was saving for a motorbike. Then I discovered he’s been gambling the profits away into crypto. A massive argument ensued. He says he’s “investing for the future” and it’s “his” money. I say he’s misinformed. What say you?

Wendy

Hi Wendy,

I see crypto as being in the same category as betting on the nags, breeding gerbils or buying Pokemon cards. So tell him, “mate if that’s your idea of fun, well, pikachu to you!”

Just gently suggest he only set aside a small amount of money for his fantasy coin fetish … and then get him thinking about directing the bulk of his profits towards something more meaningful.

Like what?

Well, I’d go on a Barefoot Date Night and ask him the following question:

“What do you LOVE to spend money on?”

He might say ‘travel’.

Then you say, “Okay, what’s one experience you’ve always wanted to have travelling?” It might be a cooking class in Italy. It might be the Grand Prix in Monte Carlo.

The key is to get him excited about saving up for a goal, and not defensive (oh, and also to make it feel like it was his idea in the first place).

Barefoot Got Hacked!

Hi Scott,

Have you been hacked? Recently I was tagged by ‘Scott Pape’ from a Facebook page congratulating me on being one of 20 people chosen to “win $1000”. According to a Facebook user called ‘ihack’ on this page, all I had to do was to follow a few simple steps such as clicking on the link to the “official website” and registering my credit card details. I have reported the post, but I also wanted to bring this to your attention.

Sarah

Hi Sarah,

Yes, this is one of the many Facebook scams that target me, or more specifically my followers.

Let me be crystal clear:

I will never contact you via social media, and for a very good reason: I can’t.

You see, my long-serving assistant controls all my social media profiles and I don’t have any of the logins. Honestly, I spend zero time on social media.

As in none.

Finally, Sarah, if anyone actually fell for this scam it’s a sign that it’s time to delete their Facebook account. After all, the scammer’s profile name is ihack?!

Get off the grass!

We Thought Our Daughter Had a Learning Disability

Hi Scott,

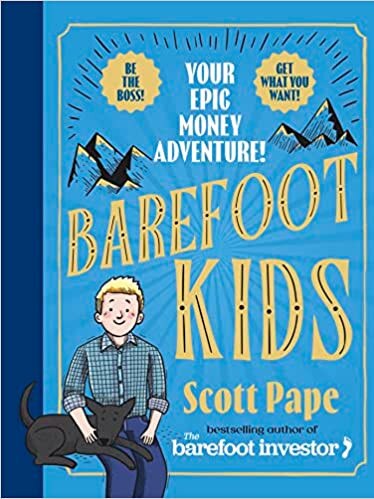

I want to say thank you for writing one of the most incredible books for kids. My eight-year-old daughter has a tendency to read the first chapter of a book then get bored. At first we thought she had a learning disability, until I purchased your book. She was obsessed! Couldn’t put it down and read it twice in three days! She was so into it that she put her headphones on

when reading so no one could distract her. She kept reading it even to and from school. So thank you for helping us start one of the most essential conversations with our kids – about finances – and for validating that she doesn’t have a learning disability. I was just making the wrong book selections!

Lina

Hi Lina,

What a little legend!

You know it’s awesome that kids are reading this book, but what’s even better is that they’re using it to become Barefoot Bosses and teach their parents a thing or two about making money.

Oh, and now that she’s reading, I’ve got another recommendation for her: my kids are loving Nazeem Hussain’s book Hy-Larious Hyena.

Information and opinions provided in this column are general in nature and have been prepared for educational purposes only. Always seek personal financial advice tailored to your specific needs before making financial and investment decisions

Barefoot Kids: Your Epic Money Adventure! (HarperCollinsPublishers) RRP $32.99

If you have a money question, email scott@barefootinvestor.com.

More Coverage

Originally published as Scott Pape’s advice for rich woman who is stuck working