Barefoot Investor reveals his top book gifts for Christmas

Stuck for a Christmas gift? Here are the four books Scott Pape is putting under the Christmas tree. One of them might even help you get a hefty pay rise next year.

Barefoot Investor

Don't miss out on the headlines from Barefoot Investor. Followed categories will be added to My News.

Ho! Ho! Ho!

Years ago, I cracked the Christmas code: I buy people books.

Giving people a book says, “I think you’re the sort of person who can unglue yourself from your screen and spend a few hours learning something. In other words, I think you’re smart.”

And it’s a smart deal for me too: books cost under $30, they don’t require a separate card (I just scribble a Merry Christmas message on the inside cover), and my local bookstore will even giftwrap them for me. Job done!

Here are the books I’ll be putting in my Santa sack this year:

NEVER SPLIT THE DIFFERENCE

By Chris Voss

So inflation is ripping the backside out of your buckets … everything costs more these days.

Which is exactly why you need to negotiate a hefty pay rise – at least 7 per cent – next year.

If the thought of that negotiation fills you with horror, you need to read Never Split the Difference.

Chris Voss is a former FBI hostage negotiator, and his method doesn’t involve being sleazy or manipulative … in fact it’s just the opposite. Instead, he shows you how to get what you want while still being empathetic, understanding and non-confrontational.

It’s both practical and powerful, and I use these techniques in the trenches every day (with my kids).

4000 WEEKS

By Oliver Burkeman

Did you know the average person gets just 4,000 weeks on this planet?

Doesn’t sound like a lot, right?

But it gets worse: you’ve already used up a good chunk of them (I’m about halfway – hopefully).

Heavy, huh?

Yes, it is. And the book’s introduction kicks off cheerfully: “In the long run, we’re all dead.”

Yet that’s what makes this book so interesting: it doesn’t fall for cookie-cutter time management tips, and it takes an axe to the current culture where ‘busy’ has been rebranded as ‘hustle’ and worn like a badge of pride.

Every other time management book I’ve ever read talks about how you can stuff more things into your schedule. This book turns that idea on its head: it smacks you in the face with how little time you have left, and shows you how to really make the most of it.

THE LITTLE BOOK OF COMMON SENSE INVESTING

By Jack Bogle

Over the years I must have given away at least fifty copies of this little classic. (Whenever someone tells me they’re going to see a financial planner, I give them a copy.) Jack Bogle was the founder of Vanguard Investments and is regarded as an ‘investment hero’ by none other than Warren Buffett.

What makes this book so powerful is its simplicity: Jack demolishes Wall Street sales spin and teaches the reader everything they need to know about investing – and how to earn above-average returns – in a little book that you can read in an afternoon.

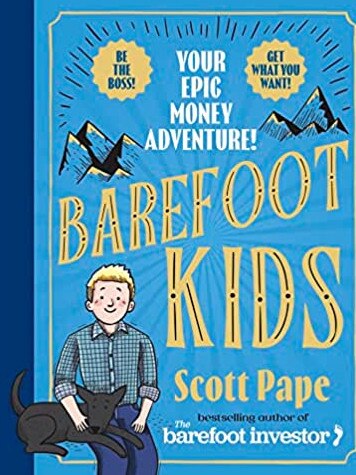

BAREFOOT KIDS (OF COURSE)

Yes, you guessed it, I’ll also be giving a plug to my new book, Barefoot Kids.

I’ve been getting messages from parents and grandparents all around the country that it’s the first book their kids have read cover to cover in a long time. And it makes the perfect stocking-filler – a cheap gift you can actually feel good about buying them.

Tread Your Own Path!

My Wife Has No Idea What I’ve Done …

Hi Scott,

I write this with a heavy heart. Three days ago I found out that the investments that my wife and I were making were a scam. We have lost $90,000, our entire house deposit savings. The thing is, she doesn’t know yet. Tough pill to swallow.

This wasn’t a run-of-the-mill scam like clicking on a link or allowing a hacker access to our banking details – it was a sophisticated scam involving purchasing of ‘shares’ for multiple ‘companies’. What concerns me most is how do I face the shame when telling her? (Yes, she was on board with it at the time, but it was my idea.) During our Barefoot Date Nights, along with other topics, we discuss the shares we’ve ‘purchased’. This is probably my biggest fear – letting her down.

And where to from here? Four years of savings, all gone. Thanks to Barefoot we’ve been debt free, but I’m in such disbelief that our house deposit has vanished. Your words keep replaying through my head: “put it into a high-interest savings account if you plan on using it in the next five years”. Fool me once …

Steve

Hi Steve,

I’m so sorry this has happened to you.

The only thing you can do is to be honest with her. Admit that you screwed up and then quickly ‘assume the brace position’, as they say on the Qantas safety cards.

Then, once the turbulence has passed, I have a practical suggestion for you:

I want you to go on a Barefoot Date Night and ask yourselves the following questions:

– What can we learn from getting scammed?

– How could this be a good thing?

– What are we grateful for?

Look, this scumbag scammer already took your money. Don’t let him steal your most precious assets: your self-esteem and your time. You two got yourself out of debt and built up a deposit in four years. You’re still standing. You have each other. You’ll build back better. You got this.

What’s in a name?

Hi Scott,

Just wanted to let you know how hurtful it is to see my name used as a stand-in for a whinger in last week’s column (‘Karen Gets Angry’). When it’s used by such highly respected people as yourself it just perpetuates it. You wouldn’t believe how many people snigger when I tell them my name. How about you stop stereotyping people?

Karen

Oh, Karen!

I’m sorry for taking such a cheap shot. And I should know better. After all, my family has also been affected by negative name associations: my old man’s name is Donald (as in the guy with the orange hair) and my name is Scott (as in the guy from marketing). This too shall pass, Kazz.

We Got This!

Hi Scott,

I’m sure you must get 20 million of these emails, but I just wanted to say thank you! Barefoot works, your buckets work, and my little four-year-old even has her Jam Jars set up. Our little cottage (built in 1914) may not look like much, but it has a beautiful renovation on the back, big sheds, and 2.5 acres with a round yard perfect for our two ponies. When I left an unhappy relationship a few years ago with very little savings, I never dreamt I could not only pay off my debts (including a car) but save enough for a home deposit. Yet here we are, with a SOLD sticker to prove it. I even have enough in my Smile and Splurge accounts to have fun on weekends and plan a holiday. Life is good!

Rhea and Clancy

Hi guys,

Your home is the spitting image of my favourite home in the world: my grandparents’ house in Ouyen. It had three bedrooms … it raised six kids … and it was like Disneyland for me. That place has so many happy memories. Here’s to you making some of your own. You Got This!

DISCLAIMER: Information and opinions provided in this column are general in nature and have been prepared for educational purposes only.

Always seek personal financial advice tailored to your specific needs before making financial and investment decisions.

If you have a money question, email scott@barefootinvestor.com

More Coverage

Originally published as Barefoot Investor reveals his top book gifts for Christmas