Barefoot Investor’s tips for ‘mouldy, desperate parents’

Being rejected doesn’t have to be a blow, in fact those looking to improve their lives should seek it out, writes Barefoot Investor.

Being rejected doesn’t have to be a blow, in fact those looking to improve their lives should seek it out, writes Barefoot Investor.

A run to save $30 on a camping dunny has exposed a ‘dumb and dangerous’ move that will drive house prices even higher, writes Barefoot Investor.

Trump’s tariffs have sent stocks tumbling, but history favours the patient investor. Here’s why staying the course beats panic-selling, according to Barefoot Investor.

He’s only a kid but Barefoot Investor Scott Pape’s son had some choice words for Treasurer Jim Chalmers about the gaping holes in his budget.

A young couple is ready to pull the ripcord just three months after getting their mortgage because they can’t get their expenses under control. Here’s what Barefoot Investor suggests they do.

Donald Trump believes we are entering a ‘golden age’ of investment returns but legendary stock picker Warren Buffett is screaming ‘SELL’. So who’s Barefoot Investor backing?

HECS is ‘good debt’, Barefoot Investor tells a mother who paid off her struggling son’s $85,000 bill because he was unable to find a well-paying job or save for a house.

In terms of your portfolio, it doesn’t matter who wins the US election, says Barefoot Investor. What does matter is that you buy and hold shares and weather the political storms.

Barefoot Investor tells a bride-to-be who discovered her fiancé’s $9000 Afterpay and Uber Eats debt to ‘give love a chance’ before kicking him to the kerb.

A couple who loaned their son and his partner $30,000 for a home loan only to have them squander it are at odds about what they should do. Scott Pape has some advice.

Scott Pape loves his new kelpie pup but there’s no way he’ll be forking out $60,000 in vet fees like one of his financially-strained, dog-obsessed Barefoot followers did.

‘Learn from my mistakes,’ says Scott Pape, who is kicking himself for being so slow to take up solar which he now regards as one of the best investments you can make.

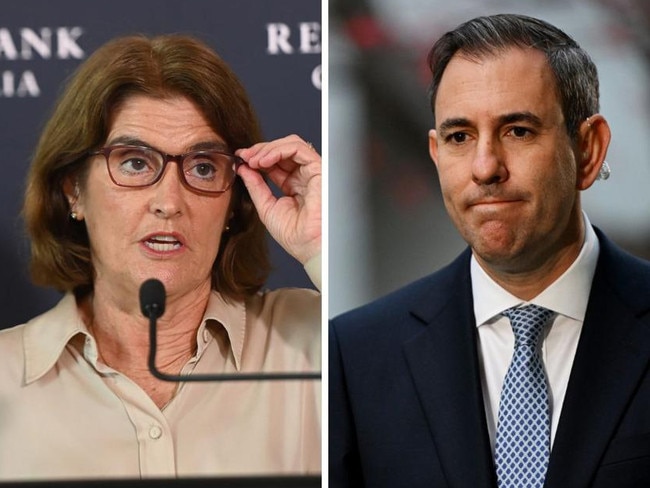

RBA governor Michele Bullock suggests some highly-geared borrowers might have to sell their homes but you won’t hear Jim Chalmers utter the same warning, even though it’s good advice.

Scott Pape admits he was wrong for being sceptical about driverless cars but that doesn’t mean he expects Tesla shares to soar 1000 per cent, as some analysts have tipped.

Original URL: https://www.dailytelegraph.com.au/business/barefoot-investor/page/3