Barefoot Investor says some highly-geared borrowers need to consider selling their homes

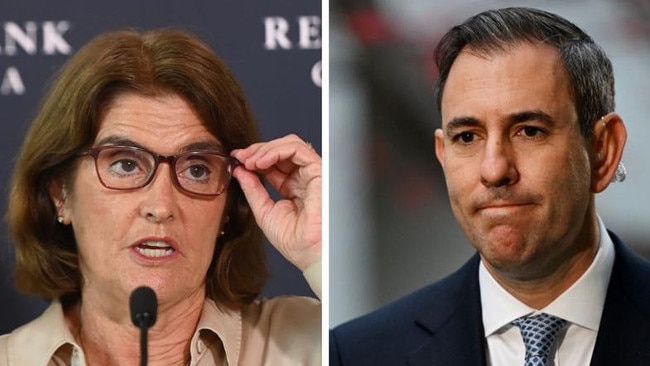

RBA governor Michele Bullock suggests some highly-geared borrowers might have to sell their homes but you won’t hear Jim Chalmers utter the same warning, even though it’s good advice.

Barefoot Investor

Don't miss out on the headlines from Barefoot Investor. Followed categories will be added to My News.

This week, I found myself standing in my underwear while a man took photos of me.

“Oh, this doesn’t look good” he said, getting right up in my grill. “Best we freeze this sunspot off,” said my doctor, walking back to his desk.

He returned with a giant metal canister and pointed it at my temple, Terminator style.

“This … is going to hurt”, he said matter of factly.

“Hey! You are not supposed to say that!” I protested.

Yet it was too late. I felt a stinging sensation for a couple of seconds … and then it was all over.

Contrast this approach to that of another doctor – our Federal Treasurer, Dr Jim Chalmers.

(He’s not a medical doctor, he’s a doctor of political science … in other words, he’s a spin-doctor).

In the past few weeks the Treasurer has thrown a little bit of inner Karen at the Reserve Bank, whining that they are ‘smashing the economy’ by their decision not to cut interest rates.

I actually agree with Jim.

There is no doubt that interest rates are hurting our economy, just as they are in other parts of the world, like the United States, the United Kingdom and New Zealand, all of which, it has to be said, have higher rates than us right now.

Having said that, the Treasurer is doing the equivalent of protesting against a sting on the side of the forehead, while the Reserve Bank is focused on eliminating a potentially cancerous melanoma … in the form of entrenched inflation.

As we’ve experienced since Covid, the effects of runaway inflation are cancerous to the economy … and they hurt people on the lowest incomes the most.

So now I’m going to pick up a giant metal canister and aim it at your temple:

Too many people (and journalists!) have anchored their expectations to ultra-low interest rates. It’s high time we pulled up that anchor and sailed into the sea of sustained higher rates.

(And to be clear, I expect them to be consistently higher than we’ve experienced in the past few years, whether it’s Labor, the Coalition or the Breakdancing Party – don’t discount her: Raygun has better name recognition than Albo or Whatshisname).

Last week, RBA Governor Michele Bullock spoke about the small number of borrowers who can’t make ends meet, suggesting that some “may ultimately make the difficult decision to sell their homes”.

That’s the “this is going to hurt” line my doctor gave me. Which is a ballsy thing to say in her position, but also good advice: if I had a dollar for every time I’d told people in financial stress that they need to consider selling their home, I could rent a house in Ouyen (for a week).

Yet, as a spin doctor (especially one on the eve of an election), Jim sadly can’t say that. Still, if the thought of that causes you heart palpitations, right now is a very good time to get a financial check-up!

Tread Your Own Path!

Warren Buffett’s $5.4 BILLION Warning to investors

Scott,

Why haven’t you written about your idol Warren Buffett selling BILLIONS of dollars worth of his Bank of America shares? Sounds like he knows something we don’t …

Chris

Hi Chris,

So I’m guessing you picked this up from that prestigious financial news digest Daily Mail – which ran this typical Daily Mail headline this week:

“Warren Buffett’s $5.4 BILLION warning to investors after he dumps popular stock – and Wall Street better pay attention”

“Oh my god”, I thought to myself.

Then I spat out my coffee and violently jerked my mouse towards the headline on the screen.

DOUBLE-CLICK!

However, as I read the actual article, I started frowning. Shockingly, it didn’t live up to the headline.

(Does it ever?)

Yes, it’s true that Buffett has sold $5.4 billion in Bank of America shares (well, the actual figure is $7 billion, but … close enough).

So, is he sending investors a warning?

No.

How can I be so sure?

Well, firstly, because the 94-year-old has said publicly thousands of times over his career:

“I have never made any investment decision based on an economic prediction.”

So there’s that.

Yet what was missing from the headline was context:

His Bank of America sale represents … just 0.7% of Berkshire’s overall assets.

(And he still owns a whopping 882 million Bank of America shares, worth US$33.7 billion.) A more likely explanation is that he was taking a profit, given the stock is up 70% since October.

Anyway, just for kicks, I decided to get my Daily Mail on and ask ChatGPT to come up with a clickbaity headline on Buffett that investors could actually use.

Here’s what it came up with:

“Shocking Move: Warren Buffett Bets His Entire Fortune on Just ONE Stock”

It’s true.

For context, in his will, the 94-year-old billionaire is investing his inheritance into one low-cost index fund.

The reason is that Buffett argues that index funds are the best investment for everyone and advises that we should be buying them consistently throughout our lives, saying:

“The temptation when you see bad headlines in newspapers is to say, well, maybe I should skip a year or something. Just keep buying.”

You’re Telling me NOT to Invest in the Stock Market?

Scott,

I’m 50 years old and confused. You recently said: “Don’t save up a deposit in the share market; instead park that money in an online saver or term deposit”. But isn’t the point of investing in shares that you can have the financial freedom to do what you want, like buy a dream house?

Barry

Hi Barry,

How would you feel if after years of saving you found your dream home to buy … and that same day the share market fell and wiped out 25 per cent of your deposit savings?

You’d be pretty bummed, I’d reckon.

I’m not saying that’s going to happen to you, but I am saying that it’s happened at least once before.

That’s why the Barefoot Steps are very clear: until you own a home, the majority of your long-term investments should be via your super. In other words, save for your deposit in a high-interest online saver or a term deposit – not in shares.

Bank CEO is OUTRAGED

Hi Scott,

Another one of your predictions is coming true, with the Government planning on scrapping surcharge fees. I read in the paper today that the NAB CEO said he was horrified after he was slugged with a 10% surcharge for a coffee! Change is coming!

Krishna

Hi Krishna

Wake up and smell the coffee!

Up until now the Government hasn’t given a frappé-latte about the billions of dollars in surcharge fees we’ve been slugged over the years.

So what’s changed?

Albo knows he’s in more muck than a Werribee duck, and he needs to do something about the cost of living before the coming election.

Then there’s the (new) NAB CEO. If he meets his target this year, he’ll earn $5,000,000. Do you really think a 50 cent surcharge is enough to blow the froth off his coffee?

Please.

Look, until they ban surcharge fees, the only hope of getting around the percentage-based surcharge is (annoyingly) to pull out your card and stick it in the machine, or swipe and select ‘cheque’ or ‘savings’ to go through the EFTPOS system, which means you hopefully will be charged only 30 cents or so for the transaction.

DISCLAIMER: Information and opinions provided in this column are general in nature and have been prepared for educational purposes only. Always seek personal financial advice tailored to your specific needs before making financial and investment decisions.

Originally published as Barefoot Investor says some highly-geared borrowers need to consider selling their homes