Barefoot Investor’s guide to navigating treacherous economic waters

Inflation has put an end to our smooth sailing. Here’s what Scott Pape suggests you do this week to get your ship in order as we enter more treacherous waters.

Barefoot Investor

Don't miss out on the headlines from Barefoot Investor. Followed categories will be added to My News.

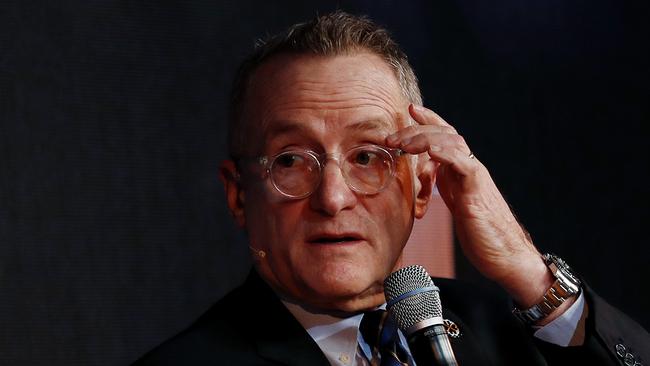

Howard Marks is one of the world’s greatest investors.

He’s so influential that Warren Buffett says that whenever Marks writes anything he stops what he’s doing and reads it immediately.

Late last year Marks wrote about a major ‘sea change’ that he believes will change everything:

“In my 53 years in the investment world, I’ve seen a number of economic cycles, pendulum swings, manias and panics, bubbles and crashes, but I remember only two real sea changes. I think we may be in the midst of a third one today.”

That sea change is what we’ve experienced this year: sustained higher interest rates.

Marks argues that the last 40 years of falling interest rates have provided investors with a wonderful wind in their sails. And, as a consequence, many people still believe that interest rates of 2% are normal.

They are not.

Inflation has put an end to our smooth sailing. Rising interest rates means we’ll soon be moving into much more treacherous waters.

So what does all of this mean for you?

Well, you need to understand that the economic winds are now blowing against you (and all of us).

So let’s focus on you, and where your ship is heading.

Yes, I’m talking to you.

You’ve been putting off making that financial decision, right?

Perhaps it’s selling that dud investment property … or downsizing from your current place.

Maybe it’s reaching out to your super fund’s financial advisor about your retirement … or making the call to get a better home loan rate.

Hopefully it’s to sell your Dogecoin … or perhaps it’s calling the Small Business Debt Helpline (1800 413 828) to admit you haven’t paid your business taxes and ask for their help.

Heck, it could even be to finally make the ultimate (diamond ring) investment.

You may tell yourself that it’s not the right time, or that you don’t have all the facts, or that you’re too busy.

Yet deep down you know they’re all excuses.

So, whatever you’ve been putting off, I want you to do something – anything – towards it this week.

Call your bank. Break up with your stoner boyfriend. Buy some index funds.

And then email me at scott@barefootinvestor.com and let me know what you did (big or small).

I promise I’ll read it.

So go on, name your ‘one thing’ you’ve been putting off, and then set sail!

Tread Your Own Path!

So My Wife Has a Boyfriend …

Hi Scott,

I was reading your article ‘So My Husband Has a Lady Friend’ from last week, and it struck me that this is exactly my story. Except it’s me, the husband, who has discovered his wife is having ‘catch-ups’ with her ex-boyfriend from before we met. I’m gutted. She is already talking about getting her name off joint accounts and is asking about separate bank accounts. I’m very worried because I run my own business and don’t know how this will affect it, as well as the equity we’ve built up in our home (we have put most of the retained profits from the business into the mortgage). Is there any advice you can give dads out there, as this doesn’t only happen to women – it can happen to hardworking, loving, supportive blokes too.

Terry

Hi Terry

Thank you so much for reaching out to me – I can’t imagine how tough this would be for you.

So let me be blunt:

Whether you work it out with your wife or not, the next year or two is going to suck.

You’re going to be put through the wringer emotionally, and you’ll need a lot of time to focus on you. Yet, if you’re the chief ballboy and bottle-washer for your business, something’s going to have to give. It could be your mental health, or the health of your business, or … both.

So here are three meetings I’d suggest you have:

First, sign up to a free Small Business Mentoring Service in your state and get some help setting up procedures and strategies that will allow you to step away from the business when you need to.

Second, talk to the NewAccess for Small Business Owners service (1300 945 301). It’s a government-funded program that matches you with a mental health coach (all the coaches are former small business owners, not bureaucrats) who will have really practical ways to help you manage stress and overwhelm.

Finally, see a family lawyer – this week – and explain exactly what’s going on.

Good luck.

The Magic of Manifesting Money (Without Hard Work)

Hi Scott,

You need to share this book with your audience. It’s called The Magic of Manifesting Money: 15 Advanced Manifestation Techniques to Attract Wealth, Success, and Abundance Without Hard Work.

I read it last Sunday, and then strange things started to take place. My little business scored three new clients which will bring in $15,000, and my husband got a call from an organisation that had found an old long-forgotten insurance policy worth $3,000! Money is energy, and you just have to tune into its frequency.

Taylor

Hi Taylor

Whenever I read about these ‘magical’ money books I think about the favela (slum) I visited in Brazil a few years ago. It was built on the side of a mountain. Tens of thousands of families living in tiny tin sheds, ruled by violent gangs with bigger guns than the police. Surely all these wretchedly poor people needed to do was simply think the right thoughts and they’d magically grow rich?

Oh no, señor, it’s not that easy.

My worry is that if you buy into the belief that it’s the universe’s job to kiss your ring then you’ll be less likely to do the thing that really manifests success (and money): a well-thought out plan backed by hard work and a commitment to taking massive action.

At Barefoot, I’ve noticed a pattern: the most hardcore people who follow my book tend to sort themselves out inside of one year and, if they keep going, become successful (in their terms) in around six years.

The results people manifest frequently astonish me … but there’s nothing magical about it.

The Farmer

G’day Scott,

My name is Sam Williams, I’m 13 years old, and I own a business – a Poll Dorset sheep stud. We’ve had an exceptionally wet couple of years – the sheep have wet feet (which causes lameness), they have skin issues due to moisture, and my first lamb went a little crazy in the yards and broke its neck and died in my arms.

It has been hard, very hard, but it’s my dream. My parents have worked so hard to be supportive and constantly say they don’t want me to have to work to breaking point like Dad, while still appreciating the values and work ethic it takes to get there. I was wondering if you have any words of advice for me, and does it matter if I am forced to sit still for a bit as our finances are tight?

Sam

Hi Sam,

There’s no doubt your parents are proud of you … I am too!

Now let me tell you a little secret, Sam. I bought my farm so that my four kids would learn the lessons and values you’re living: hard work, resilience, and an understanding of where money (and food!) comes from.

Now, to your question.

I don’t think it matters if you’re forced to ‘sit for a bit’ if money is tight. Sometimes it’s the best thing to do, given prices have come down quite a bit (I sold some lambs the other day and got absolutely fleeced).

More importantly, don’t lose sight of the bigger picture either, Sam.

While everyone is getting excited about the future of artificial intelligence, for me a much more fundamental fact is that we need to work out a way to feed billions of people sustainably.

That’s where the smart money is going right now. And with your hard work, country ethics and down-to-earth nature, there’s absolutely no reason you can’t be someone who leads the industry into the future.

DISCLAIMER: Information and opinions provided in this column are general in nature and have been prepared for educational purposes only. Always seek personal financial advice tailored to your specific needs before making financial and investment decisions.

Originally published as Barefoot Investor’s guide to navigating treacherous economic waters