Aussie takes on the banks after scammers stole $11k

After a Melbourne man was scammed out of $11,000 and confronted his bank, he didn’t expect to hear this.

An increasing number of Aussies are falling victim to fraudsters stealing their card details to splash thousands of dollars at JB HI FI stores. Money that most victims will never see again.

Former President of Hawthorn Football Club and current Chair of Golf Australia, Andrew Newbold is just one of countless Australians battling with their banks to have that stolen money returned.

When Andrew received an alert from his credit card provider, Latitude, verifying that a single purchase was made at an Essendon JB HI FI, he assumed that the transaction was for a camera his daughter had purchased earlier that morning.

Little did he know scammers had drained over $11,000 from his credit card, hitting up three different JB HI FI stores around the centre of Melbourne.

After checking his online accounts, spotting four purchases ranging from $4994 to $1997, he immediately put a lock on his card and rang Latitude’s customer service line.

Having alerted Latitude to the fraudulent purchases he was told there was nothing they could do to stop the transactions, as goods had been exchanged in store.

However the saga did not stop there.

Before his second, newly issued card had even arrived at his doorstep, another fraudulent transaction appeared on his account. This time, $50 at a barbecue chicken shop on Elizabeth street in Melbourne’s centre.

Fearing thousands more would surely be spent, and unable to put a lock on a card he had not yet received, Andrew again rang Latitude’s customer service line.

“I couldn’t believe the card was still on its way from Latitude, and the fraudster was still able to use it but I couldn’t,” Andrew said.

Upon talking to a representative from Latitude, Andrew says “I was told they (Latitude) hadn’t removed the token associated with the card.”

Credit card tokenization is a security measure where a customer’s primary account number (PAN) is replaced with a series of randomly generated numbers. It is unclear how exactly the scammers were able to bypass these measures.

Dissatisfied with the response from Latitude, Andrew submitted a transaction dispute and began contacting the JB HI FI stores where the fraudulent transactions had been made.

“I called Essendon JB HI FI and was put through to a manager who informed me that the purchases were in fact made in-store,” Andrew said.

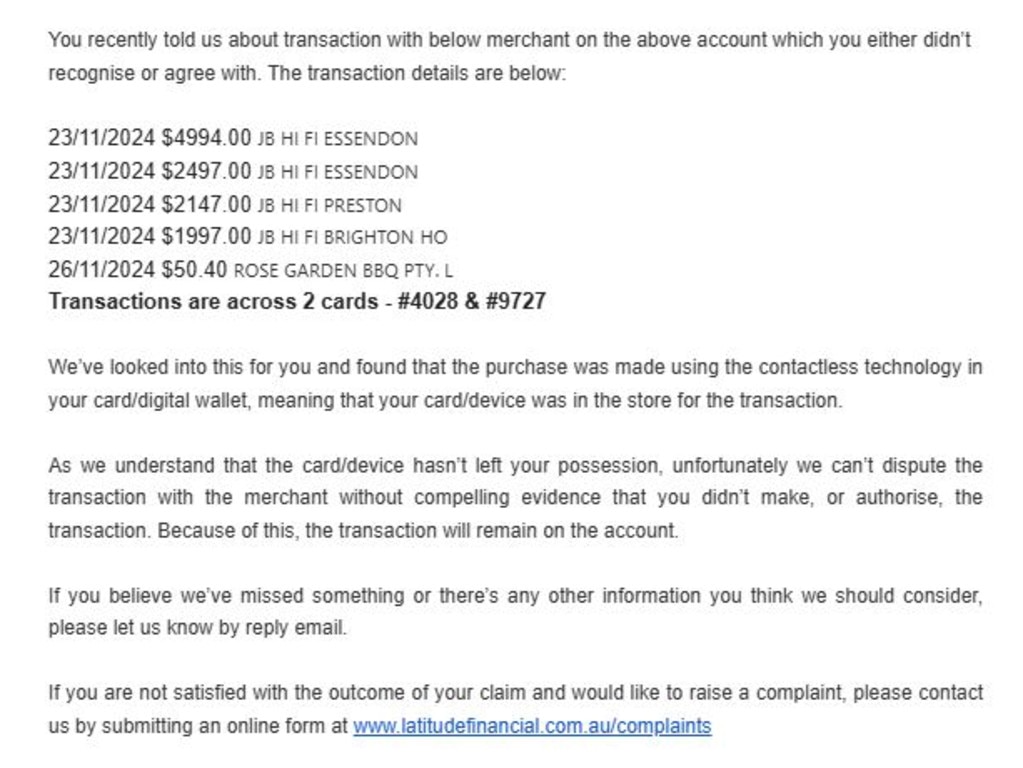

Two weeks later Latitude responded to the dispute but maintained the transactions would remain on the account. A customer specialist from Latitude’s Fraud Claims and Disputes team responded, “We’ve found that the purchase was made using the contactless technology in your card/digital wallet, meaning that your card/device was in the store for the transaction.”

“As we understand that the card/device hasn’t left your possession, unfortunately we can’t dispute the transaction with the merchant without compelling evidence that you didn’t make or authorise the transaction,” they said.

After news.com reached out to Latitude for comment, it backflipped on its decision informing Mr Newbold that his money would be refunded in full with an additional $200 as compensation.

A spokesman for Latitude said, “Latitude has confirmed that the customer was the subject of a sophisticated fraud. We have apologised to the customer and waived the fraudulent transactions.”

“I’m lucky this hasn’t created havoc in my life, but I’m sure for some people it would and that behaviour is unacceptable I would’ve thought.” Mr Newbold said.

“If I’ve lost my actual card or misplaced it, I could sort of understand the bank’s position, but when I’m sitting at home on a Saturday afternoon and I haven’t done anything to put my card at risk, they should definitely be refunding that money.”

Earlier this year the UK implemented measures mandating that all banks using the faster payment system reimburse fraud victims up to £85,000 ($169,121 AUD).

Another victim who requested to remain anonymous, received an email from JB HI FI notifying him of a purchase on his account, but thought they may have mistakenly put down his email for somebody else’s purchase.

However upon checking their bank account they realised scammers had spent almost $2000 on a brand new iPhone 16 through JB HI FI’s click and collect system.

“So they bought the phone online then went in store to collect it and there was never any authentication” the victim said.

“I have absolutely no idea how they were able to hand over the goods, I would’ve thought at this dollar amount there would be two-factor authentication or some kind of identification process in place.”

Citibank has provided the victim with a temporary credit to his account while they investigate the fraud but the victim says this may be a lengthy process.

These are just the latest cases in a spate of frauds sweeping Melbourne’s JB HI FI outlets. Just last month another Melburnian had $14,000 drained from his accounts in a similar fashion, with scammers hitting up five different JB HI FI stores.

After Bendigo Bank refused to refund the fraudulent purchases, he took matters into his own hands to investigate the matter.

“Why don’t (they) want to stop it happening? The bank says they are up to date with scams but prevention is better than a cure – they should get on top of how people are doing it, why they are doing it and make their product more secure.”

Bendigo similarly refunded the $14,000 following outreach for comment by news.com.

Originally published as Aussie takes on the banks after scammers stole $11k