Aussie’s hunt for scammers who stole $14k

A Melbourne man saw his money disappear from his account but was shocked when the bank blamed him. What he did next changed everything.

Costs

Don't miss out on the headlines from Costs. Followed categories will be added to My News.

When an Australian man discovered scammers had gone on a $14,000 spending spree across multiple JB Hi-Fi stores on his credit card but his bank “didn’t care”, he went on the hunt to track down the criminals himself.

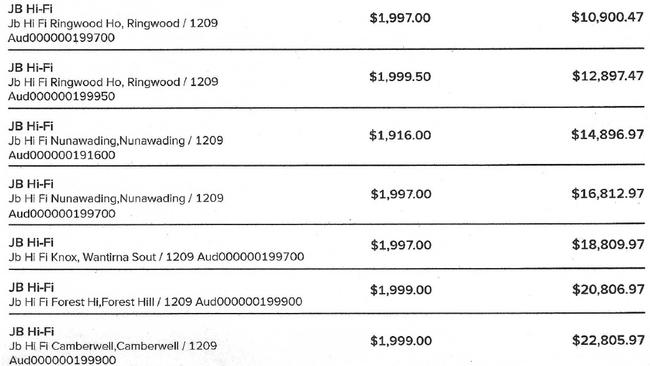

Walter Vantilburg said he noticed seven unauthorised transactions across five different Melbourne JB Hi-Fi stores when he was in his bank accounts paying an employee in September this year.

Yet, the Melbourne man was hopeful his money would be saved when he rang Bendigo Bank about the fraud as many of the transactions were still pending.

But he was told there was nothing that could be done to stop them.

Instead, he watched his money emptied from his bank account in amounts of $1990 – including one transaction that came out while he was on the phone to the bank, he told news.com.au.

While his credit card was cancelled immediately, he said when he chased the matter a few weeks later he was told no fraud report had even been made in Bendigo Bank’s system.

The arborist again followed the fraud up a few week later but a bombshell was dropped.

Bendigo Bank told him he was at fault – accusing him of giving out his credit card details and authorising their use in an Apple wallet.

Have you been the victim of a scam? Contact sarah.sharples@news.com.au

But he denies this ever happened and has no idea how the fraudsters got access to his credit card details as it’s used for his tree cutting business.

“The card never leaves me or my wallet. I use it for fuel, it’s really a business card, that’s the major thing it’s used for things like repairs and parts,” he said.

“My wallet normally sits in a drawer in the office at home. We don’t have a lot of visitors around the house. I’m very conscious about leaving money around and your identification and if anyone had access to anything I would know. Anywhere I go, I have got to have my licence and cards on me.”

The 59-year-old said he had made a report to the police but was told initially no further action could be taken due to a lack of information.

A month later, Bendigo Bank blamed him for the credit card fraud. He was left shocked but he wasn’t going to give up.

Mr Vantilburg then started contacting the five JB Hi-Fi stores where the transactions had been made.

The first store told him there was nothing that could be done and the information would be handed on to their forensics team.

But he hit the jackpot at another store – not only did the JB Hi-Fi manager print out all the receipts but she also uncovered footage from the stores revealing two offenders making the purchases.

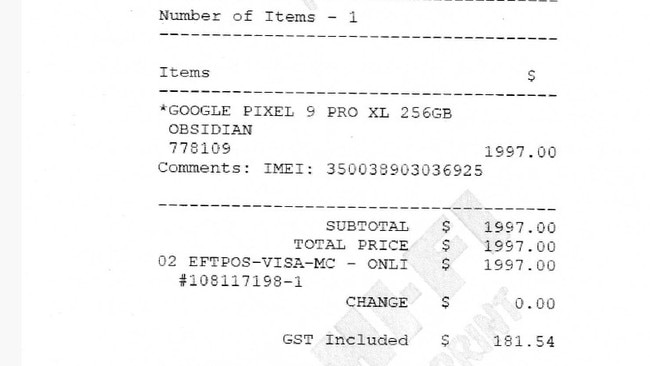

The receipts revealed three Samsung Galaxy Z Flip6 phones in the colour mint, three Google Pixel 9 Pro phones and an iPad pro with pencil had been purchased with the stolen credit card details across the stores.

Mr Vantilburg said he felt he had no choice but to do his own investigations as he had been left in “disbelief” by the response from Bendigo Bank.

“This is what I don’t understand. Bendigo Bank more or less suggests that I had something to do with it,” he said.

“They said it’s your fault we are not going to help you – that’s the attitude I got back. I got no help from them. They just said you have given your card to someone.

“The bank absolutely don’t care. I’ve been a loyal customer for 20 to 30 years and the lack of caring is unbelievable.”

He said to make that $14,000 in savings he had to complete $30,000 worth of work.

“It’s a lot of trees to cut down for that,” he said.

He added that he’s getting married in February and was hoping to pay off the last remaining money he owed to his ex-wife – as despite a amicable divorce – it would be a fresh start.

But the loss of $14,000 made that impossible.

Mr Vantilburg is particularly scathing that banks are advertising products as “secure” but he said his experience shows this isn’t the case.

“We will promote a product and we say it’s secure and you can do all these things with it but if our security isn’t working bad luck,” he added.

“If most people ran their business like that they wouldn’t be in business.”

He noted Bendigo Bank told him tracking the transactions and inquiring with JB Hi-Fi wasn’t their job.

“They say it’s not part of their job to do police work but what happens if it happens to someone else?” he asked.

“Why don’t you want to stop it happening? The bank says they are up to date with scams but preventive is better than a cure – they should get on top on how people are doing it, why they are doing and make their product more secure.”

But after news.com.au reached out to Bendigo Bank for comment, it backflipped on its original decision and informed Mr Vantilburg that the $14,000 would be refunded.

Prior to that in a letter sent to Mr Vantilburg a month after he was scammed Bendigo Bank told him he had not “provided a reasonable explanation on how a person known or unknown to you has gained access to your card details, online banking and one time password to complete these transactions”.

They said the digital wallet would have been protected by a password, facial recognition or password and there was no reasonable explanation on how his digital wallet was used without access to his device.

The letter also notes a verification code from the bank was sent on 27 August to register the digital wallet — but Mr Vantilburg said that was him registering it to his own phone and not related to the offenders.

A Victorian police spokesperson said police are investigating a theft and fraudulent deception in Melbourne’s’ East on 12 September.

“It is believed two unknown offenders used a stolen credit card at multiple stores in Camberwell, Nunawading, Forest Hill, Eastland, and Knox,” they said.

“An estimated $14,000 was spent on the credit card. The investigation remains ongoing.”

Now, Mr Vantilburg wants to see the UK legislation that makes it mandatory for banks to pay bank scam victims, unless there is gross negligence, introduced in Australia — saying otherwise there are no consequences for banks when their customers get scammed.

The amount of friends, family and employees who have also been stung by scams once he started talking about his situation means there is a huge problem, he added

“I want to have a truck parked out the front of the bank with a big sign on it,” he said.

“People need to know this stuff — it’s a bit of a community service that your money isn’t secure here.”

A Bendigo Bank spokesperson said it did not comment on customer matters specifically. They said the bank takes cyber security very seriously by protecting their customers and safeguarding their systems with a variety of cybercrime prevention methods.

“It is important customers take steps to protect themselves and do not share their passwords or allow someone they don’t know or trust to log in to their computer remotely, as it is extremely difficult to recover money that has been transferred to scammers,” they said.

“Bendigo Bank attempts to recover funds lost to scams wherever possible and it goes without saying when the bank is at fault, we will reimburse customers for the loss of funds.”

In the financial year ending 30 June 2024, the Bendigo Bank stopped $34.4 million in fraudulent transactions, the spokesperson added.

“The Bank has tightened transaction rules blocking high-risk payments to cryptocurrency exchanges, removed all unexpected links from SMS messages and significantly increased the size of its fraud prevention and response team,” they added.

Anyone with information is urged to contact Crime Stoppers on 1800 333 000.

sarah.sharples@news.com.au

Originally published as Aussie’s hunt for scammers who stole $14k