Introducing The Missing $49 Million – news.com.au’s first ever eight-part investigative podcast series.

Everything about Alan Metcalfe’s funeral seems ordinary. Except it’s not, not at all. And one word gives it away.

It’s a Wednesday, the first day of March, in 2017, in a Uniting church in Brisbane, Queensland, Australia.

The 32 degree day is hot, sweltering, and a few of the men have taken off their suit jackets. Forty sad faces stare up at the reverend as he delivers his service.

“We are gathered today to give thanks to God for the life of Alan Miles Metcalfe,” the reverend says, before everyone starts singing Amazing Grace.

But hidden among the unremarkable invite posting the details of Alan Metcalfe’s funeral is a word that catches my eye.

“Relatives, friends and shareholders are invited to attend Alan’s funeral service,” it reads.

Shareholders. There were many of them. More than 600 people, from all over Australia and the rest of the world.

Shareholders who believed in Alan Metcalfe, believed in what he was selling. And invested their money – in some cases their life savings – into a scheme the late Queensland businessman was running.

And seven years after his death, they’re still wondering what happened to their money. All $49 million of it.

News.com.au has launched The Missing $49 Million, our first ever multi-part investigative podcast series.

Lots of money has gone missing, no one seems to know where it is and I’m setting out to find it.

The series kicks off today and each of the eight episodes will come out for free every week. Listen wherever you get your podcasts.

The Missing $49 Million investigates the wild life of Alan Metcalfe, who convinced hundreds of hopeful mum and dad investors he had found the secret code to artificial intelligence buried in the Bible.

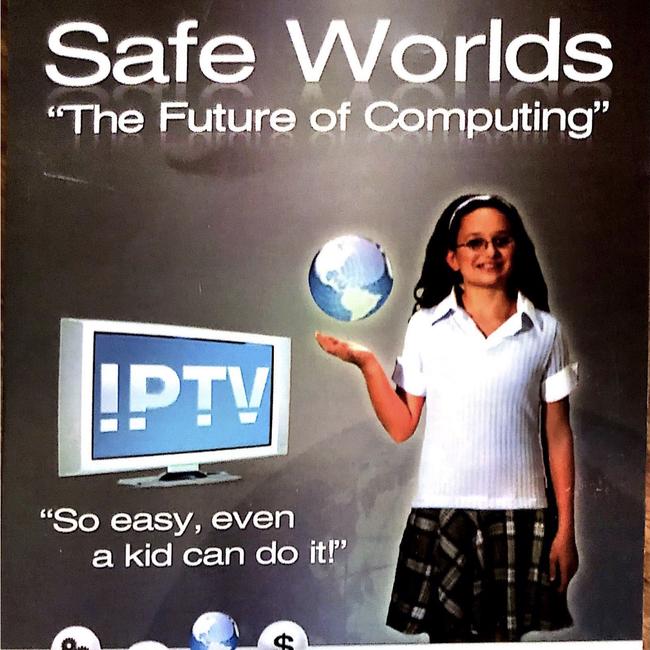

The Gold Coast ‘tech entrepreneur’ launched a start-up called Safe Worlds TV and claimed his company was going to be “bigger than Google”.

Then at the age of 70 years old, Alan died of a heart attack.

The mystery of the $49 million appeared to go to the grave with him.

And perhaps that’s the craziest part of this whole thing – that’s a lot of money.

To put in context, $49 million is about 100 Ferraris, 40 yachts.

$49 million could buy you 49 houses in Sydney. Well, maybe more like Melbourne these days.

It’s more than twice the amount that infamous Sydney con woman Melissa Caddick scammed out of people, which was $23 million.

Do you know more? Get in touch | alex.turner-cohen@news.com.au

There was barely a dry eye at Alan’s funeral and 10 people gave a eulogy, some tuning in and sending video messages from around the world.

“I truly believe he was a genius,” said one admirer. “And I trust the history books will prove that to be the case.”

But years later, that’s not quite what I find when I pick up those history books and look into Alan Metcalfe for myself.

“He’s a conman, deceitful,” said Phil Barndon, a retiree from Western Australia who was among the 600 victims and invested more than $50,000.

David Richardson, an investigative journalist at Channel 9 who met Alan after several of his friends invested, also had a few choice words about the Gold Coast man.

“He struck me as being the kind of guy who could sell ice to the Eskimos,” Mr Richardson said.

“But you just wondered, what was the ice made of?”

Alan undoubtedly had the gift of the gab, a silver tongue.

The accused fraudster had an almost magical ability to part people from their money, when he really had nothing to show for his grand ideas.

Alan launched his company, Safe Worlds, in the early 2000s, during the tech boom when people were looking for the next big thing.

For many, they believed it was going to be Safe Worlds.

Shareholders were dangled with the promise that a public listing was just around the corner, which would make their investment explode and turn them into instant millionaires.

Alan was selling shares for between $0.05 and $5.

When Safe Worlds hit the US stock exchange, it would be worth $150 per share, he said, making them very rich indeed.

One investor put money into the scheme after being told the company’s launch on the stock exchange was just six weeks away.

Another sold his farm and put the lot – $1.5 million – straight into Safe Worlds.

But the company’s stock market debut never quite came to fruition, always just out of reach, tantalising investors like a piece of forbidden fruit.

At first, Alan told shareholders $6 million would be enough to get to an initial public offering, or an IPO, by 2007. Then he said he needed $20 million.

Next it would be the following year. This went on for years.

By the time Alan died in 2017, the company still hadn’t gone public and he was in the middle of another push for $5 million.

And as for the product itself, his supposedly revolutionary tech was supposed to be an ecommerce platform that was a combination of YouTube, Google and Amazon.

Alan put off showing investors the product for years and when the tech briefly went live, it looked like a “crapified” version of its competitors, according to one person.

“Looking at the platform, it was diabolical,” said Mike Brooke, an IT expert from Melbourne who got mixed up in the scheme when his parents invested.

I stumbled across this story after I received a single email.

One investor has been trying to recover his money for the past 10 years and with everything on the line, reached out to me.

Charlie Wijnveen, from the Netherlands, has regularly been visiting Australia since the 1980s.

It was on one of these visits, when speaking to an Aussie friend of his, that he decided to invest $52,000 into Alan’s Safe Worlds project.

For Charlie, that was his life savings.

Alan “was pretty sure of himself that what he had in hand was gold,” Charlie recalled. “He was very convincing.”

He added: “Today, 10 years after the initial investment, we still occasionally get an email with an update but are all convinced that it was all one big fraud”.

I wrote an article on Charlie last year, after a three-month investigation, including the fact that his name had been misspelt on the only piece of proof he was provided that he had made an investment.

After the article came out, I realised it barely scratched the surface on this elaborate scheme. So I decided to dig deeper.

My crusade to find the missing money has taken me all over the country, to most of the capital cities and also a tiny town in Western Australia which could be the key to it all.

The search for the millions has also led me to notorious tax havens like the British Virgin Islands, and had me trying to track down a so-called Irish billionaire. At times, I’ve been looking over my shoulder for Russian cronies.

My investigation will take me from Australia’s richest woman to this nation’s most controversial politician, to American megachurches all the way to ex US President Donald Trump.

And there are also questions about whether he is really, truly dead.

The life of Alan Metcalfe was far from a boring one. As I’m about to discover.

Episode 1 of The Missing $49 Million is available to listen to now wherever you get your podcasts. An episode is coming out every week for the next eight weeks, from July 8.

Available on Spotify here.

Available on Apple Podcasts here.

alex.turner-cohen@news.com.au

‘Too long’: Plan to crack huge housing hurdle

Ahead of major Australian economic meetings next month, a big change to housing has been floated. This is how it could impact your future tax bills.

Bank launches ‘no catch’ savings account

An Australian bank is going “old school” and looking to offer customers a banking product that it said had disappeared.