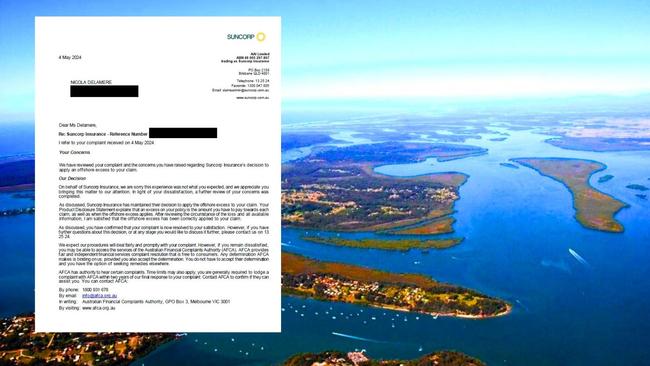

Insurance giants slammed for $500 ‘offshore’ excess fee for bay island claims

Bay islanders are furious because insurers charged a $500 excess on home claims despite being less than 8km from the mainland. They plan to fight the charge through the national watchdog.

Redlands Coast

Don't miss out on the headlines from Redlands Coast. Followed categories will be added to My News.

Residents in one of the state’s lowest socio-economic areas, including an island where six people died in a house fire last year, claim they are victims of “bully” insurance giants after being charged an “offshore excess” fee.

Moreton Bay island residents, excluding Bribie Island, are being charged an extra $500 on all home and content claims by four insurers, on top of a policy excess charge, because they lived on an island.

Island residents said they would take their complaint about the additional “offshore” excess to the Australian Financial Complaints Authority.

They also raised concerns that insurers might stop offering new policies on the islands because of “island risks”.

Insurance on the southern bay islands, about 8km from the mainland ferry terminal, made headlines after a fatal house fire on Russell Island in August when a father and five children died.

Island volunteers had to control the blaze before professional firefighters arrived.

Bush fires, storm damage and tidal disruptions to ferry services have also been raised as island risk factors.

Residents said it was discriminatory, noting that the southern bay islands were less than 8km from the mainland and not flood-prone like some nearby mainland suburbs such as Eagleby where the $500 excess fee was not charged.

Russell Island homeowner Nicola Delamere discovered the extra “offshore” fee when claiming for a freezer after its motor and wiring were ruined during a power surge in March.

It was her first claim with Suncorp, which told her she had to pay the policy excess of $100 plus a $500 “offshore excess” before the claim for spoiled food and a replacement $2000 freezer was honoured.

“I complained about the $500 offshore excess and was told it was standard for all island claims because it is difficult to get assessments done,” Ms Delamere said.

“But I got an island electrician to assess the damage to my freezer, so there should be no additional charge as it was all done on the island.

“This is not an obvious part of a policy and it was not discussed when I signed up.

“There has been a population boom on the islands, bringing many qualified tradies here, so we do not always need to pay for a tradie from the mainland.

“I cannot believe that a giant insurer is taking these punitive measures against island residents when it is the lack of infrastructure that governments are supposed to provide that is letting us down, as we saw in that fatal fire.”

Ms Delamere was finally granted a $500 “hardship payment” because the claim had taken so long to process.

Russell Island resident Greg Hartay-Szabo said the excess fee would deter many island homeowners from taking out insurance.

“The unprecedented property and land value rise on the mainland has forced many to look at the underpriced and artificially suppressed real estate on the bay islands,” he said.

“These are the types of people who will skip home-and-contents insurance in order to get a roof over their heads.

“Some parts of these islands are high bushfire risk because access for timely backup and firefighting resources are limited.

“Instead of putting up our insurance prices, we need a thorough reform of bushfire hazard mitigation.

“The bayside is less than 50km from the state capital CBD and the Gold Coast and yet we are discriminated against and forced to pay an insurance excess.”

Insurance giants Suncorp and its affiliate, AAMI, have been adding the additional “offshore” fee to island claims since at least 2020, while Youi and RACQ do not charge additional excesses based on location.

Suncorp said another of its affiliates, Apia, did not charge the excess.

Suncorp policies have a buyer beware clause and the insurer said the “offshore excess” covered the higher cost to service claims on the islands, which had limited accessibility.

“There are no new excesses being considered for the Moreton Bay Islands,’’ a spokesperson said.

“Excesses that apply to customers’ policies are outlined on their certificate of insurance.

“The additional offshore excess, which has been in place for many years on Suncorp and AAMI policies, covers the higher cost to service the islands with limited accessibility.”

Youi, RACQ and AAMI were contacted for this story.