Fifteen of the city’s under the radar billionaires and millionaires

They’re the everyday people quietly worth millions — here are the amazing stories of how a snake catcher, a gym owner and some savvy business minds have amassed fortunes with few people noticing. FULL LIST

Local

Don't miss out on the headlines from Local. Followed categories will be added to My News.

They’re some of southeast Queensland’s richest people, yet there is a fair bet you have never heard of any of them.

From property management, to savvy business plays and catching snakes as a side hustle, Brisbane’s secret heavy-hitters have all gone about amassing their fortunes in different ways.

Some have splashed out on sports cars and jaw-dropping mansions with their wealth.

Despite their differences, they all prefer to keep a low public profile.

Here are 15 richlisters living under the radar.

TONY MORRISON

A professional speaker, real life treasure hunter, super car owner, snake catcher and wannabe politician, Cleveland’s Tony Morrison can do it all it seems.

For 20 years “Supa Tony’’, as he is commonly known on the car racing circuit, has been the face and voice of countless events.

From the glitz of Hosting the Miss Universe Australia pageants to hosting live action events for Red Bull and at the Ekka, he is everywhere.

Mr Morrison ran for the Senate at the 2013 election on the Australian Motoring Enthusiast Party ticket.

Redlands locals however know him as a snake catcher, aerial photographer, fashion show compere and television host.

Mr Morrison is also a motor sports commentator. He was the voice of the 2013 Adelaide 500 and has presented on Sydney’s Top Gear Live shows.

He has more than 5000 Instagram followers who are fascinated by his lifestyle featuring fast cars, luxe holidays and yellow Lamborghini.

Mr Morrison has been in the media multiple times for his snake catching efforts and rescues.

PETER HULL

What started in the garage in his parents’ house 10 years ago has morphed into a fitness chain with 101 locations across Australia and New Zealand.

By any standards, Fitstop CEO Peter Hull’s business journey has been remarkable.

The company closed off the last financial year with a turnover of $27.9 million.

The first gym opened at Morningside in 2017 with just 30 members.

The Fitstop vision has proven to be a success with Australian athletes — Lee Carseldine, Kris Smith and Ninja Warrior contestant Ryan Solomon have all paid homage to Fitstop.

Fitstop is a leading strength and conditioning fitness franchise offering progression-based group training.

A Redlands local, Mr Hull’s rise began as a humble personal trainer.

In July 2021, Lift Brands bought 30 per cent share in Brisbane-based Fitstop in a strategic partnership that will fast-track the expansion of the franchise fitness group to the US, with plans to open three locations across Los Angeles by June 2023.

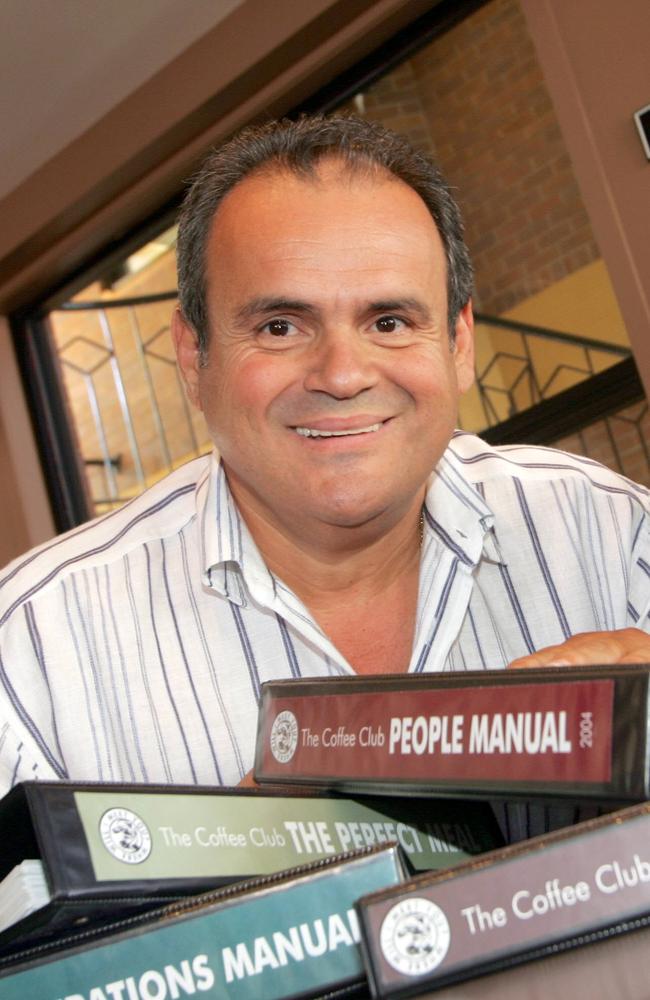

EMMANUEL DRIVAS

Mr Drivas and two mates, Emmanuel Kokoris and Emmanuel Drivas, co-founded The Coffee Club in 1989, starting with just one outlet at Eagle Street Pier.

The trio have since expand the franchise around Australia and into Asia and New Zealand.

Mr Drivas is still a director of the cafe chain, which now has 300-plus locations in Australia and over 60 in New Zealand, Thailand, China and Egypt.

He has also dabbled heavily in property, particularly retail.

In 2015 he paid $27m for the Woolworths Moorooka Shopping Centre on Beaudesert Rd.

There is currently a development application with Council to massively increase the size of the centre, possibly including an Aldi.

The Woolies is believed to be one of the busiest and most profitable in the state, if not Australia.

In 2021 The Coffee Club was inducted into the Queensland Business Leaders Hall of Fame.

It is all a long way from Mr Drivas’ hospo beginnings. He worked a number of jobs in the industry after leaving school at age 15 before starting The Coffee Club.

Mr Drivas plans to one day operate 500 at locations across Australia.

DARVENIZA FAMILY

The son of multi-millionaire property investor Bojan Darveniza, who was left nothing in his late father’s will, was awarded $3 million dollars from his father’s $27 million estate.

Steven Darveniza, the eldest son of Bojan Darveniza, took his father’s widow to the Supreme Court in 2014 to get a share of the estate, claiming he had worked for his father for many years.

Bojan Darveniza died in 2010, aged 78, leaving most of his estate to his second wife, Xiao Hong Darveniza, now known as Jane, who was 30 years younger than him.

Bojan’s personal estate was worth $40 million at the time of his death, but the net value was between $26 and $28 million, the court heard in 2014.

Bojan married twice, had a de facto relationship, and fathered eight children, including three with Jane Darveniza.

The court heard Jane married Bojan less than a year after moving in with him, after agreeing to do “housekeeping duties” in exchange for free accommodation.

Steven told the Supreme Court he was beaten as a child by his father, whom Justice Martin accepted was “an extremely harsh disciplinarian”.

The judge said Bojan’s “degrading treatment and beatings” of Steven included frequently striking him with objects including an electric cord, a piece of timber, a tree branch and a broom handle.

However Steven, who became a commercial pilot, said he worked for Bojan as a boy and young man and had a good relationship with his father before his death.

Justice Martin said Steven deserved better provision from his father’s very large estate because he had worked long and hard for Bojan, contributing to the growth of his property interests.

Two reasons for his father not providing for him in his will were misconceived or based on a misunderstanding, the judge said.

He also accepted Steven could no longer work as a pilot, because of injuries from an accident, and while he had substantial assets, he also had substantial liabilities when his father died.

COURTNEY TALBOT

The daughter of late coal mining billionaire Ken Talbot, who died in a plane crash in the Republic of Congo in 2010, she and other family members have for years been locked in court battles over his estate — worth an estimated $1.1 billion.

Known as a “humble miner’’, Mr Talbot left 30 per cent of his wealth to a charitable foundation.

Two older children from a previous marriage, racing car driver Liam and daughter Courtney, each received 24 per cent.

The remainder was divided between Mr Talbot’s wife and her two children.

Courtney Talbot owns the Summer Land Camels tourist venture at Harrisville, west of Ipswich, plus other property.

In May 2022, she sold two of her dad’s Brisbane riverfront properties at Bulimba for $10.4m.

The homes, at 35 and 39 McConnell St, occupy 2123 sqm of prime land stretching 40m along the Brisbane River and were described by the agents as “a truly rare offering in one of Brisbane’s most prestigious enclaves”.

Number 35, which Ms Talbot bought for $3.8m in 2016, was valued by CoreLogic as being worth up to $6.38m when put on the market.

The two-level, five-bedroom home features a glass-encased pool with diving boards and full bathroom, four-car garage, private jetty and pontoon with jet ski slip.

Number 39, owned by Ms Talbot’s company Artemis Investments, was valued at up to $4.92m, according to CoreLogic.

In 2018 she was awarded Queensland Community Foundation’s emerging philanthropist of the year.

In 2021 the family was embroiled in a legal stoush over Ken Talbot’s dying wish that a third of his fortune be dedicated to a charity through a single family-run foundation.

A Supreme Court judge ordered that two foundations be set up using proceeds from the estate because the four children and Amanda “would not be able to work together as a single group”.

GLENN RUTHERFORD

Glenn Rutherford is the former chief executive of Aerocare, a company he first joined as a baggage handler.

After rising to the top job, he successfully grew the business from 35 employees to 3500 employees at 32 airports, making it the leading aviation services provider in Australia and New Zealand before selling the business to Swissport International.

In 2018, Rutherford splashed $11 million to purchase a mansion at 27 Sutherland Avenue, Ascot, the former home of Domino’s CEO Don Meji.

In 2021, Robert Nioa, the boss of Australia’s largest privately-owned supplier of small arms, purchased the house next door to their Ascot mansion for $2 million, to make room for a new tennis court.

Mr Rutherford has done something similar in nearby Sutherland Ave, purchasing the house next door to his sprawling $11m abode for a tennis court complex.

GREG BAYNTON

Greg Baynton is a seasoned director and investor across the mining and technology sectors.

A Fellow of the Geological Society of London, he founded corporate advisory firm Orbit Capital in 2000.

A decade ago he started the company now known as Novonix, a major supplier to the international lithium ion battery sector with a market value approaching $1 billion.

Baynton also has been a director of leading Brisbane tech firms NEXTDC and Superloop.

NEXTDC, an ASX 100-listed technology, operates a series of data centres around the country while Superloop provides connection stability and network performance across the internet.

Mr Baynton also has been instrumental in the development of the gas sector in Queensland through State Gas.

In 2020, Baynton offloaded a whopping $8.15 million worth of stock in his Brisbane battery tech firm Novonix.

Baynton sold five million shares over five days at an average price of $1.63 apiece.

RICHARD AND KATE BELL

Richard and Kate Bell made news in 2018, when they took on Gold Coast developer Sunland in a costly and protracted legal battle to decide the fate of the old ABC studios site at Toowong.

Kate Peta Bell bought a neighbouring riverfront home for $1.27 million about six months before Sunland snapped up the ABC property.

She then sued Sunland and the Brisbane City Council in mid-2015, alleging the “Grace on Coronation’’ complex would diminish views of the river and overshadow her home.

Her legal challenge was knocked back in May 2017, even though each of the towers, slated for 24 to 27 storeys, would dramatically exceed the town plan cap of 15 storeys.

It’s understood that Kate, aged in her forties, comes from a well-to-do family on the Gold Coast, where her father made a name for himself in the tourism game.

But the mega-millions the duo controls come largely from Richard, who started life as a solicitor in Brisbane before heading overseas in the early 1990s.

Based in New York, he variously flogged equities at SG Warburg and served as head of Wilson HTM stockbroking.

He returned to Australia in the late ’90s, when he launched listed telco Reverse Corp and oversaw its expansion into New Zealand, the UK and Ireland.

Richard served as its CEO until 2007, the year he cracked the BRW Rich List for the first time with an estimated fortune of $183 million.

He has sat on the Reverse Corp board and at one point was the single biggest shareholder, controlling 22 per cent of the stock.

A serial investor, he previously secured a stake in the rapidly growing Guzman Y Gomez restaurant chain and snared the exclusive rights to actor George Clooney’s Casamigos tequila.

Richard has also sat on the board of the National Film and Sound Archive of Australia.

STEPHEN BIZZELL

Mr Bizzell started his working life as an accountant before launching a business career that has seen him ink deals worth billions of dollars and become on of the state’s coal-seam gas pioneers.

He was previously an executive director of Arrow Energy, a position he held from 1999 until its takeover in 2010 by a joint venture between Shell and PetroChina for $3.5 billion.

He earned an estimated $18 million during that takeover.

He was also a director of Bow Energy from its incorporation in 2004 until its takeover in 2012 for $550 million.

His current ASX listed company directorships Include Dart Energy, Laneway Resources, Titan Energy Services, Armour Energy and Stanmore Coal.

He also was a director of Queensland Treasury Corporation.

In 2004, Bizzell founded Bizzell Capital Partners that over the past 15 years has been the architect and financier behind numerous successful listings on the Australian and Canadian stock exchanges and has been involved in raising in excess of $1 billion in equity finance for his associated companies.

He has also been involved in debt financing of over $500 million and M&A transactions totalling over $5 billion for companies associated with him.

MARK, FREYA ROBERTSON

Mark and Freya Robertson are perhaps best known for vigorously fighting a three-storey unit block development at 50 Archer St, Toowong, even taking it to the Planning and Environment Court to contest it on being taller than three-storeys.

However, their efforts to appeal the Brisbane City Council approving the original application was dismissed.

Mr Robertson is a Queen’s Counsel and chartered tax adviser and Mrs Robertson founded the Toowong Residents Group to bring awareness about BCC’s development of the inner-Brisbane suburb.

The couple bought a $12.5 million mansion at 121 King Arthur Terrace, Tennyson in 2021.

The $12.5m sale was sealed in November, 2021 and at the time was the highest price for a Brisbane house in that financial year.

The decadent home has 10 bedrooms, including a three-bedroom guesthouse, eight bathrooms, five car parks and sits on a 3593sq m block, across three titles.

There is also a 12-seat cinema, wine cellar and a boat pavilion.

Mr Robertson, who specialises in revenue and trust law with Level 27 Chambers, is the best tax barrister in Queensland and charges “more than $20,000” a day, said one Brisbane law specialist.

The couple previously lived on a clifftop property at 48 Archer St, Toowong which was built in 1926 and has been extensively restored.

The couple also raises money for charity.

In 2017, Mrs Robertson started a campaign for the Melanoma Institute Australia after her husband was diagnosed with amelanotic melanoma.

ANGELO AND SANDRA RUSSO, ANGUS CAMPBELL

Mr Russo and Mr Campbell are the co-founders and owners of the Northshore Group, a privately owned and managed customer focused property group.

Founded in 2008, Northshore has grown from a single asset vehicle which acquired the Castrol Tank Farm in Eagle Farm into a diversified investment group.

Northshore Group now owns and manages 89,500m2 of buildings situated on a 41 hectares of commercial land, having developed and managed projects in excess of $1.8 billion across all property sectors.

Before 2008, Mr Campbell spent 15 years working for ASX Listed property development companies including FKP Limited, Amalgamated Holdings, Peter Kurts Group, South Bank Corporation and ERM.

Mr Campbell has been responsible for the acquisition and development of $1.5 billion of commercial property in Australia.

Mr Russo and wife Sandra offloaded their scenic three-level home at 1 Leopard St, Kangaroo Point.

The sale set a new record for a Brisbane residential property.

Records show the couple shelled out $4.74 million for the place in early 2010.

In 2018 Russo purchased 22-24 Ascot Street, Ascot, for $4.25m.

Correction: An earlier version of this article incorrectly stated that Mr Russo was a “partner” of the now insolvent firm Tow.com.au. This was incorrect. Mr Russo resigned as a director and sold his shares prior to its insolvency. The article also incorrectly stated Mr Russo was an owner of City Motor Auction. Mr Russo resigned as a director of that entity several years ago and sold his share simultaneously. We sincerely apologise to Mr Russo for these errors.

STEVEN SHOOBRIDGE

Born in Tully, Queensland, Mr Shoobridge is the managing director and CEO Star Hotels Group, Queensland’s largest independently owned hospitality management company.

It has a portfolio of 38 licensed venues, more than 90 retail liquor outlets and six accommodation venues throughout Queensland and South Australia.

Its popular pubs can be found in Brisbane, Townsville, Rockhampton, Ayr, Maroochydore, Mackay, Tully, Bowen, Murgon, Gladstone, Yeppoon, Bargara and elsewhere.

In 2021 Mr Shoobridge began plans to redevelop Townsville’s entertainment and dining scene, buying the former Townsville Central Hotel, as well as the Shamrock Hotel. Star also owns Rydges Southbank Townsville and its conference and events centre.

Mr Shoobridge, an alumni of Harvard Business School, has been running Stat Hotels Group for more than 27 years.

In 2018, Mr Shoobridge bought Christopher Skase’s Hamilton mansion for more than $10 million but the deal didn’t included the adjoining tennis court.

The title of that land remained in the name of former mansion owner Dr Soo Hian Beh, who died tragically in a car crash in China in 2018.

Mr Shoobridge previously sold his riverfront penthouse to former PM Kevin Rudd for $8 million in 2016.