The Adelaide directors behind South Australia’s big business collapses

They include high-flying businessmen, flamboyant winemakers, glamorous retailers. But their multimillion-dollar SA businesses either ended in failure or were revamped amid controversy.

SA News

Don't miss out on the headlines from SA News. Followed categories will be added to My News.

They were the leaders of well-known South Australian businesses that collapsed or were forced to reinvent themselves, some leaving clients millions of dollars out of pocket.

The Advertiser takes a look at the lives and tribulations of the directors behind eight of the state’s biggest business failings.

BOB DAY

He was once one of South Australia’s most successful businessmen, with a national, multimillion-dollar company and a federal politician.

But it was a stunning fall from grace for bankrupt builder Robert John Day, a devout Christian known as Bob.

The British-born businessman, a father of three, was elected to the Senate and became a Family First MP in 2014.

Mr Day, now 71, was declared bankrupt in April 2017, six months after the collapse of his national Home Australia building conglomerate with $40 million debts.

It ended his federal political career in 2016.

Mr Day, dubbed “Bob the builder” formerly of Houghton, in the Adelaide Hills, has previously told of his distress over the collapse of his empire.

“You get on a roll and you think you’re invincible, and I had an awful lot of money, things were going sweetly – everything you touch turns to gold,” he once said.

“Then you get complacent and you think this is easy you go around the country buying up building companies but of course I came crashing down and made a big mistake.”

He was embroiled in a High Court row in 2017 over his eligibility to sit in parliament over his Kent Town electoral office.

Mr Day also told how his very profitable business made a “fateful decision” to buy a NSW company in 2003.

“I thought I could run one of the biggest building companies in Australia and run the country at the same time. I couldn’t and I paid the price for that,” he said.

He last year failed to relaunch his federal political career.

FELMERI

In another dramatic construction collapse, Felmeri Homes plunged into administration in May with more than $30m in debt.

Romanian-born founders Francisc Frank Felmeri, 69, and his son Frank junior, 42, established the Wayville-based business in 2006.

It focused on small housing – especially on sloping blocks – and commercial projects.

But around the Covid-19 pandemic, it massively expanded including with a $42m Wallaroo Shores resort project.

In a now-deleted profile from its DW Fox Tucker lawyers, Frank junior revealed his secret.

“Anyone can just ‘push up’ a house,” he said.

“But, at the end of the day, someone will need to live there – and it’s really important to get their vision through.

“In Adelaide, you get more referrals. You need to be really careful that you’re doing the right thing by your clients and that you’re networking effectively.

“It is dominated by relationships, rather than just purely advertising to the market. Which is a good thing … people know you and understand what you’re about.”

Its collapse has left more than 100 customers, including the country’s largest regional accommodation operator and dozens of first-home owners, without completed projects and owed.

Taxpayers will also spend more than $1m finishing a southern suburbs development road.

Felmeri’s website, also deleted, revealed it was a Adelaide 36ers sponsor.

Both founders amassed a $12m property empire including luxury homes in Burnside and Hallett Cove.

Asked about customer complaints, Mr Felmeri Sr said: “Not everything is true”.

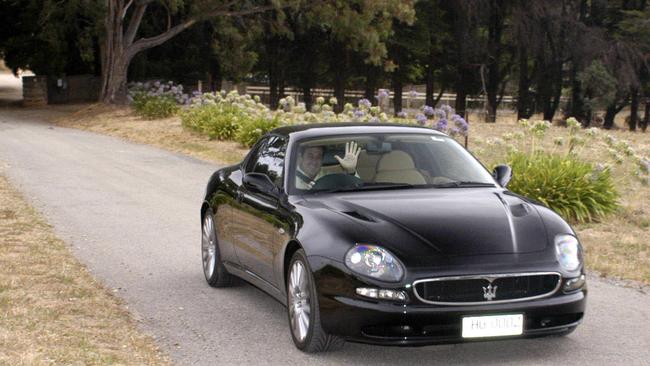

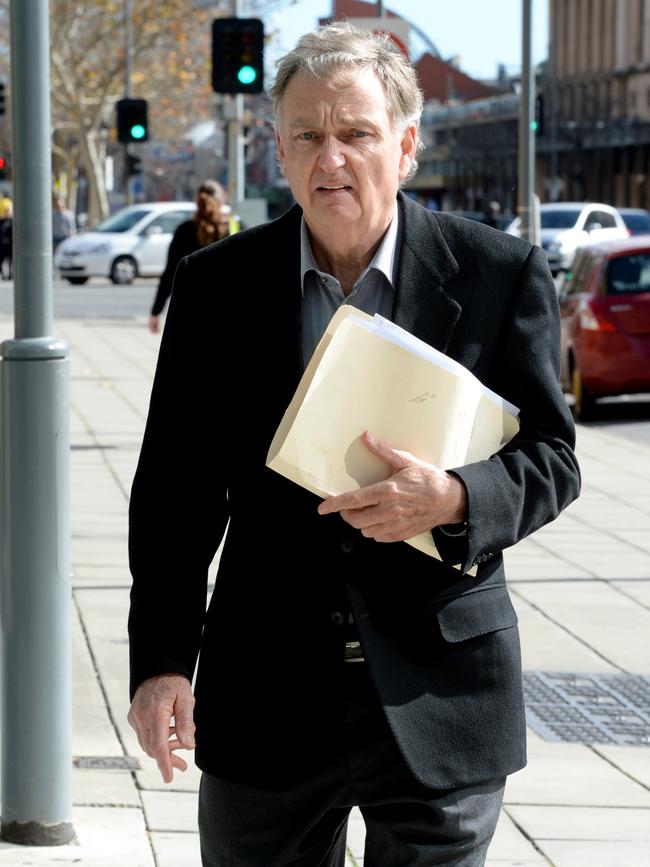

ANDREW GARRETT

Former winemaker Andrew Morton Garrett is a colourful businessman and serial litigant.

Garrett, whose name still graces the sparkling shiraz that made him a household name, was declared bankrupt in 2004 and a vexatious litigant in 2006.

The latter meant he cannot file action in South Australia without Supreme Court permission.

Starting as a white-wine maker, Garrett, 66, was a flamboyant, high-flying industry figure in the 1990s, mostly in McLaren Vale but also in Victoria and Tasmania.

With a gregarious personality, the St Peter’s College educated businessman excelled in sales, and enjoyed his spoils with luxury cars and an Adelaide Hills mansion at Leawood Gardens, near Eagle On The Hill.

He sold his business to Foster’s 1995. It included annual $300,000 royalties for his name.

Later, another Braidwood Group of companies collapsed in 2003 with debts of more than $12 million, including $9.6 million owed to the National Australia Bank.

A chaotic few years characterised his increasingly bizarre legal claims, before a suspended 10-month jail term for breaking almost 100 restraining orders and bail breaches.

Garrett, a father of two, blamed the NAB for its demise along with Australian Securities and Investments Commission “maladministration”, courts “corruption” and SA Government “cover ups”.

His chequered business history culminated last month when the Federal Court ruled he falsely operated unlicensed banks.

He was convicted and fined in September 2021 for breaking bankruptcy laws.

MYNETSALE

MyNetSale, an e-retailer which sold top brands at heavy discounts, went broke in 2014 with debts of almost $13 million as it denied accusations it sold fake goods.

Former Adelaide businesswoman Agnieszka Todt, now 42, co-founded the business, which had

more than 700,000 Australian and New Zealand customers.

The Sydney-based business plunged into administration owing 138 creditors more than $12.88 million.

The glamorous entrepreneur later re-emerged in a boutique clothing store despite her former company’s debts, angering creditors and former employees.

Polish-born Ms Todt, known as Agy, told how she developed her idea “over a glass of wine”.

The website, founded in 2011, sold international brands with discounts of up to 80 per cent including Chanel, Gucci, Prada, Burberry, Givenchy, Saint Laurent, Calvin Klein, Alexander McQueen, Tom Ford and Christian Louboutin.

It settled Federal Court action with British label Burberry.

The company repeatedly denied it sold fake goods after some customers made complaints to this effect.

Ms Todt, now believed to be of Bondi Beach, went to ground, deleting all social media profiles.

But she was reborn under another name, Saint Agnieszka, with various glamorous, and risque, pictures.

Company records show she founded Streetmasks Pty Ltd, in August 2020, which urged customers to “feel safe in style”.

The business was closed in June this year but it is unclear why although there is no suggestion of wrongdoing.

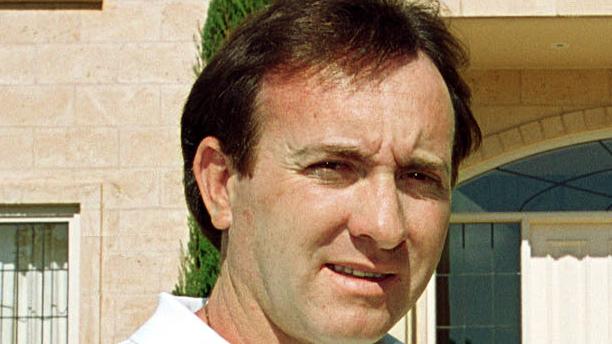

SAM SGHERZA

Disgraced Adelaide property developer Salvatore “Sam” Sgherza declared bankruptcy more than a decade ago after losing a legal stoush with one of the state’s wealthiest families.

Mr Sgherza, a high profile developer of North Haven’s Crown Marina, West Lakes’ Infinity Waters and the CBD’s August Towers, has suffered legal troubles since 2012.

In September 2012, a company he was a director, was ordered to pay $3.48 million to the Shahin-owned C Convenience for breach of contract over a failed $300 million hotel and apartment complex opposite the Wayville Showgrounds.

The row was a key domino in felling nine companies, which employed at least 12 full-time staff and 200 subcontractors.

He was discharged from bankruptcy in 2015.

In March 2018, finance company CEG took control of the August Towers, triggering the liquidation of his firm, South 2015, with debts of nearly $30 million.

He avoided jail in 2019 after being convicted and fined for breaching business laws when he illegally withdrew $247,000 from bank accounts a year before declaring bankruptcy.

Last year, a court heard SA Police dropped 12 charges over allegations he stole $1.22 million from investors of a property investment syndicate.

Company records show Mr Sgherza, 60, of Adelaide, had more than 82 directorships and at least 31 shareholdings.

In evidence before a Federal Court examination he could not explain why $233,000 was allegedly transferred from one of his business accounts to a property firm connected to his daughter and ex-wife.

There is no suggestion of any wrongdoing on the part of his daughter or ex-wife.

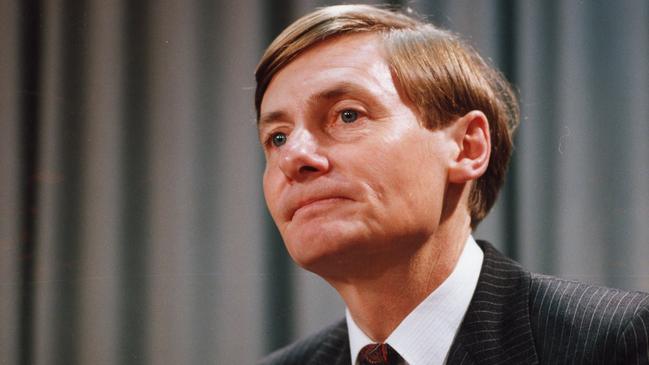

STATE BANK

The State Bank collapse in the early 1990s, with losses of more than $3.15 billion, triggered unprecedented economic and political turmoil while shattering public confidence for decades.

Tim Marcus Clark, the bank’s suave managing director, was the villain responsible for bringing SA to the brink of bankruptcy.

Critics said he embodied the 1980s reckless spirit and gung-ho atmosphere.

He presided over the collapse of the publicly guaranteed State Bank, which saddled taxpayers with a debt worth at least $6.58 billion in today’s money, sparked the resignation of Premier, and Treasurer, John Bannon and forced a fire sale of state assets including ETSA.

The Bannon Labor government appointed Mr Marcus Clark – a scion of the NSW department store family and a star East Coast banking recruit – in 1984 as the fledgling bank’s boss.

Mr Marcus Clark, a Dubbo-born father of three, orchestrated a rapid – but largely unaccountable – global expansion that tripled its assets to $11 billion in four years.

Under his bullish leadership, the Harvard educated banker – who survived a 1980 stabbing outside his luxury Melbourne home – opened branches in London, New York and Hong Kong.

The charismatic, bespectacled executive, who the Adelaide and political establishment revered, transformed a home lender to risky commercial venture financier.

“The train is heading north – if you don’t like it you can get off,” he reportedly told a senior manager in 1988.

In February 1991, Mr Marcus Clark quit from his $500,000-a-year post – $1.1m today – as Mr Bannon revealed the bank’s bad debt needed an almost $1 billion bailout.

He quit his premiership in September 1992 as the disaster’s sheer scale emerged and his lack of oversight was laid bare.

Labor was demolished at 1993 state election to just 10 lower house MPs, leaving Mr Bannon suffering significant public scorn.

Royal Commissioner, former Supreme Court judge Samuel Jacobs, QC, condemned him being “mesmerised” with Mr Marcus Clark and his failure to listen to “messages of doom”.

In 1996, Mr Marcus Clark, a self-declared bankrupt, was ordered to pay a record $81 million damages to taxpayers but escaped with a $1.5 million settlement his American-born wife Micaele largely paid.

The disgraced banker, who became a recluse in Melbourne, died aged 83 after a long illness in Sydney in December 2015, a few days after Mr Bannon, 72, who was afforded a state funeral.

The State Bank reinvented into BankSA, which is now part of Westpac Banking Corporation.

Its former headquarters is now the RAA building.

TAGARA

Another major construction collapse was Tagara Builders, which liquidated in 2015 with huge debts.

The former Glynde company, in Adelaide’s east, collapsed with at least $27 million owing to 750 creditors, leaving the industry reeling with more than $100m in unfinished work.

Directors John Kassara, 66, formerly of Rosslyn Park, and Italy-born Tullio Tagliaferri, 67, of Clearview, founded in the company in the early 1990s.

Mr Tagliaferri, who resigned as the then Master Builders Association president, apologised for his role as managing director from August 1992 until June 2015.

In a joint statement, the businessmen said liquidating the firm was “one of the most heartbreaking decisions we’ve ever had to make”.

“Our appreciation of … our subcontractors (and) our employees made our decision

so much more difficult,” they said.

He is now a project manager for another Adelaide building firm.

A Consumer and Business Services investigation cleared the pair of wrongdoing, concluding they worked to professional building licence conditions.

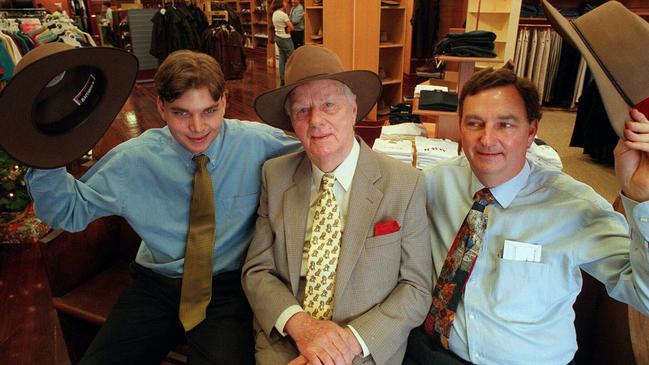

TRIMS

It was a South Australian retail icon for almost 90 years, helping generations of blue collar workers buy a pair of Levi’s jeans or RM Williams boots.

Twins Alf and John Trim, founded the historic workwear outfitter in 1937.

“Trims has long been the number one store in Adelaide for Levi’s and other quality brands,”

former managing director, Russell Trim, once said.

According to a Prince Alfred College profile, Russell’s sons, Justin and Matthew, were a third generation in the business.

But all that came crashing down in May 2013 when it plunged into administration owing more than $3.2 million to unsecured creditors and $580,000 in staff wages and entitlements.

It was placed into liquidation the next month.

Justin Trim, 48, and former operation and marketing manager Peta Thompson, 53, bought the name and moved a few doors along King William St, reviving the business.

Russell was “politely’’ asked not to be involved.

The business is today successfully operating under Ms Thompson’s stewardship.

Justin, who company records show left its parent company in March 2019, operates a window cleaning business from a Burnside property.

Russell, now 76, who company records link him to a Queensland address, had his conduct examined in the Federal Court about a February 25, 2014, bankruptcy and movement of assets.

The court heard he backdated the sale of his $1.9 million Toorak Gardens house to one day before going bankrupt but denied claims he used business money to bail out ill-fated restaurant ventures of Matthew, 46.

Matthew Trim previously operated restaurants including Grace The Establishment at Norwood, Farina on Hindmarsh Square and North Adelaide Sparrow as well as The Manse.

The consumer watchdog, and SA Police, are investigating a failed real estate agency, Commercial Adelaide, which Matthew and prominent businessman, Remo Russo, 49, founded.

There is no suggestion of wrongdoing, just that authorities are investigating.

More Coverage

Originally published as The Adelaide directors behind South Australia’s big business collapses