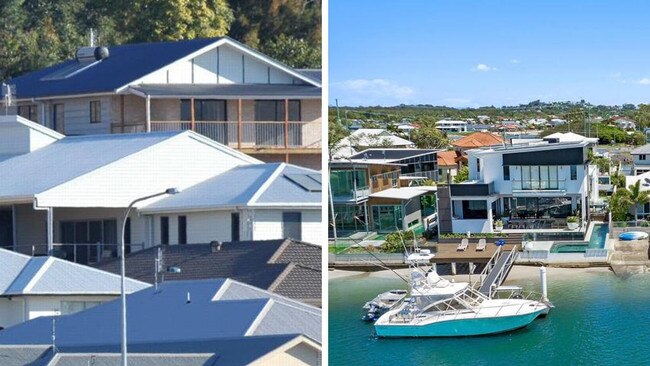

Rising property prices on the Sunshine Coast ahead of RBA cash rate decision

House prices in the Sunshine Coast rose 1.1 per cent in the last quarter ahead of a Reserve Bank decision next week that could see another rise in the cash rate.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

House prices in the Sunshine Coast rose 1.1 per cent in the last quarter in March ahead of a Reserve Bank Australia decision that could see another rise in the cash rate.

A new report released Saturday April 1, 2023 showed the price rise as the author spoke of the upcoming RBA meeting.

Despite this rise, the report found that prices on the Sunshine Coast are still down 5.28 per cent year-on-year.

Compared to pre-pandemic levels in March 2020, home prices are up 49.3% in regional Queensland.

Cloud-based valuation platform PropTrack senior economist and report author Eleanor Creagh said the RBA’s decision on Tuesday, April 11 might lead to them to further raise the cash rate as households are feeling the pressure of raised interest rates.

“Concerns around inflation expectations remaining anchored and the Board’s commitment to overcoming the challenge of high inflation make a 25-basis point lift next week more likely than not,” she said.

“But it’s a close call and the end of interest rate rises is in sight, whether the Reserve Bank pause this month or next.”

Ms Creagh said if the RBA does lift the cash rate next week by 25 basis points, it will be the 11th consecutive hike, bringing the cash rate to 3.85%, its highest level since April 2012.

“This would likely be the point at which the RBA pauses its tightening cycle and assesses the impact of the tightening already delivered,“ she said. she said.

She said there was evidence that the substantial tightening pushed through in a short period was weighing on households.

“It takes time for higher interest rates to fully impact household cash flows,” she said.

“In this tightening cycle, with so many borrowers having taken advantage of record low fixed rate mortgages throughout the Covid period yet to feel the full impact of rate rises, this is especially the case.

“This is leading some to speculate that an earlier pause is on the cards in April, giving the RBA more time to assess the full impact of rate rises already delivered on households, businesses, and economic conditions.”

The Property Baron buyers’ agent Jason Baron said a lot of people had been talking about a drop in prices.

“But there’s not too much evidence of it dropping,” he said.

“There still a huge demand on the Sunshine Coast and very little supply.”

Mr Baron said a halt in interest rate rises could see the prices shoot up.

“The next thing to come is when interest rates stop increasing you might find buyers are a little more confident,” he said.