Suncorp bank scam victims’ fury after nearly $500,000 stolen in six weeks

Heartbroken victims who lost their life savings have accused a major bank of failing to protect them after they were hit by new scams impersonating real phone numbers and services.

QLD News

Don't miss out on the headlines from QLD News. Followed categories will be added to My News.

Banks being targeted in sophisticated new “impersonation scams” are calling on telcos to do more to stop their phone numbers and text message services being hijacked by hackers.

It comes as angry victims in the frightening fraud attack on Suncorp Bank call in lawyers, with the scale of the scam growing.

The Sunday Mail has now spoken to victims who have lost almost $500,000 to scammers who contacted them using what appeared to be Suncorp’s actual phone number and text messaging service over the past six weeks.

New victims who have come forward include a Sydney family who were scammed out of $230,000 and a young Toowoomba tradie who lost more than $45,000.

Some victims were scammed as late as last weekend, more than a month after Suncorp said it first became aware of the attack and contacted the Australian Communications and Media Authority to have the cloned numbers used by the scammers disconnected.

Suncorp says it’s “distressed’’ for victims but is “working hard” to protect customers and says banks are lobbying telcos and ACMA for stronger measures to stop scammers “spoofing” their phone numbers and text message services.

But upset victims are planning legal action, accusing Suncorp of failing to prevent their systems from being compromised and showing “no empathy”.

A Sydney family who lost $230,000 on December 2 – a month after Suncorp said it became aware of the scam – said the bank had allowed four transfers into CBA accounts operated by the scammers after an initial transfer was flagged as suspicious and stopped.

The family said they had clawed back about $43,000 but the loss had devastated them.

“It was our life savings and it’s extremely distressing, especially ahead of Christmas,” said the husband, who did not want to be named.

“Where is Suncorp’s duty of care in all this? We’ve banked with them for 28 years but there has been zero empathy or accountability.”

Toowoomba apprentice electrician Jacob Byrne, 20, who lost $45,530.82 to the scammers in October that he was saving towards a house, said Suncorp had failed to protect him and he was considering legal action.

“Suncorp has failed me … and now the money is gone, (it) simply wants to wash its hands of me,” he said.

“I will not accept this and I cannot afford to let this go.”

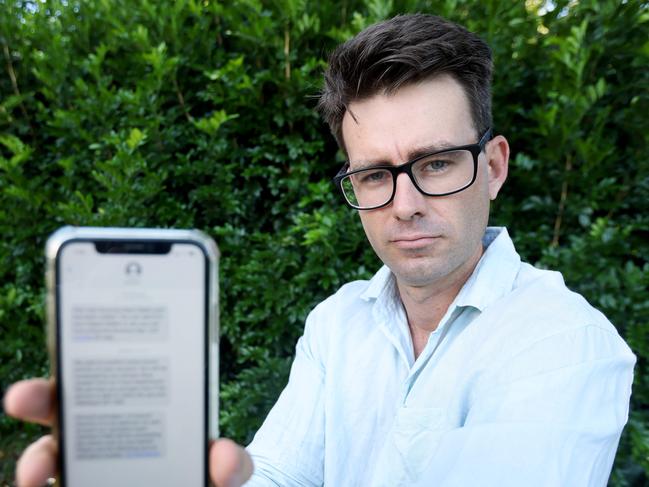

Brisbane man Blake Talbot, whose partner is pregnant after expensive IVF, said their life savings of $26,000 had been wiped out by the Suncorp scammers last weekend.

He said he had never authorised a $26,000 transfer previously and it should have rung “alarm bells” with the bank.

“Their attitude is ‘tough luck’ – I don’t understand or accept that,” he said.

“They need to hold some responsibility. This is a company with a $15 billion market capitalisation.

“If I can’t trust someone ringing off the bank’s number and sending texts on the same chain which I’ve received texts from Suncorp before, who can I trust? What else can I do as a person to protect myself?”

Suncorp Everyday Banking executive general manager Nick Fernando said the bank had not been hacked and scammers were known to use a range of tactics to build a profile on victims.

“Due to the nature of these sophisticated impersonation scams, often fraudulent transactions are difficult to identify as suspicious,” he said.

“While we would like to emphasise that the recent impersonation scams are not the result of any data breach by Suncorp Bank, this does not change the fact that these scams are having a significant financial and emotional toll on victims.

“We are distressed to hear some customers targeted in this scam have not felt supported during their time of need. We feel for every person impacted by scams and we are working hard to protect our customers.

“The Banking industry continues to lobby telcos and ACMA to introduce stronger measures to protect against ID spoofing and the use of their services to commit fraud and scams.

“We ask our telco providers to work with us to prevent legitimate telephone numbers being used by scammers to convince people that they are speaking to their trusted bank.”

A Suncorp spokeswoman also said the bank continues to work with law enforcement agencies as and when required.

The Australian Banking Association said financial institutions had last year prevented scams or recovered funds totalling $341 million.

She said banks would never ask someone to transfer funds to another account over the phone.

The Australian Financial Complaints Authority said it was receiving more than 420 scam-related complaints a month and disputes had risen almost 30 per cent in 2021-22.

Financial institutions had been forced to repay scam victims more than $15 million last financial year, an AFCA spokeswoman said.

“We continue to be concerned by the ever-increasing number and growing sophistication of scams and welcome all efforts to prevent them and educate consumers about the dangers,” she said.