Why Mackay Whitsunday housing market is so tight in 2021

With the market up 10-15 per cent in a year, landlords see it as an opportunity to liquidate Mackay and Whitsunday investment homes. Find out why that is creating a housing squeeze.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

Mackay and the Whitsunday regions are part of a nationwide trend of increasing pressure on availability in the rental market.

With a rising trend in residential sales prices, some investors are leaving the market.

Blacks Real Estate director and sales consultant Peter Francis said Mackay was in line with this trend.

“What we are seeing is a lot of investment properties [coming onto the market], because the market has improved dramatically in the past 12 months,” Mr Francis said.

“It is the first time in the past eight years that they have seen any significant capital growth. With the market going up 10-15 per cent over the past 12 months, landlords are seeing it as an opportunity to liquidate those investment homes, and the majority of the buyers are owner-occupiers.”

The result is a dwindling supply of rental properties, as local first home buyers enter the market, and with pressure increasing as people move to regional areas looking for stability in work and public health-related issues. He said typically 80-90 per cent of the residential market were owner-occupiers.

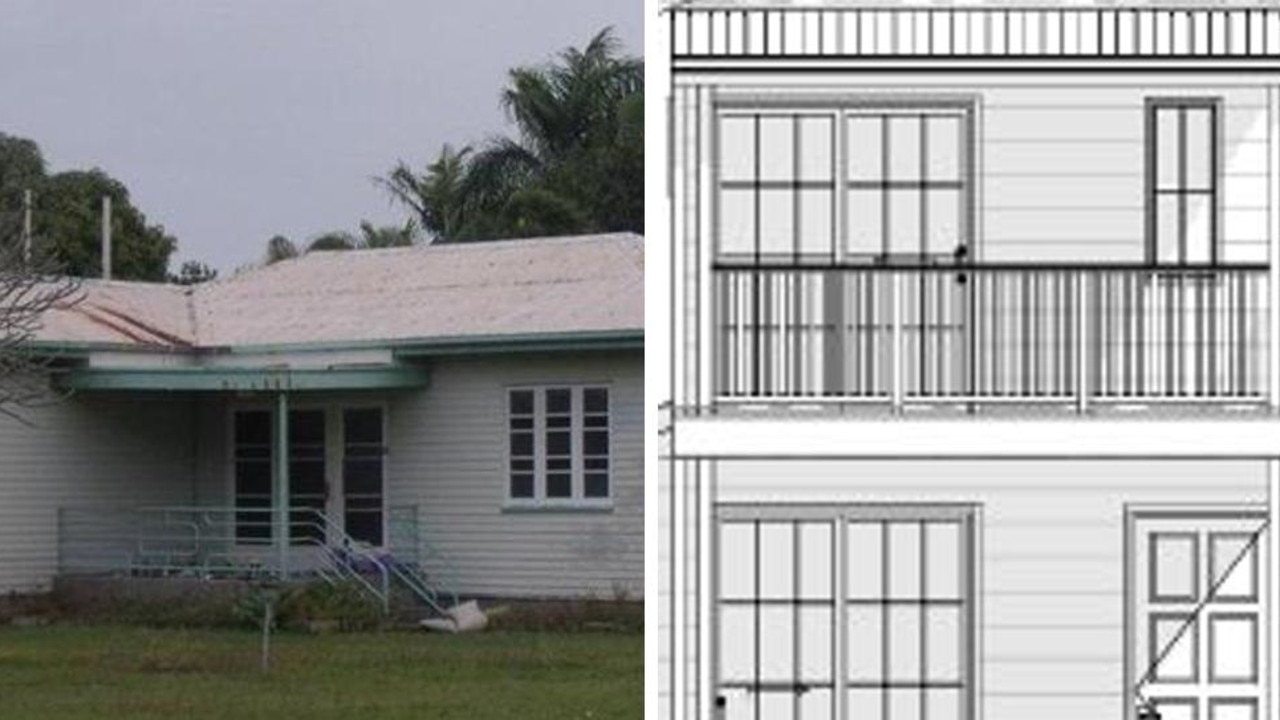

Mr Francis also identified a lag in construction activity in the previous five years as contributing to a housing gap for the region.

PRD Whitsunday chief executive Annette Neil has identified similar pressures in the Whitsundays, with the region seeing pressure on the rental market with increased owner-occupier sales, and as Australian workers move into the area to take up work in the tourism and agriculture sector- employment areas that more traditionally would have been filled by more fluidly transient international backpacker group.

“There has been discussion in the region, with council, of how to solve the housing crisis: there are a number of people without anywhere to live,” Ms Neil said.

“It’s quite real at the moment with such a short supply of rental properties, and that’s being increased by people purchasing properties that were in the rental market.

“That’s decreased availability, but there is increased demand with people moving in for those agriculture and tourism jobs. It’s not clear how we solve this housing crisis.”

For the foreseeable future, with an uptick in the regional economy and population migration under way, pressure on the rental market is set to continue.

Mr Francis said he was encountering many inquiries when in public.

“Whenever I am wearing my badge, I get asked at coffee shops, service stations, or just walking through Caneland (Central), whether we’ve got any rental properties for people,” Mr Francis said.

“There’s a real sense of desperation for people looking for accommodation at an affordable price.”

________________________________________________

HIGH RENT SUBURBS*:

1.Airlie Beach $675

2.Cannon Valley $600

3.Mackay Harbour $550

4.Glenella $510

5.Bakers Creek $500

6.Ooralea $500

7.Shoal Point $485

8.Cannonvale $483

9.Rural View $465

10.Moranbah $460

*Median weekly house rent for 12 months to September 2021.

Source: REA Group/realestate.com.au September Market Trends