Barbera group Bundaberg farm company RBPAC liquidated over $4.3m debt

Liquidators have taken over a Bundaberg region labour hire firm which collapsed with alleged debts of more than $4m, amid questions over possible insolvent trading worth millions of dollars.

Bundaberg

Don't miss out on the headlines from Bundaberg. Followed categories will be added to My News.

A Bundaberg region farming company has been forced into liquidation by creditors who claim they are owed more than $4.3m.

It comes amid questions over whether the business engaged in millions of dollars of insolvent trading.

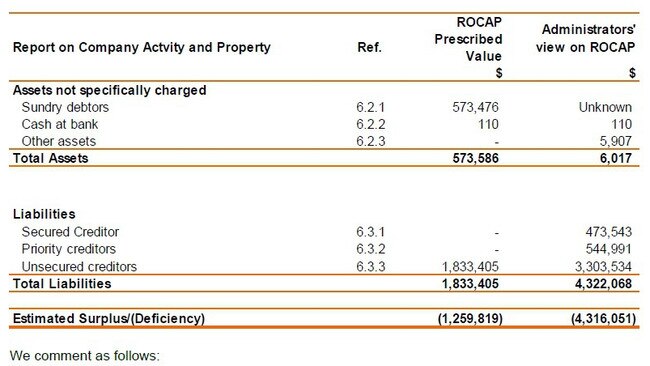

RBPAC Pty Ltd was moved into administration on November 10 on the back of a significant debt, now believed to be worth $4.3m, $3m above initial estimates.

Its Bargara-based business traded as a labour hire firm for M & R Farms, a related company on which it relied on for “the entirety of its revenue”.

Dad, daughter die in fire days before Christmas, wedding

The December 8 report to creditors compiled by administrator BRC Advisory reveals M & R Farms owes the RBPAC at least $573,476.

M & R Farms is itself under administration.

Revealed: 39 recommendations as hospital’s sedation policies probed

According to the creditors report, another $473,543 is owed to two secured creditors, including $329,915 owed to related company M Barbera Properties Pty Ltd.

The Australian Taxation Office is claiming $1.56m in money owed in the report, but this is “likely” to increase to $2.8m.

Other creditors are owed more than $464,000, the report states.

Director Ross Barbera told the administrators RBPAC’s cash flow problems were caused by ongoing losses at M & R Farms, and a lack of available work due to droughts and floods, it further states.

The report also shows RBPAC’s finances nosedived in 2020, with a 64 per cent drop in revenue in the 2021 financial year.

A loss of $1.9m in the 2020-21 financial year was recorded by the company by the end of June, 2021.

However the administrators flagged several concerns about details which would be a matter for liquidators to resolve.

These include possible “action against the Director for insolvent trading for an amount of $2,233,362”, and further investigation into “potential unfair preference payments to related party creditors” totalling about $13,400.

The BRC’s December report to creditors posed questions about a journal entry “on the 30 June 2021, reducing the owner’s drawing account from $111,265 to nil”.

It said the transaction “may have a commercial justification” but to date BRC was not able to confirm “whether it was reasonable”.

In response to questions about these concerns, Mr Barbera said “all matters regarding the liquidation of RBPAC are in the hands of the liquidators”.

BRC Advisory’s Dane Skinner declined to make further comment about the matter beyond what was in the report.

It had recommended creditors accept its proposed deal, which would have returned unsecured creditors up to 0.3c in every dollar owed.

Under a liquidation, unsecured creditors were unlikely to repaid at all, the report says and “in our opinion, we do not consider that it would be in the creditors’ best interests for (RBPAC) to be wound up”.

Creditors ultimately decided otherwise, rejecting the proposed arrangement at its meeting on Thursday December 15 and voting for the company to be wound up with Mr Skinner appointed liquidator.