Noel Whittaker: How your choice of partner could lead to your financial doom

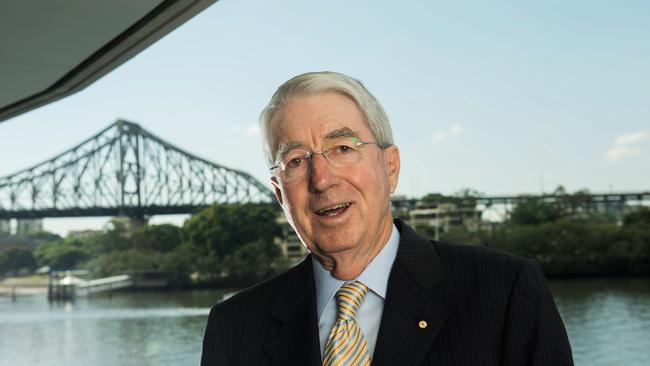

As the rising cost of living bites, leaving everyday Aussies “scared as hell”, Des Houghton speaks to money legend Noel Whittaker, who says younger couples must be on the “same wavelength” or risk financial failure.

Opinion

Don't miss out on the headlines from Opinion. Followed categories will be added to My News.

Australia’s most successful financial planner today injects some much-needed optimism into the cost-of-living debate and offers advice on how to save for a home.

Noel Whittaker, known in the industry as Mr Money, says it is still possible for young people to control their spending in tough times by having a plan and setting goals. At the same time, he says older Australians are “scared as hell” the Federal Government is coming to raid their investments. And he says younger couples must be on the “same wavelength” or risk financial failure.

“I strongly recommend that before entering a relationship you should discuss your common values,” he said.

“If your main goal is to get a house and your partner’s main goal is to splash it on a Lamborghini and a big wedding, you have some major talking to do. Maybe you are not suited.”

Whittaker also says it is not the time to wallow over gloomy economic forecasts.

Historically the market goes up and down. Amid talk of a looming downturn, we must not forget that good times always follow bad.

And there is a bleedingly obvious way to start right now to make money.

“Spend less than you earn, and you immediately position yourself to be in the top 10 per cent,” he said.

Whittaker speaks with authority. He produced a certificate dated May 1972 to show he got the highest mark ever recorded in his taxation exam while studying accountancy.

He believes threats to our financial freedom come from bureaucrats and society’s “buy-now-pay-later” mentality.

He adds: “You also have to be practical and sensible and accept there is some expenditure you can’t cut back on.

“There are all sorts of cheap things you can do but to me the one that always works for those who use it is to write down your average essential expenses: rent, mortgage repayments, car insurance and school fees.

“They’re the things you can’t cut back on; they’re the things you must pay.

“And then you add that up, and if it comes to say, $52,000, you divide it by how often you are paid.

“So, if you’re paid fortnightly, 26 into $52,000 is $2000.

“So, your first spend out of each pay is $2000 that goes into a separate bank account and is only to be used for those essential items.

“Once you’ve done that, those items are taken care of.”

Whittaker, 83, was born in Beenleigh and went to Sailsbury high before a career as a banker, investor and financial guru.

“I was in a smart class where two fellow students topped the state. Extraordinary.”

His father Bert was the first person to lead a pig at the Ekka in, he believes, 1928. It was a Gloucester old spot, a most handsome English breed with large black spots. Whittaker’s mother Jean’s family worked at the Kingston butter factory founded by her family, and she helped build a pipeline to deliver buttermilk to fatten Bert’s pigs.

Bert and Jean Whittaker had lived through the Great Depression and warned their son to get a “safe, secure job” so he wouldn’t be unemployed when the next depression arrived.

“So I joined the Bank of NSW in Queen Street because two uncles were bank managers. And the Bank of NSW was the oldest company in Australia, established in 1817.”

Whittaker has offered sage advice on saving and investing for more than 20 years in his Sunday Mail column. His new book, 10 Simple Steps to Financial Freedom is his 25th, and he is already writing another book on estate planning. His first book, Making Money Made Simple, published in 1987 was a bestseller which sold 5000 copies a week at its peak. It has been updated.

Whittaker recommends forming groups with like-minded people to discuss goals and share advice.

Once he had his own “mastermind” group with top real estate salesmen, a leading lawyer and a top builder who met once a month.

“We just sat around for breakfast and talked about where we were going. It was extremely motivating. It helps you stay on track.

“Goals are fine but there are dangers to being lured off track.

“Once your goal is set and you set the steps to reach the goal, you keep doing the steps.’’

That’s how champion tennis players and concert pianists succeed, he said. Impatience hurts wealth creation efforts. “Everything in life takes time. Everything that is worthwhile takes time.

“You break down your big goals to sub-goals.’’

However, every couple should have a little bit of pocket money to spend however they like.

Whittaker wonders whether parents still teach their children about frugality.

“When I was a kid we never went to restaurants, we just ate at home.’’

It might sound like a cliche, but “it is the little things that count” in a cost-of-living squeeze.

“Goals keep you on track. If you spend less than you earn and your goal is to get a house deposit that will overshadow your thinking. You will say to yourself, I can’t afford five bucks for a cup of coffee.’’

Grabbing a takeaway coffee for $4.50 to $5.50 means you will spend about $2000 a year, enough for a holiday.

More money-saving tips: Move back home with mum and dad. Go camping instead of paying for rooms at hotels and resorts. Get married on the beach and celebrate in the local park. Take your lunch to work.

Opportunities to make extra money will present themselves.

A boy in his neighbourhood had a thriving business taking out neighbour’s wheelie bins.

How to save money and stick to a budget

When he lived at Carindale in a building boom he admired the entrepreneurial spirit of Ben, a 15-year-old boy.

“He had a little trolley with an Esky on it and he would tow it around the building sites selling soft drinks. He also sold sandwiches.”

When Whittaker got married he pinned his home loan statement in the pantry. “Every time I opened the pantry I’d see the loan balance. My main aim was getting that home loan paid off, nothing else.’’

He fears for single women over 60 who don’t have a house.

“Their numbers are growing. They can’t afford to pay rent on the age pension.

“Albo promised to build a million homes in five years and one year is nearly up and nothing has happened.

“We have a critical shortage of men, materials and land.’’

He blames councils.

“There is not enough available land because of the council charges. If you have a nice paddock and want to subdivide it, it’s hard.

“But the time you pay for your headworks and wait two or three years for approvals, it’s very difficult to make anything. I think taxes add about $175,000 to a block of land.

“So, the development of land is a very slow, expensive process thanks to government hold-ups.”

He said governments at all levels were “obsessed” with compliance.

ALBO’S AFTER YOUR NEST EGG

Noel Whittaker, the financial guru, fears the federal government is not only coming after workers’ superannuation.

He fears the government will “bend the rules” to tax investment properties.

“The worst thing about these new superannuation rules is that they want to tax an unrealised capital gain. That’s never been done before,” Whittaker said.

“It’s like saying, we see you have a good investment property and we are going to tax you on what we believe is the increase in value – whether or not that is realised.

“Capital gain is never certain, and this is the point. How can you tax a gain that never happened? It’s frightening. If they can do it to super, how about investments outside super?

“If they are prepared to bend the rules that much, they could do it outside super.

“They could say you have an investment property outside super and we will tax you every year on the unrealized gain on that.”

He said it was easy to do a poll asking, “Do you think the rich should pay more tax?”

The answer will inevitably be “yes” and the government will claim a moral right to plunder private citizens’ wealth.

“The argument goes that people are dying

with money left in super so therefore they have too much.

“That is their stupid argument.’’

As a result of government interference most retirees were “scared to hell” worrying about aged care costs and afraid to spend.