World turns in favour of Forrest-owned mining company Wyloo after nickel nightmare

Everything is turning up trumps for Wyloo, the private mining company owned by billionaires Andrew and Nicola Forrest.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

This time last year the boss of Andrew and Nicola Forrest’s private mining company was preparing to shut down the West Australian nickel mines that he had purchased for $760m just 11 months earlier.

A year on and the mines remain in mothballs, but the fortunes of Forrest-owned Wyloo and its chief executive Luca Giacovazzi have turned around dramatically.

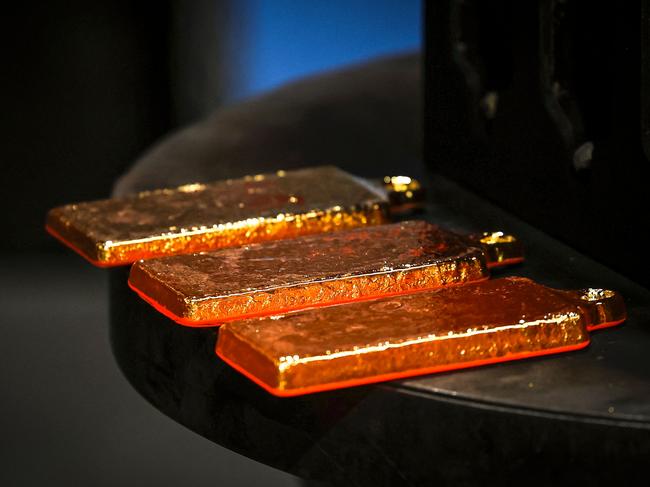

Investments in gold have been good for Wyloo, as have punts on rare earths and permanent magnets, and in Trump-slapped Canada there are suddenly blue skies for the company’s big investment in critical minerals production via assets known as the Ring of Fire.

World events have worked in Wyloo’s favour over the past six months, with the gold price soaring to record highs, Canada shifting gear on mining, and China’s threat to restrict supply sparking a renewed focus on rare earths and permanent magnet production.

Wyloo started life a bit over four years ago with a mixed bag of assets valued at about $15m. The Forrests are currently sitting on a $700m gain after a string of strategic and capital creative deals, and notwithstanding the badly-timed acquisition of nickel miner Mincor Resources.

Wyloo is days away from officially taking charge of one of Australia’s biggest rare earths projects and it now holds a 19.9 per cent stake in Toronto-listed Neo Performance Materials, which uses rare earth oxides in the production of permanent magnets found in electric vehicles, wind turbines, electronics and the defence industry.

In Ontario, the government is a week or two away from passing legislation that will make it a whole lot easier for Wyloo to develop the Ring of Fire assets it picked up after winning a 2021 bidding war with BHP.

Ontario premier Doug Ford said the bill, known as the Protect Ontario by Unleashing Our Economy Act, will “cut the red tape and duplicative processes that have held back major infrastructure, mining and resource development projects, including in the Ring of Fire”.

“The maze of bureaucracy, red tape and duplicative processes holding back our economy means that a single mining project can take 15 years to be approved,” he said.

“In the face of current Ontario-US trade tensions, it can no longer be business as usual. We are cutting red tape to unlock our critical minerals and unleash our economy to create new jobs and opportunities in the north and across the province.”

Even the Mincor acquisition has had a silver lining amid the collapse of the Australian nickel industry and thousands of job losses – mainly at BHP – blamed on a glut of so-called “dirty nickel” coming from China-backed operations in Indonesia.

Hot project

Zero value was attributed to a gold project that came as part of the 2023 Mincor deal. But the Widgiemooltha Gold Project is now hot property, with Mr Giacovazzi fielding interest from multiple parties.

Wyloo, headquartered a two-minute walk from the Dr Forrest-led iron ore heavyweight Fortescue in the Perth CBD, is now drilling down to see just how much gold there is at the Widgie project.

Mincor mined the shallow pits at Widgie last decade during a previous mothballing of nickel operations due to a price plunge.

Mr Giacovazzi says the beauty of Widgie is that it sits between the St Ives gold mine owned by South Africa’s Gold Fields and the Higginsville mine owned by Westgold.

“It’s on this amazing gold trend. We really like it, and the reason we like it is it has not had a single hole drilled below 50 metres. We’re got an open pit resource there that you could go and mine straight away,” he said.

“But the bit that excites us is what’s going on underneath those pits. There’s drilling rigs turning there as we speak.”

That’s not to say Wyloo is giving up on nickel in Australia. It expects to eventually reopen nickel mines and is seeking approvals to build a nickel concentrator on its ground around Widgiemooltha, about 90km south of Kalgoorlie.

Another option is to buy a concentrator – Wyloo previously relied on the BHP plant at Kambalda and sold its nickel to the mining giant.

Mr Giacovazzi said Wyloo’s nickel assets around Widgiemooltha, once owned by Western Mining and Mincor, will come into play when the market takes a turn for the better.

“I don’t lose too much sleep over nickel because I keep a close eye on the demand growth. And demand is still growing at between 5 and 7 per cent every year. If you said to copper industry guys would you like 7 per cent year-on-year demand growth, they would fall over themselves,” he said.

It was Mr Giacovazzi, then in his 20s, who convinced Dr Forrest to roll the dice on nickel for a second time with a presentation called Nickel: Get its mojo back.

It was a bold move given Dr Forrest’s horrible history with Anaconda Nickel.

Anaconda came close to squeezing the life out of Dr Forrest’s career as a mining entrepreneur. He was kicked out as chief executive in 2001 after falling foul with backers Glencore and Anglo American over production delays and processing plant misfires.

A quarter century later the project started by Anaconda – Murrin Murrin – is owned by Glencore and one of only two nickel mine mines still standing in Australia.

Mr Giacovazzi says he feels blessed to have Andrew and Nicola Forrest as the Wyloo shareholders. The separated couple have remained united in their support of Wyloo despite the nickel setbacks.

“It’s not easy to go through what happened to the nickel market last year. They’ve both obviously gone through many cycles themselves in mining, so they’ve got that experience and they’ve been really supportive,” he said.

The Forrests set up Wyloo, which sits under the umbrella of their flagship private company Tattarang, with a brief to invest in critical minerals set to play a role in decarbonisation.

Gold rush

Gold sits outside that brief but Mr Giacovazzi said it has been impossible to ignore, with Wyloo’s investment in Greatland Gold its biggest hit to date.

The Forrest-entity has so far made a profit of about $450m on paper in backing Greatland over the past three years and through its acquisition of the Telfer mine and an 80 per cent stake of the adjacent Havieron project from Newmont.

“I don’t think gold is core to our strategy, but when you’re in WA it is such a big part of the DNA,” Mr Giacovazzi said.

“We are very focused on critical minerals, and we are very focused on the minerals that are needed in the decarbonisation story. Being in WA you get so exposed to gold, and you naturally see a lot of the gold opportunities coming across your desk. There’s just been a handful of them where we really thought these are under-valued assets, and they’re good assets, and so we had a crack.

“We also had a view, just in terms of coming out of Covid and where monetary inflation was sitting, that gold was in for a good run. It has exceeded our expectations.”

Wyloo made money on investments in Regis Resources and Bellevue, and his only regret in the gold sector is that it didn’t follow through after a “fill or kill” share raid aimed at securing 15 per cent of Regis that fell short of the mark.

“When I look back on Wyloo and think about the past couple of years, I think probably our core strength is an ability to do stuff that’s a little bit different, creative and usually very structured,” he said.

“We’ve had some real rippers. We haven’t always got the timing 100 per cent right. On nickel, we caught it on the way down. But we’ve had some deals where we’ve had incredible timing and the past six months have probably been the best we’ve ever had.”

One of the more creative deals came in 2022 when Wyloo committed $150m in convertible notes to allow rare earths play Hastings Technology Metals to buy a stake in Canadian magnet maker Neo.

The upshot of the 2022 investment is that Wyloo is about receive a 60 per cent stake in Hastings’ flagship Yangibana project in WA on top of the 19.9 per cent stake in Neo. In return, Wyloo cancels Hastings debt in the form of exchangeable notes that would have had a face value of about $220m by the time they matured in October.

Wyloo will become the operator of the Yangibana project, where almost $200m has been invested to date.

Mr Giacovazzi sees it as great timing just weeks after China moved to restrict rare earths and permanent magnet supply to the Western world in response to Trump administration tariffs.

The Neo share price has jumped more than 75 per cent in the past year and its new permanent magnet plant in Estonia just shipped samples of the product required in electric vehicles to major customers.

“People are waking up to the fact that Neo is so uniquely positioned (as a Western world supplier of permanent magnets),” Mr Giacovazzi said.

“It’s a quiet but a very strong performer. It’s a business that could be three or four times bigger than what it is, and that’s what we like about it.

“Neo has suffered through the rare earth cycles and that’s an odd one. When the miners really started to struggle, Neo maintained its cash flow.”

Credit due

Mr Giacovazzi notes that at one point Neo was valued at $300m and making more money than ASX-listed Lynas Rare Earths, which at the time had a $3bn market capitalisation and is now valued at $7.45bn.

He is siding with the Albanese government in its row with Lynas boss Amanda Lacaze over a critical minerals strategic reserve set to include are earths.

Ms Lacaze has warned Labor’s stockpiling concept will not unlock new sources of supply to allow Australia to compete with China and will instead fund new warehouses which will largely lie idle.

Lynas is the world’s biggest non-China supplier of rare earths in contrast to strategic reserve supporters like Wyloo and Iluka Resources, who are seeking to enter a market where China can use its dominance to manipulate prices.

Mr Giacovazzi gives the government deserved credit for trying to create a stable price regime for projects.

“That’s always been missing in rare earths. The price cycles are incredible. They go really high or they can drop really low because for geopolitical reasons China might be trying to suppress the market,” he said.

“I don’t think there’s been a single rare earths CEO, including Amanda (Lacaze), who hasn’t spoken about manipulation of pricing in the sector.

“Now the devil will be in the detail but they’re (the government) taking a very collaborative approach by wanting to engage with industry to understand how it could work, and they did that exceptionally well on the production tax credit legislation.”

How the strategic reserve works will be a factor as Wyloo weighs up the future of Yangibana. “We’re feeling really positive about Yangibana. It is a fantastic asset, unique and probably the only rare earths asset on the planet where you could have concentrate in less than 12 months if you wanted it,” he says.

If Wyloo does hit the accelerator on Yangibana, Mr Giacovazzi says Wyloo will have no qualms about selling rare earths concentrate to China.

“Industries don’t start up overnight … you have to take steps to get there. China is the world leader in rare earths, and we’ve got a lot to learn from them,” he said.

“Over time, I think Australia will develop its own rare earths capability. It’s not there today.”

Lynas produces rare earth oxides in Malaysia from concentrates shipped out of WA while Iluka is building the nation’s first fully integrated rare earths refinery at Eneabba using $1.65bn in taxpayer funding.

Yangibana would represent the first mine developed by Wyloo with the Eagle’s Nest project in the Ring of Fire set to follow before the end of the decade.

Eagle’s Nest is touted as one of the highest grade nickel, copper and platinum group element (PGE) deposits in the world and the first in a series of seven ore bodies Wyloo believes can be developed across its Ring of Fire assets.

Mr Giacovazzi says Eagle’s Nest will have a long mine life and some similarities to the Nova-Bollinger nickel, copper and cobalt mine operated by IGO Limited in WA.

The knock on the project has always been that it is too controversial and too remote to be developed.

Mr Giacovazzi reckons that has changed with the Ontario legislation now out for consultation and the province’s innovative approach to letting first nations communities decide the route of a road to the site in a way that helps the communities access freight and power supply.

“Now it’s probably Canada’s No.1 critical minerals project,” he said. “I think a lot of countries have come to the realisation that critical minerals are essentially our generation’s version of oil, and it’s a huge opportunity.

“Trump’s definitely helped push it along a little bit, but it’s really been a big effort for a couple of years to get it (Eagle’s Nest/Ring of Fire) to the point where it is now.”

Wyloo expects to shed more light on its plans for a fully electric underground mine that has a footprint of less than one square kilometre in the next few months.

“People are nervous about the mine and that’s fair about a mine in a new area and in an untouched part of Canada,” Mr Giacovazzi said. “We also need to put it into perspective. It is very, very small and very high grade. This is the type of nickel that we should be producing. We should not be stripping rainforests, dumping deep sea tailings, causing landslides and fatalities and everything else that’s going on in Indonesia.”

More Coverage

Originally published as World turns in favour of Forrest-owned mining company Wyloo after nickel nightmare