Closing Bell: ASX sticks the landing with 1.34pc lift

After last week’s chaos investors are breathing a sigh of relief today, buying into a marginally calmer market and driving the ASX up 1.5pc.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

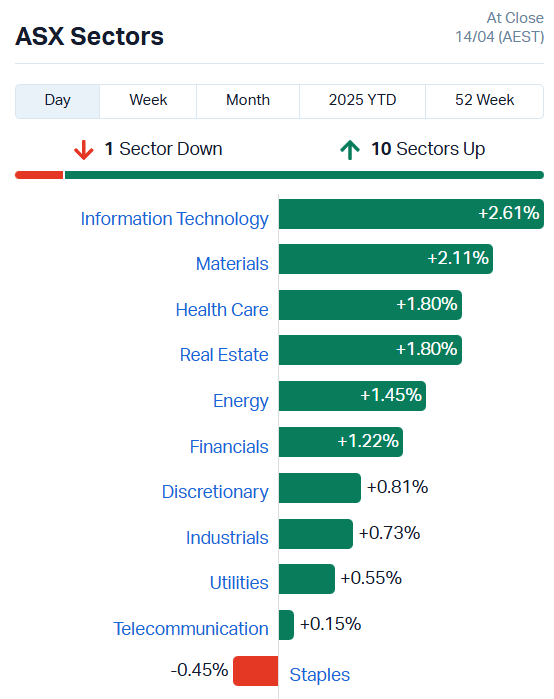

ASX climbs 1.34pc with 10/11 sectors in the green

Base metal prices recover as USD falls

Gold continues strong performance, remaining near all-time highs

It’s certainly a calmer start to the week for the markets today.

Strong numbers from US banking stocks buoyed US markets, giving us all a little breathing room amidst all the tariff furore. JP Morgan Chase gained 4%, and Morgan Stanley 1% to lift the S&P500 1.8%, the Dow Jones 1.6% and the Nasdaq 2.1%.

The US indices were all over the place last week, trading up and down more than 10% each before finally settling in the positive, although still down for the last month.

ASX investors have enthusiastically bought into the reprieve, driving the ASX up 1.34% with strong movements in resource, tech, real estate and health care stocks.

Tech, resources lead ASX sectors higher

In fact, just about every sector was in the green today… bar consumer staples, which has ironically been mostly steady despite the recent market chaos, up 7.18% for the month.

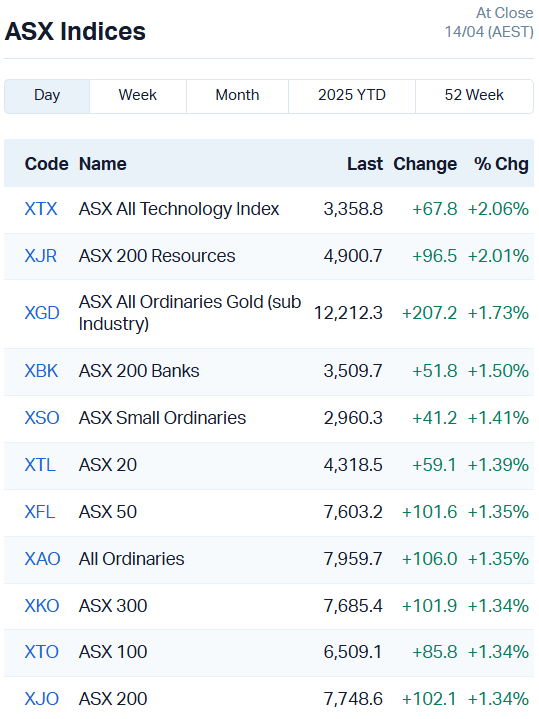

Looking at the ASX indices, the XTX All Technology Index is leading the way, up 2.06%.

Heavyweights like Xero (ASX:XRO), WiseTech (ASX:WTC) and TechnologyOne (ASX:TNE) are the main contributors, all up between 2.34% and 3.08%.

A special mention should be made for Siteminder (ASX:SDR), an e-commerce software provider, which is up 9.75% today.

Unfortunately, this is more of a recovery than a triumph. SDR’s stock price fell off a cliff earlier this year, descending from highs of $6.37 late in February each to just $3.94 today, a sharp 38% plunge in just two months.

The US dollar also eased last week, relieving pressure on base metal prices, which strengthened. Copper futures jumped 4.3%, while aluminium climbed 2.2% and iron ore lifted 0.9% to US$99.95 a tonne on Friday night.

That directly benefited iron ore and base metal miners, who’ve been missing out on the gold rally thus far. BHP (ASX:BHP) notched a 2.68% gain, Fortescue (ASX:FMG) 0.86% and Rio Tinto (ASX:RIO) 1.43%.

Gold has also maintained its momentum despite the calmer market waters, still up near all-time highs.

That made for another positive day for gold miners, particularly small caps. Antipa Minerals (ASX:AZY) gained 8.42% (read more about this stock’s latest news below) and Gorilla Gold Mines (ASX:GG8) 7.5%.

Other worthy mentions included Neuren Pharmaceuticals (ASX:NEU) which Stockhead’s own Eddy Sunarto gave some attention to in today’s Lunch Wrap, as well as Droneshield (ASX:DRO) which gained 16.29%, and Oceania Healthcare (ASX:OCA), up 15.46%.

Droneshield just inked a $32.3 million package deal with an Asia Pacific military customer, with payment expected to arrive in Q2 and Q3 this year.

The counter drone and artificial intelligence defence stock will provide both vehicle-mounted and fixed anti-drone systems, a vital new element of modern defence if the war in Ukraine is anything to go by.

Oceania is another story of recovery versus progress, with shares having dropped more than 23% in the last six months.

Now, let’s take a look at the small cap winners and losers for today.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| GGE | Grand Gulf Energy | 0.0035 | 133% | 52667629 | $3,675,581 |

| RLC | Reedy Lagoon Corp. | 0.002 | 100% | 936510 | $776,707 |

| 88E | 88 Energy Ltd | 0.0015 | 50% | 3169795 | $28,933,812 |

| CRB | Carbine Resources | 0.003 | 50% | 100001 | $1,103,476 |

| SKN | Skin Elements Ltd | 0.003 | 50% | 2985000 | $2,150,428 |

| EXR | Elixir Energy Ltd | 0.028 | 40% | 15823494 | $27,925,585 |

| CR3 | Core Energy Minerals | 0.015 | 36% | 1806770 | $3,615,551 |

| EWC | Energy World Corpor. | 0.019 | 36% | 1290873 | $43,104,897 |

| AX8 | Accelerate Resources | 0.008 | 33% | 2630366 | $4,723,132 |

| GMN | Gold Mountain Ltd | 0.002 | 33% | 343857 | $6,868,835 |

| MRQ | Mrg Metals Limited | 0.004 | 33% | 2614020 | $8,179,556 |

| SFG | Seafarms Group Ltd | 0.002 | 33% | 882083 | $7,254,899 |

| FLG | Flagship Min Ltd | 0.06 | 33% | 265537 | $9,161,740 |

| KEY | KEY Petroleum | 0.059 | 26% | 9142 | $1,183,437 |

| KGD | Kula Gold Limited | 0.0075 | 25% | 4566224 | $5,527,522 |

| FEG | Far East Gold | 0.15 | 25% | 15484 | $44,043,294 |

| BYH | Bryah Resources Ltd | 0.005 | 25% | 2926647 | $3,479,814 |

| CTN | Catalina Resources | 0.0025 | 25% | 2500000 | $3,032,524 |

| GCM | Green Critical Min | 0.01 | 25% | 11710835 | $15,693,426 |

| RDN | Raiden Resources Ltd | 0.005 | 25% | 17087390 | $13,803,566 |

| SPQ | Superior Resources | 0.005 | 25% | 2950679 | $9,483,931 |

| TEG | Triangle Energy Ltd | 0.005 | 25% | 44070046 | $8,356,936 |

| VFX | Visionflex Group Ltd | 0.0025 | 25% | 150000 | $6,735,721 |

| VRC | Volt Resources Ltd | 0.005 | 25% | 9313457 | $18,739,112 |

| NAG | Nagambie Resources | 0.021 | 24% | 3933432 | $13,656,140 |

Grand Gulf Energy (ASX:GGE) more than doubled its share price to $0.0035 a share after executing an options agreement to take a 70% working interest in an offshore oil exploration block in Namibia. There are seven offshore wells scheduled for drilling in the area in 2025, indicating high prospectivity.

Elixir Energy (ASX:EXR) is preparing the path to formal development of the Grandis gas project in Queensland, tapping former Strike Energy (ASX:STX) CEO Stuart Nicholls to replace outgoing CEO and managing director Neil Young.

“Starting my Elixir journey today, I intend to bring the sum of my experiences from Strike Energy, which over my tenure grew from a junior explorer into one of Australia’s most successful explorers and midcap energy producers,” Nicholls said.

Accelerate Resources (ASX:AX8) was another winner today, after outlining three “high impact” gold targets at the Kanowna East gold project in WA. The company intends to target the primary source of gold mineralisation on the project with an RC drilling program.

A reassessment of geochemical data has revealed tungsten in Gold Mountain’s (ASX:GMN) Serido Belt project in Brazil, offering new tungsten targets along strike from known mines. Tungsten’s uses in semiconductors and defence industries have been driving an increase in demand globally.

ASX SMALL CAP LAGGARDS

Today’s worse performing small cap stocks:

| Name | Price | % Change | Volume | Market Cap | |

|---|---|---|---|---|---|

| NNL | Nordicresourcesltd | 0.08 | -30% | 548589 | $16,949,142 |

| ADD | Adavale Resource Ltd | 0.0015 | -25% | 760000 | $4,574,558 |

| CHM | Chimeric Therapeutic | 0.004 | -20% | 600328 | $8,100,749 |

| ERL | Empire Resources | 0.004 | -20% | 437200 | $7,419,566 |

| LML | Lincoln Minerals | 0.004 | -20% | 4795988 | $10,281,298 |

| OLI | Oliver'S Real Food | 0.004 | -20% | 2034889 | $2,703,660 |

| OSL | Oncosil Medical | 0.004 | -20% | 5524709 | $23,032,901 |

| BNR | Bulletin Res Ltd | 0.069 | -19% | 1278689 | $24,957,132 |

| BRX | Belararoxlimited | 0.13 | -19% | 1938988 | $25,043,577 |

| PUA | Peak Minerals Ltd | 0.009 | -18% | 3330423 | $30,880,534 |

| EBR | EBR Systems | 1.39 | -18% | 5235694 | $630,194,788 |

| KNI | Kunikolimited | 0.12 | -17% | 28750 | $12,599,669 |

| AUA | Audeara | 0.03 | -17% | 55546 | $6,477,638 |

| BGE | Bridgesaaslimited | 0.015 | -17% | 2481299 | $3,597,466 |

| EG1 | Evergreenlithium | 0.05 | -17% | 306476 | $3,373,800 |

| ANX | Anax Metals Ltd | 0.005 | -17% | 7344807 | $5,296,845 |

| DTR | Dateline Resources | 0.005 | -17% | 3596198 | $15,393,412 |

| EM2 | Eagle Mountain | 0.005 | -17% | 1091911 | $6,810,224 |

| M2R | Miramar | 0.0025 | -17% | 366666 | $2,990,470 |

| SER | Strategic Energy | 0.005 | -17% | 10 | $4,026,200 |

| THB | Thunderbird Resource | 0.01 | -17% | 1191982 | $4,385,297 |

| WNR | Wingara Ag Ltd | 0.005 | -17% | 135170 | $1,053,255 |

| ZMM | Zimi Ltd | 0.01 | -17% | 190837 | $4,643,329 |

| MPP | Metro Perf.Glass Ltd | 0.055 | -17% | 17500 | $12,234,954 |

| AMD | Arrow Minerals | 0.024 | -14% | 3800864 | $23,910,798 |

IN CASE YOU MISSED IT

All 11 holes in Riversgold’s (ASX:RGL) latest RC drilling campaign have hit gold at the Northern Zone project in WA, boding well for an upcoming maiden resource for the tenure.

“The results continue to complement previous drill programs and we continue to increase the footprint of the gold mineralisation, revealing good gold tenor within the shallower top of this considerable mineralised porphyry,” RGL chairman David Lenigas said.

Bonanza gold hits at Cannindah Resources’ (ASX:CAE) Mt Cannindah copper-gold project up to 1m at 96.85 g/t gold has highlighted strong precious metal potential within the project’s porphyry system, which already holds a mineral resource of 14.5Mt at 1.09% copper.

Preparing to produce a pre-feasibility study for the Minyari Dome gold project in WA, Antipa Minerals (ASX:AZY) is advancing several parallel workstreams, including metallurgical test work, environmental studies and permitting activities. The company also plans to complete an exploration drilling program targeting resource expansion, near-term development and new discoveries.

Leeuwin Metals (ASX:LM1) has ticked off a maiden reverse circulation drilling program at the Marda gold project in WA, focused on untested strike and depth extensions to historical pits at Marda Central. Phase 2 drilling will begin once LM1 receives the results, expected in 3-6 weeks.

Following up on a result of 4m at 9 g/t gold from 12m at the Newman gold project, Peregrine Gold (ASX:PGD) is gearing up for an 8,000-metre air core program, with a specific focus on the Tin Can prospect. Soil sampling recently extended gold and arsenic anomalies in the Tin Can trend, indicating the presence of mineralisation.

At Stockhead, we tell it like it is. While Riversgold, Cannindah Resources, Antipa Minerals, Leeuwin Metals and Peregrine Gold are Stockhead advertisers, they did not sponsor this article. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX sticks the landing with 1.34pc lift