Lunch Wrap: ASX up, but energy stocks sink after IEA says we’re swimming in oil

ASX kicked off strong this morning, while Wall Street stayed wary. WiseTech climbed but energy stocks were pummelled after IEA report.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX starts strong, despite cautious session on Wall Street

WiseTech rises after signing up founder for 10 years

Gold soars, but oil demand slumps

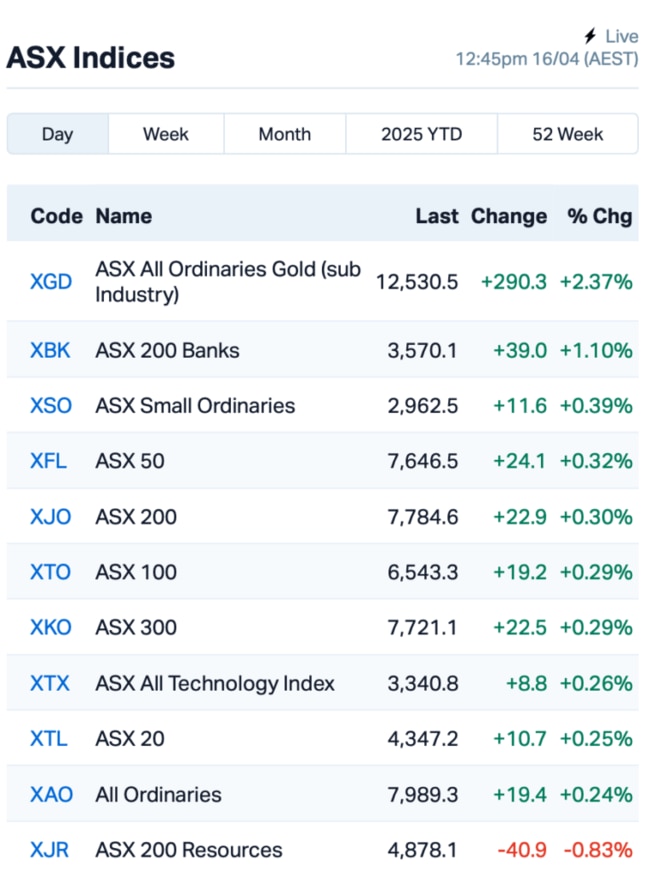

ASX had a solid start on Wednesday, ticking up 0.3% by lunchtime AEST.

But traders opened the day with one eye on Wall Street, and the other on the economic tea leaves, trying to figure out which way the wind's blowing.

Overnight in the US, President Trump signalled he’s open to striking a trade deal with China. Sounds promising, except the White House wants Beijing to make the first move.

The mood across Wall Street stayed cautious, with the S&P 500 closing lower by 0.17%, and the tech-heavy Nasdaq by 0.05%.

Meanwhile, US banks like Citi are still showing signs of a strong economy underneath all the noise, with decent trading results and signs consumers are still spending.

And just for good measure, Nvidia rose 1.35% after Trump threw his weight behind the company's US$500b AI plans in the US, promising fast-tracked approvals.

In total, Big Tech has now pledged over US$1.6 trillion to US AI, some serious coin.

But many fundies are still pulling back from US stocks, spooked by the economic outlook.

ANZ chimed in, too, saying there’s a 40% chance we’ll see a recession here at home (yes, here in Australia).

On the ASX, it was a tug-of-war between consumer staples and bank gains, and losses from energy.

Defensive plays like Woolworths (ASX:WOW), communications, and utilities all held their ground; all safe bets when the market’s looking rattled.

But energy was a different story.

Woodside Energy Group (ASX:WDS) and Santos (ASX:STO) both slipped over 2% after the International Energy Agency (IEA) took a machete to its oil demand forecasts, not just for this year, but all the way through to 2026.

The IEA reckons the world’s swimming in oil and has too much supply, with demand growth slowing sharply thanks to EVs and a sluggish global economy.

Elsewhere, gold hit another record high this morning, blowing past Monday’s peak and getting comfy above $US3,250 an ounce, taking gold stocks higher with it.

As you may recall, Goldman Sachs has been calling a $US4000 price for gold by mid-2026.

Here’s where things stood at about 12:45pm AEST:

In the large caps space, WiseTech Global (ASX:WTC) rose 1% after locking in founder Richard White for another 10 years as its executive chair and chief innovation officer on the same $1m salary, no pay rise.

The company has also brought back old hand Zubin Appoo as deputy chief innovation officer to help drive the next phase.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for April 16 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| NSB | Neuroscientific | 0.062 | 77% | 8,186,195 | $5,061,170 |

| WMG | Western Mines | 0.190 | 73% | 504,362 | $9,938,868 |

| PGY | Pilot Energy Ltd | 0.008 | 50% | 33,691,885 | $8,293,300 |

| EDE | Eden Inv Ltd | 0.002 | 50% | 528,735 | $4,109,881 |

| PAB | Patrys Limited | 0.003 | 50% | 2,793,151 | $4,114,895 |

| NWM | Norwest Minerals | 0.012 | 33% | 2,442,274 | $4,366,076 |

| REE | Rarex Limited | 0.033 | 32% | 15,825,763 | $20,021,146 |

| WIN | WIN Metals | 0.018 | 29% | 4,003,958 | $7,700,813 |

| CCO | The Calmer Co Int | 0.005 | 25% | 12,798,367 | $10,215,485 |

| LML | Lincoln Minerals | 0.005 | 25% | 128,500 | $8,225,038 |

| VRC | Volt Resources Ltd | 0.005 | 25% | 80,000 | $18,739,112 |

| DXN | DXN Limited | 0.037 | 23% | 326,754 | $8,961,109 |

| TG6 | Tgmetalslimited | 0.120 | 22% | 268,955 | $7,302,392 |

| MDX | Mindax Limited | 0.090 | 22% | 875,330 | $169,736,652 |

| PTX | Prescient Ltd | 0.051 | 21% | 3,400,276 | $33,823,431 |

| ASM | Ausstratmaterials | 0.685 | 21% | 1,191,829 | $102,457,485 |

| AMS | Atomos | 0.006 | 20% | 1,000,000 | $6,075,092 |

| LU7 | Lithium Universe Ltd | 0.006 | 20% | 1,700,303 | $3,929,898 |

| PBL | Parabellumresources | 0.050 | 19% | 10,000 | $2,616,600 |

| ZIP | ZIP Co Ltd.. | 1.750 | 18% | 25,070,610 | $1,932,274,477 |

| AGH | Althea Group | 0.021 | 17% | 304,108 | $9,393,060 |

| BNL | Blue Star Helium Ltd | 0.007 | 17% | 516,539 | $16,169,312 |

| SPX | Spenda Limited | 0.007 | 17% | 2,081 | $27,691,293 |

| LGM | Legacy Minerals | 0.285 | 16% | 380,136 | $30,603,765 |

NeuroScientific Biopharmaceuticals (ASX:NSB) skyrocketed after sealing a deal to acquire StemSmart, a patented stem cell tech from Isopogen WA, giving it full rights to produce next-gen cell therapies using mesenchymal stromal cells (MSCs). Early trial results in Crohn’s patients are looking promising, showing the treatment is safe, effective, and potentially life-changing. To fund the move, NSB has raised $3.5 million and lined up fresh board talent, including industry veterans and a new chief scientific adviser.

Pilot Energy (ASX:PGY) has pulled in $5 million through a heavily oversubscribed placement at 1 cent a share, double its last trading price. The fresh cash will go toward wrapping up the recently announced Korean deal. The deal is a proposed investment by a Korean consortium into Pilot’s Mid-West Clean Energy Project, aiming to develop a large-scale clean hydrogen and ammonia operation in WA.

Norwest Minerals (ASX:NWM) has just secured a key mining lease for its 100%-owned Bulgera gold project, a historic site with a 217,600-ounce gold resource. The project sits just 50km from Catalyst Metals’ 1.8Mtpa gold plant, making it ripe for a potential restart. With the gold price surge breathing new life into Bulgera’s economics, Norwest will be holding off on any capital raise for now while it reworks its models.

WIN Metals (ASX:WIN) has updated its Butchers Creek Gold resource, now sitting at 5.23Mt at 1.91g/t Au for 321,000oz of gold, with a big boost to the indicated resource, up 86% to 258,000oz. This increase sets the stage for development studies, as WIN eyes low-cost open-pit mining in the current high gold price environment. WIN’s also planning more drilling in 2025, targeting high-priority areas like Golden Crown, which recently returned 6m at 10.85g/t Au.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for April 16 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| TMS | Tennant Minerals Ltd | 0.005 | -38% | 20,556,631 | $7,647,123 |

| RLL | Rapid Lithium Ltd | 0.002 | -33% | 500,000 | $3,734,834 |

| PIL | Peppermint Inv Ltd | 0.003 | -25% | 78,000 | $8,950,558 |

| GLE | GLG Corp Ltd | 0.130 | -24% | 6,000 | $12,597,000 |

| GR8 | Great Dirt Resources | 0.100 | -23% | 100,000 | $3,815,664 |

| AVE | Avecho Biotech Ltd | 0.004 | -20% | 602,939 | $15,846,485 |

| CTN | Catalina Resources | 0.002 | -20% | 300,000 | $4,159,399 |

| ICG | Inca Minerals Ltd | 0.004 | -20% | 431,858 | $6,381,950 |

| MTB | Mount Burgess Mining | 0.004 | -20% | 50,000 | $1,697,687 |

| RLG | Roolife Group Ltd | 0.004 | -20% | 1,011,286 | $7,480,156 |

| GNM | Great Northern | 0.014 | -18% | 133,334 | $2,628,694 |

| EM2 | Eagle Mountain | 0.005 | -17% | 150,000 | $6,810,224 |

| SER | Strategic Energy | 0.005 | -17% | 500,017 | $4,026,200 |

| SHP | South Harz Potash | 0.005 | -17% | 23,608 | $6,495,472 |

| TMX | Terrain Minerals | 0.003 | -17% | 80,000 | $6,010,670 |

| WBE | Whitebark Energy | 0.005 | -17% | 1,900 | $2,399,441 |

| ASE | Astute Metals NL | 0.021 | -16% | 60,003 | $15,453,506 |

| NTI | Neurotech Intl | 0.029 | -15% | 160,162 | $35,687,145 |

| AJL | AJ Lucas Group | 0.006 | -14% | 691,527 | $9,630,107 |

| IMI | Infinitymining | 0.012 | -14% | 243,965 | $5,922,221 |

| RFA | Rare Foods Australia | 0.006 | -14% | 774,477 | $1,903,883 |

| ORD | Ordell Minerals Ltd | 0.600 | -13% | 311,554 | $24,831,492 |

| SHV | Select Harvests | 4.715 | -13% | 787,248 | $768,802,327 |

| FFF | Forbidden Foods | 0.007 | -13% | 500,000 | $5,696,816 |

IN CASE YOU MISSED IT

With an eye to growing the mineral reserves at the Minyari Dome gold project, Antipa Minerals (ASX:AZY) has kicked-off a 35,000-metre drilling program incorporating air core, reverse circulation and diamond core drilling. The drill bit will test the Parklands target, Minyari Dome deposit and GEO-01 south prospect over the three-month program, designed to increase the existing 2.3-million-ounce gold resource.

At the Kasiya natural rutile and graphite project in Malawi, Sovereign Metals (ASX:SVM) has initiated several geotechnical drilling programs. The results will inform infrastructure layout and engineering design for the project’s definitive feasibility study, scheduled to be released in Q4 2025.

At Stockhead, we tell it like it is. While Antipa Minerals and Sovereign Metals are Stockhead advertisers, they did not sponsor this article. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Lunch Wrap: ASX up, but energy stocks sink after IEA says we’re swimming in oil