‘Big Ben’ takes on Poms over Glencore London listing

Where the bloody hell are youse! Tribeca fund manager Ben Cleary says Glencore needs to forget London and list on the ASX to lift its flagging share price.

QLD Business

Don't miss out on the headlines from QLD Business. Followed categories will be added to My News.

Terrace old boy Ben Cleary came out swinging this week to tell us what we already guessed: the Poms know jack about mining.

The Tribeca Investment Partners portfolio manager wrote to the board of mining giant Glencore telling them they needed to forget their listing in dear Old Blighty and high tail it to Australia, which he described as the “home of mining investment.”

Glencore, which operates the huge Mount Isa mines along coal, nickel and zinc operations around Australia, has been a poor performer on the London Stock Exchange since its listing in 2011. Maybe it’s the weather and stodgy food? Over that period returns to shareholders, including buybacks and dividends, has been a lacklustre 9 per cent compared to 95 per cent for ASX-listed BHP, 99 per cent for South32 and Rio Tinto’s 126 per cent. Tribeca also wants Glencore to ignore the woke greenies and keep its coal assets.

Cleary’s campaign has attracted media attention around the world including the august Financial Times, no doubt read by old boys of the London establishment suitably outraged by the cheek of this colonial upstart.

Tongue in cheek, Cleary also has released a Glencore mascot he calls Aussie Bruce complete with cork hat. Cleary relocated his young family back home from Singapore last year as the new local head of $4bn investment firm Tribeca Investment Partners after a 20-year career in high finance spanning London, Hong Kong and Singapore.

Tribeca purchased a three-storey office building in Wandoo St in the Valley as its headquarters that was quickly renamed Tribeca House. Tribeca was founded 25 years ago and has offices in Sydney, Singapore and New York, managing capital for some of the largest sovereign wealth funds and pension funds in the Asia Pacific. Cleary says he sees Queensland universities as being a very strong feeder into the local funds management industry and one day graduates won’t have to go to Sydney or London to further their careers.

Cleary is an old mate of another Terrace success story, Doug Tynan, a former forklift driver who now heads Sydney-based investment firm GCQ and also likes a corporate scrap or two. City Beat readers will recall Tynan, while a partner at VGI, famously shorted the stock of Jamie Pherous’ Corporate Travel Management as well as taking on the fresh produce czars down at the Brisbane Markets. Watch this space.

Wheels turning

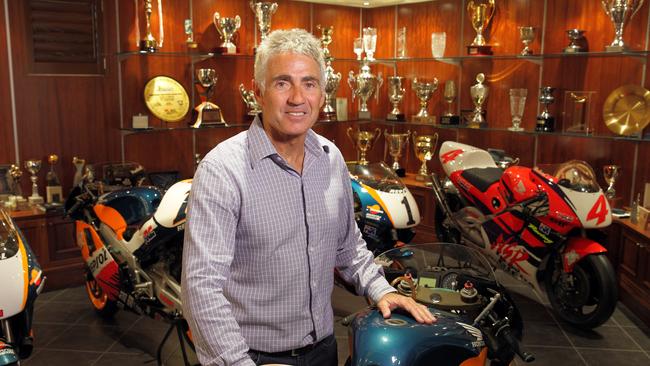

The wheels keep turning for one of the largest remaining beachfront development sites on the Gold Coast, linked to a world motorcycle champ and a transport industry icon.

Marquee Development Partners has confirmed they are the new owners of the 3,304sqm Palm Beach parcel on the beach at 1293 Gold Coast Highway.

The property was formerly partially owned by world motorcycle racing champion Mick Doohan and more recently, wholly owned by Gold Coast bus industry magnate, the late Joe Calabro and his wife Roma. Marquee Director Jacques Winterburn said the property represented a rare opportunity to deliver a special project.

“This is a unique property and we are looking forward to respecting the legacy of the Calabro family,” he says. The project is due to be released to the market in April 2024 when full details will be released.

More Coverage