Ominous warning as 540,000 Queensland homes remain uninsured in the face of Cyclone Alfred

As millions of residents brace for Tropical Cyclone Alfred to make landfall on Friday, experts have issued an ominous warning as the stock market reacts.

Costs

Don't miss out on the headlines from Costs. Followed categories will be added to My News.

As millions of residents of Queensland and northern NSW brace for Tropical Cyclone Alfred to make landfall on Friday, experts have warned insurance claims could top $2 billion.

More worryingly still, more than half a million households have no home and contents insurance at all — and the best they can do is strap in.

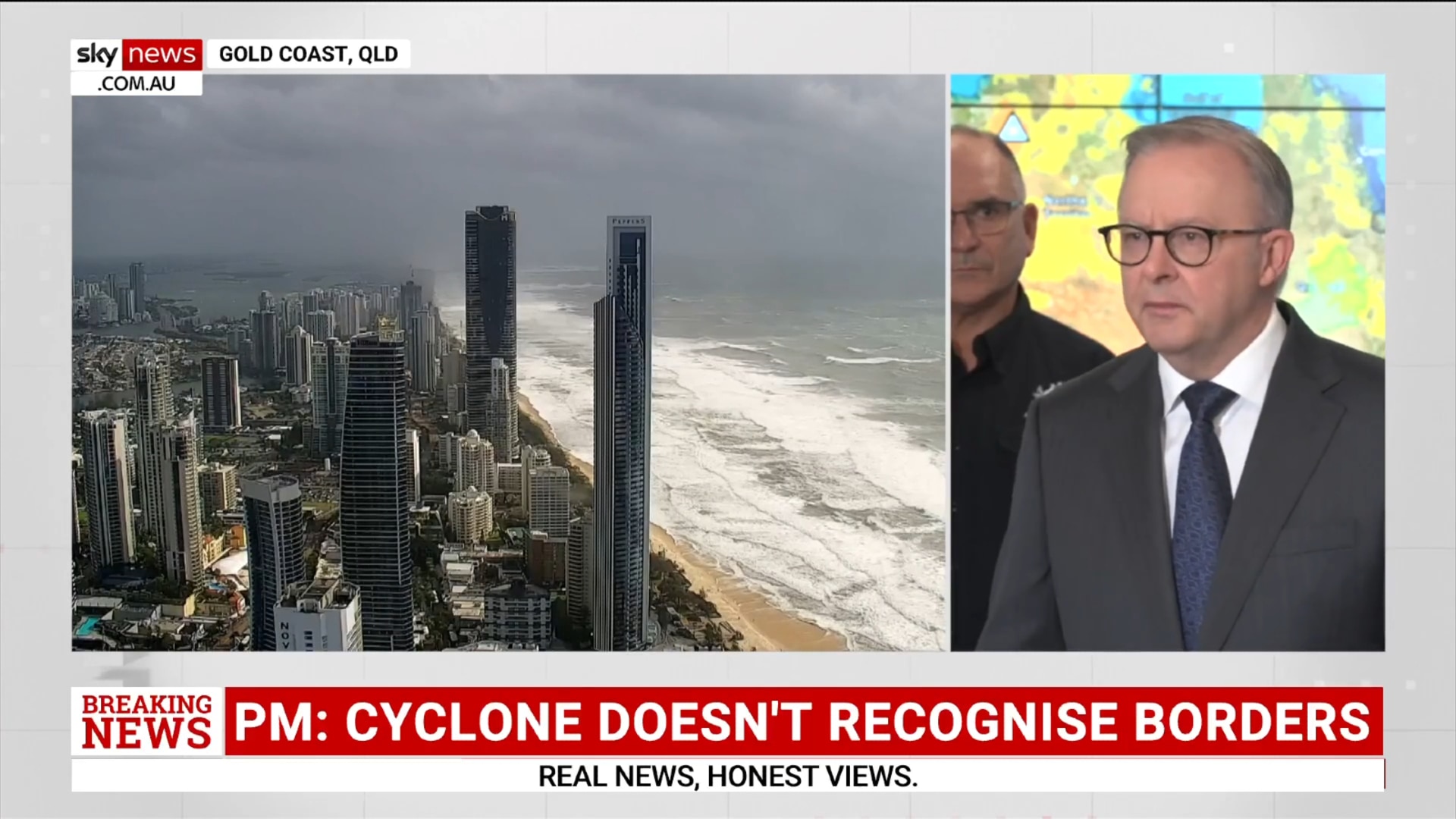

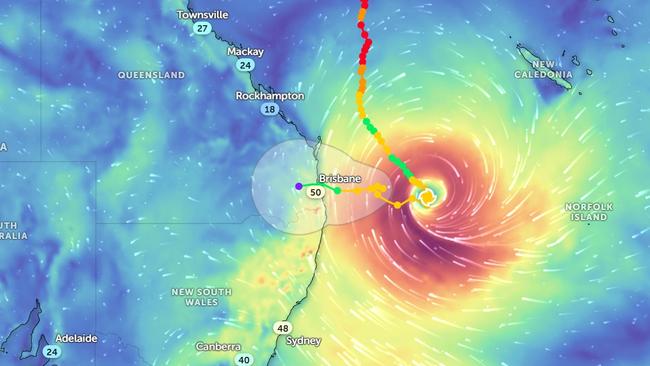

The slow-moving storm system is now tipped to make landfall between Maroochydore and Coolangatta on Friday afternoon, with the category two cyclone 325km east of Brisbane and 300km east of the Gold Coast on Thursday morning, moving west-southwest at 7km/h.

“There’s a lot of people in harm’s way here,” Treasurer Jim Chalmers told the ABC.

“We’re talking about something like 4.5 million Australians potentially in harm’s way, 1.8 million homes, and we expect there’ll be billions of dollars of damage done by Cyclone Alfred. The best we can do is prepare and stay informed, make sure that people are accessing all of the relevant information and getting it from trusted sources. But it’s going to be a difficult couple of days.”

Shares in the country’s biggest insurers have been battered this week, despite assurances from two of the top three, IAG and Suncorp, that they are well positioned financially to manage claims.

QBE Insurance is down more than 6 per cent since Monday and Suncorp Group is down 4 per cent, however Insurance Australia Group (IAG) is down 1.5 per cent, roughly in line with the broader market.

Ratings agency S&P said on Wednesday that while the path and strength of the cyclone was uncertain, similar events suggested insured losses of more than $2 billion, with Alfred on track to match or exceed some of the Australia’s largest natural catastrophes in the past 10 years.

Cyclone Alfred will be the first major test of the federal government’s Australian cyclone reinsurance pool (ACRP), established in 2022, which takes the first layer of insured losses after an initial deductible held by the insurer, while extreme losses can be covered by the pool’s $10 billion guarantee.

“Australia’s three largest property and casualty insurers have strong credit quality and their maximum event retentions are well covered at the moment and represent about 20 per cent of each entity’s natural perils allowance,” S&P Global Ratings credit analyst Craig Bennett said.

“Capital adequacy is very strong, or better, by our assessments, based on our global insurance capital model.”

Credit fundamentals of the rated insurers are supplemented with participation in the ACRP, S&P noted.

“We expect the ACRP and government-guarantee, if required, to respond to eligible property claims incurred up to 48 hours after the event,” Mr Bennett said.

“Where claims fall outside the ACRP cover — like large commercial losses or ongoing rain and flood — primary insurers will have access to their own resources and then significant reinsurance covers.”

Strong winds, heavy rainfall, and storm surge are likely to affect residents between the Sunshine Coast and NSW’s Northern Rivers region, including Brisbane with a population of 2.5 million.

Brisbane City Council estimates about 20,000 homes to be at risk of inundation in the Brisbane region alone. This compares with the 2022 floods where about 35,000 homes were materially damaged out of a total 245,000 claims, with incurred claims of about $6.4 billion. The last major tropical cyclone, 2017’s Debbie, incurred about 77,000 claims worth some $1.8 billion.

“A cyclone hitting a major city like Brisbane can result in elevated property damage and insurance claims and may include significant business interruption,” Mr Bennett said. “Most rated insurers have already enacted emergency disaster management plans.”

The idea behind the ACRP is to lower insurance premiums for households and small businesses at high risk of cyclone and flood damage by reducing the cost of reinsurance — insurance for insurance companies — which is a significant part of the cost of premiums.

A report by the consumer watchdog last year found the cyclone reinsurance pool had begun delivering lower premiums for some consumers in cyclone-prone regions, although these savings had been offset by other cost increases.

“Insurers are making changes to pass these savings on to consumers, and also to better recognise specific mitigation measures consumers have implemented,” Australian Competition and Consumer Commission deputy chair Catriona Lowe said in September.

“However a range of factors including a hardening of global reinsurance markets and extreme global weather events are contributing to these savings being less apparent to consumers, who continue to face very high insurance premiums.”

The ACCC found more than one quarter of combined home and contents policies in areas of medium to high cyclone risk saw premiums decrease, by anywhere from 8 per cent to 24 per cent, as a result of the reinsurance pool.

Despite this, home, strata and small business insurance premiums remained much more expensive in northern Australia where cyclones are more prevalent, compared to the rest of Australia.

The ACCC found that in 2023, the median premium for a combined home and contents insurance policy was highest in north Western Australia at $4376, the Northern Territory at $3054 and in north Queensland at $2,959.

In comparison, the median premium in the rest of Australia was $1781.

Ms Lowe said feedback from the community showed the need for more affordable insurance premiums across northern Australia.

“We continue to hear consumers say that the cost of insurance for their home or small business has become prohibitive, forcing them to risk underinsurance or go without insurance at all,” she said.

Research by comparison website Finder suggests 27 per cent of Queenslanders don’t have home and contents insurance, or an estimated 540,000 uninsured households.

Similar research by Compare the Market last year found around one quarter of Queenslanders did not have home and/or contents insurance, with Gen Z the least likely to be insured at just 42 per cent, compared with baby boomers and millennials at 85 per cent and 72 per cent respectively.

“This could be the first tropical cyclone to hit Brisbane in 50 years and households are very concerned about how wild weather will impact their homes,” said Finder insurance expert Tim Bennett.

“Intense rain could lead to flooding and wind gusts could be damaging leaving them vulnerable to expensive repairs and event displacement. Australians are facing an escalating challenge that goes beyond just immediate concerns for safety and property destruction — it’s about long-term financial security.”

Mr Bennett said it was unfortunately too late to take out home and contents cover ahead of Cyclone Alfred.

With insurance premiums on the rise due to worsening disasters, many homeowners were “finding it harder to balance preparedness with affordability”.

“The family home is the largest financial asset for many Australians, so insurance must not be overlooked,” he said.

“Disaster-proofing is one way homeowners can minimise damage, protect themselves and reduce financial loss during natural disasters.”

In an update to the share market on Wednesday, IAG noted it had a comprehensive reinsurance program that includes quote share reinsurance that covers 32.5 per cent of all losses, and catastrophe cover that provides cover for 67.5 per cent of all losses above $500 million up to $10 billion.

IAG also has perils volatility cover of $680 million, which provides “strong downside protection against retained natural perils costs exceeding the FY25 allowance of $1.283 billion”. IAG noted in its half-year results last month that its year-to-date natural perils costs were running around $100 million below expectations.

IAG managing director and chief executive Nick Hawkins urged everyone in the potential path of the cyclone to make safety their priority follow the directions of emergency authorities.

“We’re co-ordinating our response through our Major Event Command Centre and our call centres across Australia and New Zealand are well prepared to support all our customers who may be impacted,” he said.

“We have already contacted many customers to let them know the range of ways they can reach us immediately to ledge any claims and access support such as temporary accommodation and emergency financial assistance.”

Suncorp said in a statement to the ASX it had a comprehensive reinsurance program in place that provides protection against large weather events, with a maximum event retention of $350 million. Suncorp’s main catastrophe cover provides protection of up to $6.75 billion with a full reinstatement in place.

In its half-year results, Suncorp said it was running $277 million below its natural hazard allowance.

“Our Disaster Management Centre is active, and Suncorp’s disaster response team is closely monitoring the weather system as it approaches the Queensland coast,” Suncorp chief executive Steve Johnston said.

“Given this system is likely to affect a large geographical area, we are preparing our response and claims teams to assist impact customers. Any customers affected by this event are reminded they can lodge their claims through our digital channels as soon as it is safe to do so.”

The Insurance Council of Australia (ICA) on Tuesday urged residents of southeast Queensland and northern NSW to secure their properties of loose material that may cause damage during extreme winds and heavy rain, and place important documents and valuables in plastic bags or waterproof containers.

“The safety and wellbeing of the community is of paramount importance and while it is still too soon to determine the true intensity of Tropical Cyclone Alfred, insurers stand ready to support customers and to help alleviate the stress and uncertainty associated with this event,” said ICA chief executive Andrew Hall.

“A cyclone of this scale hasn’t made landfall along the east coast for 35 years, and it’s important to not be complacent.”

Originally published as Ominous warning as 540,000 Queensland homes remain uninsured in the face of Cyclone Alfred