Aussie exposes alarming bank issue

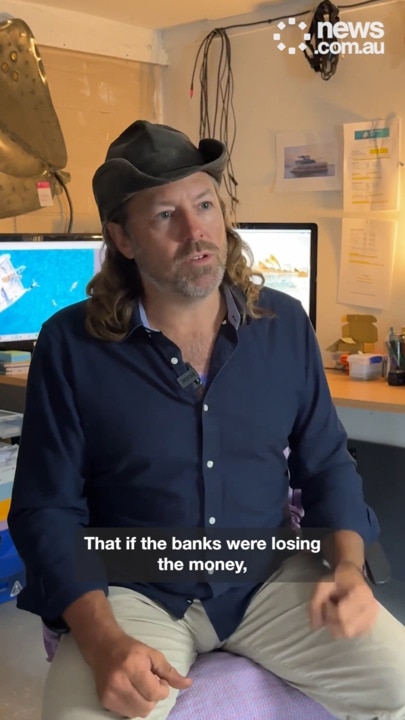

While he lost a bunch of money, it was what he uncovered next that left him disturbed at how easy it was to get away with a crime.

Costs

Don't miss out on the headlines from Costs. Followed categories will be added to My News.

An Australian man was disappointed when he lost more than $11,000 in a devious scam, but what he uncovered next left him disturbed.

Carl Fitzgerald was having solar panels installed on his Tasmanian home last year when he paid off the money to the company after a request via email.

But when the tradie showed up and Mr Fitzgerald casually asked if the money had landed in the account, he was shocked to discover the email had been intercepted. Instead, he had been given the bank account details of a scammer.

Mr Fitzgerald had fallen victim to a type of scam which saw Aussies tricked out of a whopping $16.2 million in 2023, ACCC data showed.

But not content to just sit back and be defrauded, the experience sent Mr Fitzgerald on a sleuthing mission.

The Tassie man wanted to see how easy it was open a bank account in Australia online and he was shocked by what he discovered.

He first tested opening a new account with Westpac – where his stolen funds went – and said he only needed his Medicare number and driver’s licence.

“I would contend Westpac have scores of fraudulent bank accounts in their system and thus facilitate online financial crimes … Driver’s licence and Medicare card numbers are easily obtained by criminals,” he told news.com.au.

Then he tried with another bank and was shocked by what he uncovered.

“It was a driver’s licence number and away I went and opened an account with a credit union. Not only was I able to open an account with the driver’s licence number, I could also get the card sent to another address,” he revealed.

“I didn’t even have to match the driver’s licence address to get hold of the card.

“It just showed me how easy it is to open bank accounts. Banks have a vested interest to have it nice and easy to open bank accounts as they want to have as many accounts as they are all potentially high earners for them as customers.

“But banks have got no incentive to try and mitigate which accounts are fraudulent.”

Mr Fitzgerald said if banks were liable for scam losses they would conduct rigorous checks on customers’ opening accounts.

“The banks have a duty to properly know the true identity of their customers, rather than facilitating crime through their lax online bank account opening processes,” he added.

The 56-year-old said the most distressing aspect of the fraud was the response from the banks — and that’s what set him on a mission to prove how easy it is for scammers to infiltrate.

“It’s not so much about the loss but to me how the banks don’t have any incentive to really monitor fraudulent bank accounts,” he said.

“It must be pretty obvious someone opens an account and there’s no activity and the account just sits there … until they get someone to deposit money randomly and then the money is miraculously transferred overseas.”

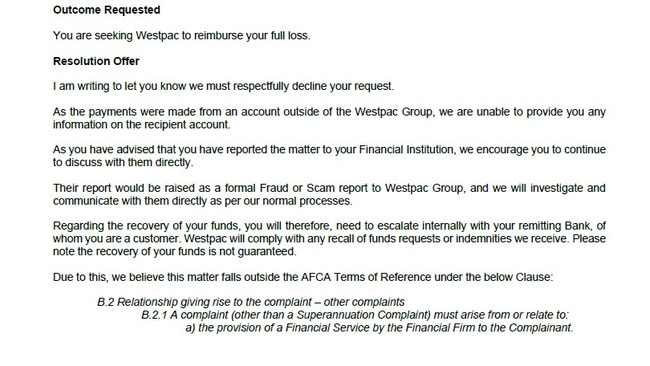

None of his stolen funds were recovered from the Westpac account but he was left feeling hopeless in terms of finding out more.

“They don’t tell you any information other than the funds are not recoverable,” he noted.

“I am the victim of this fraud, yet I am not entitled to know the real name of the bank account or how were the funds moved from the fraudulent account.”

He attempted to raise a case against Westpac with the independent dispute resolution service AFCA but was told there was no jurisdiction as it was the receiving bank.

“I was even prepared to throw good money after bad and engage a lawyer to pursue Wesptac and the lawyer … stated there was no possible remedy as I had no contract with Westpac,” he noted.

A Westpac spokesperson said when the bank is informed of scam activity by another bank, it takes immediate action, including by blocking accounts where necessary.

“Whether criminals have fraudulently accessed an account or tricked an unsuspecting customer into getting involved, we are focused on identifying, investigating and shutting down illegitimate accounts to prevent further harm,” they said.

“When it comes to detecting mule accounts, we’re tackling this in a number of ways including through biometrics and ID verification when people open a new account to make sure they are who they claim. We also co-operate with other banks directly as well as through the Australian Financial Crimes Exchange and we continue to work with authorities.”

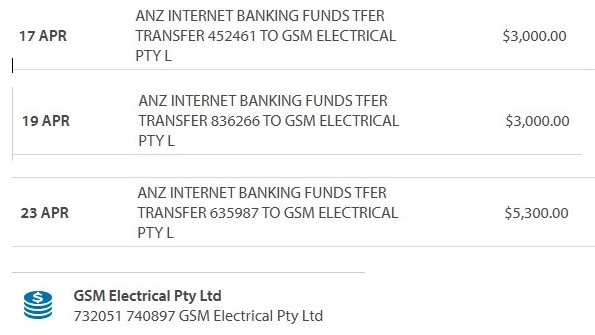

Mr Fitzgerald was also critical that when he transferred the money from his ANZ account that banks do not require the name of the account to match.

“The banks create a false sense of security for the sender of funds by requiring the name of the bank transfer account,” he added.

However, he said ANZ was ultimately “reasonable” as they provided him with $1750 worth of compensation, although it wasn’t for the lost money but for the way he was treated over the matter.

An ANZ spokespeson said the bank is on track to deliver confirmation of payee this year and has a range of other measures to help detect scams and protect customers.

“The ways in which criminal syndicates are scamming and defrauding customers is sophisticated and constantly evolving and ANZ encourages customers to be cautious of any unsolicited calls, emails or messages from someone claiming to be from their bank,” they added.

Account name matching is a basic anti-scam measure that has blocked many fraudulent transactions in other countries and despite a $100 million pledge for Australian banks to roll out the technology — it still isn’t place.

The confirmation of payee system is not due to be implemented by all Australian banks until the end of 2025.

A spokesperson for the Australian Banking Association said implementing an industry-wide confirmation of payee system requires a significant build and investment.

sarah.sharples@news.com.au

Originally published as Aussie exposes alarming bank issue