Insurance wars move into Queensland as IAG moves on RACQ

The two biggest insurers are about to go head to head in Queensland. Will the $855m buyout deliver for Sydney’s IAG?

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The insurance wars are making a return, although the battle is starting to shift into cyberspace with Sydney’s Insurance Australia Group making a big strike at rival Suncorp’s home market in Queensland.

After on again, off again talks IAG’s chief executive Nick Hawkins has paid $855m for a 90 per cent stake in the insurance arm of RACQ. There’s an option to move to full ownership in two years’ time that could see the final acquisition price move to $1bn.

The deal is complicated in that it’s the form of a joint venture – the motoring organisation RACQ will continue to control front-end distribution and have access to customers, although IAG will own the underwriting operation.

In addition the distribution deal has a 25-year limit, which means there’s a point in the distant future where the two will need to sit down and renegotiate.

As far as the market is concerned, that’s a matter for another day and this is largely behind a near 5 per cent jump in IAG’s shares.

The deal represents one of the last independent insurance properties at scale, and delivers second-biggest general insurer in Queensland to IAG. This is a market where IAG has traditionally been underweight. It also offers a very strong local brand for IAG over the long term.

RACQ has been shopping its insurance arm for some time. As my colleagues Bridget Carter and Glenn Norris reported names like Allianz were in the mix while IAG had been running the numbers for almost a year. The structure of the deal had kept others away, but IAG was a natural fit given its previous history.

This was the model that saw IAG initially spun out of NSW’s NRMA business and there’s history with a similar joint venture in Victoria, where IAG sits behind RACV insurance while the motoring arm delivers the distribution. The difference there is that the arrangement has no sunset clause.

“We’ve got a track record of being able to work in this under type of concept, and I think the evidence of that is the way that our RACV relationship has worked for the last 25 years,” Hawkins tells The Australian.

IAG’s call to bulk up on home and property signals its view that pricing gains will hold and the worst of the inflation bubble is over, meaning the high costs in construction and repairs can be contained.

Queensland too represents one of the fasting-growing states, and this population growth underpins demand for motor vehicles and property prices.

As well as $1.3bn in additional premium income, for IAG much of the upside will come from moving RACQ onto its own lower cost digital platform. If this goes smoothly it will deliver savings in claims policies and pricing. IAG also hopes to carve out gains by spreading the cost of reinsurance over a bigger customer base.

This is insurance, what are the risks?

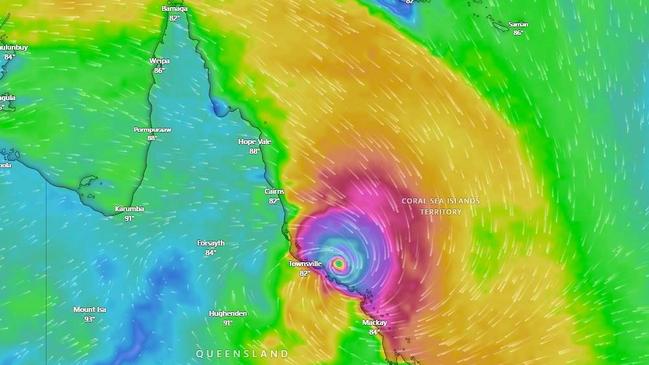

A bigger slice of Queensland also delivers a bigger exposure to tropical weather, and insurers say the intensity of storms and cyclones is getting worse. This means the prospect of costly payouts when storms inevitably hit.

Hawkins says regulatory changes in recent years including the government-backed cyclone pool, has created a different risk profile than what existed before.

So too RACQ has since quit the state’s compulsory third party insurance scheme given heavy losses. Hawkins says he will consider getting back into that market but that only if the new government is prepared to overhaul the scheme.

The competition regulator will now have to consider whether RACQ was a price leader and whether the loss of number two will leave the state high and dry. This now pits two large players (IAG and Suncorp) against a long-tail of others including Allianz, QBE and the David Foster-chaired Youi. In the Suncorp banking sale, the ACCC highlighted market share issues at a state level as a sticking point. A smooth regulatory run is not guaranteed.

The deal also raises questions for the future RACQ. Following completion the member-owned organisation will sitting on nearly $1bn in cash. It has a small banking business through the merger nearly a decade ago with QT Mutual and a roadside assist business. Some of these funds will be reinvested into the motoring arm, including gearing it up for the EV shift. Tourism and resorts offer another option for the business.

The RACQ deal also comes while arch rival Suncorp faces its own internal distractions in coming years. While it has finally freed itself of its capital intensive banking business, chief executive Steve Johnston has committed to a major upgrade of technology. Still, there’s nothing quite like a Queensland rivalry. Let the games begin.

eric.johnston@theaustralian.com.au

More Coverage

Originally published as Insurance wars move into Queensland as IAG moves on RACQ