Industry funds ill prepared for peak super

As the superannuation sector’s value passes the $4 trillion barrier, it is nearing the moment where more cash will come out of the system than go in.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Australia’s super industry will no doubt be celebrating the moment it passed the $4 trillion milestone, making it the third biggest pool of cash anywhere in the world.

There’s good reason. From nowhere, the sheer size of the funds under management in the super sector is now double the annual output of the Australian economy ($2.4 trillion) and has long overtaken all the deposits sitting in the nation’s banking system ($3 trillion).

It is held up as a model to be followed around the world, and BlackRock’s co-founder, Larry Fink, argues it should be studied for the US.

However, the big top-line number overshadows the cracks building in the super sector which is now dominated by a handful of big industry funds. Super in Australia is fast reaching its tipping point as the demographic bulge of workers prepares for retirement.

The pace of withdrawals from the system in the form of lump-sum payments and pension payouts is accelerating, and there are no signs of it slowing.

Had it not been for the higher-than-expected wage rises over the past year and an increase in superannuation guarantee over each of the past two years, the sector would have easily hit negative jaws. That is, the outflows would be bigger than the inflows.

The last tranche of the super guarantee rises come next July, when the rate increases to 12 per cent.

Wage increases are starting to plateau on a slowing economy and more capacity in the jobs market. This means that at the current pace, growth of withdrawals will soon start to eclipse contributions and that moment marks a critical shift in the super sector.

That will put even more pressure on the funds to generate adequate returns to fund retirements.

While super funds have done well in the accumulation phase, many are struggling to adapt to members’ needs in the retirement phase. A recent Treasury paper found that only half of super trustees surveyed offered retirement products to members. Others were only in the development phase.

Latest figures from financial regulator APRA show total contributions into the super system rose 13.1 per cent to $191.3bn in the year to the end of September. This compares with an 11.4 per cent increase in total payments to nearly $120bn over the same period.

The bulk of the increase in payments is attributable to a 20.3 per cent rise in pension payments to a record $55bn, and the remaining payouts are made up of lump sum which also hit record numbers.

Labor hopes to get its controversial super tax legislation through parliament this week, although it looks highly unlikely, as the details of the bill face intensive negotiations in the Senate. This legislation seeks to slap a 30 per cent tax on super funds worth more than $3m, and the tax would apply to unrealised gains. This could result in a number of assets being shifted out of self-managed super funds.

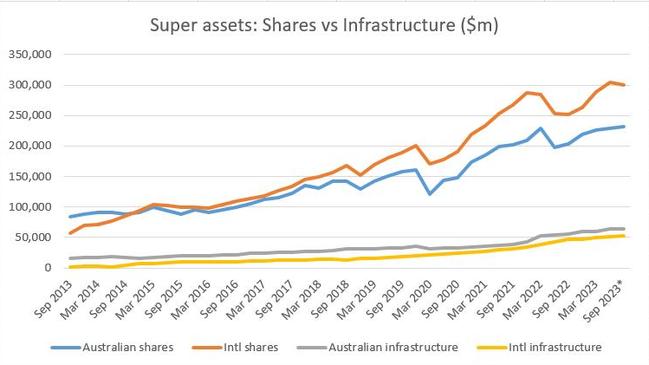

The latest APRA figures show industry funds make up $1.43 trillion in super assets. They were the biggest beneficiaries of rising super guarantee and wage rises, with total assets under management lifting 18 per cent on the year.

Self-managed super funds have passed the $1 trillion mark for the first time, with growth coming in at 10 per cent. Retail funds now represent $790bn of super system assets.

But it’s industry funds which are now under scrutiny for not getting their plumbing – the administration side – in order. The industry funds have been able to undercut their retail rivals on fees, which they argue has allowed them to plough that back into performance measures. But as the funds have got bigger and members’ needs are becoming more complex, many have a back office that falls short of adequate.

APRA deputy chair Margaret Cole recently told a superannuation conference, many industry fund trustees “don’t even manage to have a paper trail that stacks up”.

Coming out of this is the landmark legal action regulator ASIC has launched against $94bn industry fund Cbus which has allegedly been late, or dragging out, life insurance payments to partners and other claimants despite repeated warnings from the regulator to do so.

Cbus is yet to file a defence against the action, which was lodged earlier this month.

The demographic pressures building on super is forcing the sector to push harder on returns.

Trump’s tariffs

Australia will now closely watch Canada’s response to Donald Trump’s vow to impose 25 per cent tariffs on the US’ northern neighbour.

It’s a fine political line to walk for Canadian Prime Minister Justin Trudeau, who is already well behind in the polls.

If he goes too soft he’ll be crushed further for being perceived as weak against Trump. If he responds too hard with his own sweep of tariffs on US imports, he risks sparking off inflation and sinking the economy.

The Trump tariff plan has US carmakers sweating, given so much of their product and components come from both sides of the north and southern border. At the same time, Canada supplies almost half of the US oil imports which could be caught in the tariff net.

This hasn’t fazed the incoming president. As Canada is so plugged into the US economy, on the surface the tariff threat would be a crushing blow.

The reason it’s going to be a case study for the Albanese government is that Donald Trump’s downpayment on tariffs from China (10 per cent) as well as Canada and Mexico (both 25 per cent), is a taste of what’s still to come for the rest of the world.

This was enough to rattle global markets, even as Trump is still two months away from the White House.

Like Canada, Australia has a free-trade agreement with the US. But no country should assume they will be exempt from Trumps tariffs – including Australia. The bigger the trade with the United States, the greater the risk.

The three countries in Trump’s immediate sights – Canada, China and Mexico – represent about 43 per cent of all goods imported into the US.

Still, with Trump it’s a well established line that it’s always about the deal. And especially any leverage that makes him out as the master negotiator.

In this case the tariffs on Mexico and China are unlikely to settle at their headline rate if any rate. Instead Trump will use them to get an outcome on tougher immigration and drug enforcement.

As Barclays’ economists point out, Trump has previously walked back from a 5 per cent tariff threat on Mexico after striking a quick immigration deal. Their baseline case is no tariffs.

However, it’s not so clear with China as there’s more to come on tariffs given the steep trade surplus with the US. Other big importers into the US are the EU, Japan and South Korea.

The Reserve Bank of Australia war-gamed the impact of Trump’s global tariff threat. An internal analysis done before the US election, but released this week, shows only a slight impact if Australia were hit with a 25 per cent tariff due to the very small proportion of exports to the US as a proportion of GDP.

Weaker Chinese growth from a threatened 60 per cent tariff will have relatively strong negative implications for Australia thanks to the strength of export trade links.

Goldman Sachs has trimmed its growth outlook for Australia in the coming year entirely on spillover from a trade war. It sliced 20 basis points off its growth forecast to 1.8 per cent.

Nufarm looks set to be caught in the middle of a trade war, as two thirds of its sales are generated in Europe and the US. Nufarm is off more than 6 per cent this week alone. Steelmaker BlueScope, another fast becoming a Trump tariff proxy, is off almost 3 per cent in the past two days.

eric.johnston@news.com.au

Originally published as Industry funds ill prepared for peak super