Banks and lenders offering mortgage cashbacks and incentives as demand rises

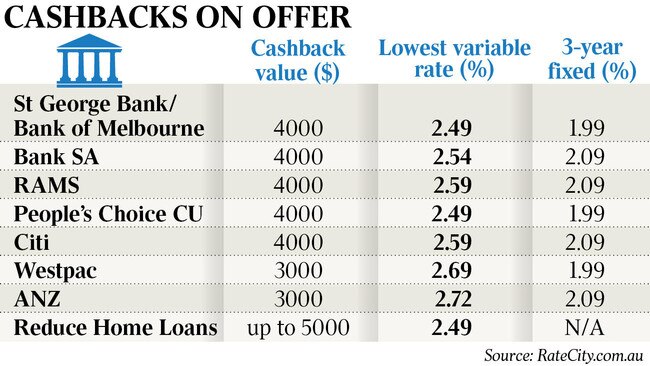

Mortgage cashbacks are on offer at over 20 banks and lenders across the country, but experts warn check the fine print. LIST OF TOP CASHBACKS

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Mortgage brokers are not expecting a house price bubble to emerge later in 2021, even as sharp mortgage pricing, lender cashback offers and incentives for first-home buyers trigger higher demand.

The views of listed firms Mortgage Choice and AFG come as December building approvals surged, with data on Wednesday showing those for private sector houses climbed 15.8 per cent to a record high from the prior month.

Overall mortgage demand has been buoyed by the federal government’s HomeBuilder stimulus payments, first-home buyer incentives, record low interest rates and enticing market offers.

RateCity’s database has 24 lenders offering cashback when borrowers refinance their home loan with them, ranging from $1500 to $4000. Reduce Home Loans offers up to $5000 cashback, although that only kicks in when loans of $1m and above are sought, and at a higher interest rate.

But despite those offers, which need to be carefully assessed alongside interest rates, fees and loan conditions, some banks and lenders are still taking as long as three months to settle a mortgage.

“There’s been unprecedented volumes going through some of these institutions; so many people with questions about coming off a lending (repayment) hiatus, people wanting to buy a new home, wanting to refinance … that (some) banks are a bit smashed,” Mortgage Choice chief executive Susan Mitchell said.

She is positive on the market’s prospects as brokers field strong demand, but does not anticipate a bubble scenario given COVID-19 loan repayment pauses and other stimulus measures are rolling off over coming months.

“I’m not worried yet,” she said.

“We still need to play through what happens when some people come off loan (repayment) hiatus and how that actually works into the system. Does that mean some properties end up being sold?”

Record low fixed mortgage rates have also led to changing borrower preferences, according to AFG and Mortgage Choice.

AFG boss David Bailey said customers opting for fixed-rate products had more than doubled to 29.2 per cent from a year earlier.

Ms Mitchell said Mortgage Choice was seeing 30 per cent to 35 per cent of applicants fixing home loan rates, up from average levels of 10-15 per cent.

NAB is using its digital arm UBank as an attacker brand in the mortgage market, offering the lowest three-year fixed rate at 1.75 per cent, which then reverts to 2.92 per cent.

The lowest variable rate comes from Homestar Finance at 1.79 per cent, with an upfront fee of $910.

Of last year’s three official RBA rate cuts, the big four banks passed on in full only the first reduction of 0.25 per cent to variable rate home loan customers.

The second cut saw just ANZ pass on 0.15 per cent to variable rate customers, while the other three reduced fixed rates instead.

The final cut in November saw none of the big banks reduce variable rates, with most citing concerns about their deposit books, and fixed-rate offers were rolled out instead.

RateCity research director Sally Tindall said borrowers had to closely scrutinise options and loan type, even though cashback deals were becoming more compelling than in the past when it was usually better to go for a low ongoing rate.

“In recent months the tide has started to turn. That’s because banks are increasingly offering sign-up specials on their lowest rate loans, making them far more competitive than they used to be,” Ms Tindall said.

“For most banks offering cashback, their lowest rate loans are fixed ones, but people need to think carefully before signing up. Fixed rates are typically less flexible than variable.”

In a speech on Wednesday, Reserve Bank governor Philip Lowe said the housing market was entering a different phase, with prices rising across most of the country and prompting closer monitoring of lending standards.

“It remains to be seen how long this continues, but sustainable increases in asset prices support household balance sheets and encourage spending,” he said.

“Higher housing prices can also encourage additional residential construction. But as housing prices rise again, we will be monitoring lending standards closely. We would be concerned if there were to be a deterioration in these standards, but there are few signs of this at the moment.”

The RBA this week held the cash rate at 0.1 per cent and is likely to keep rates on hold until 2024 to help the economic recovery.

AFG’s Mr Bailey said while demand was robust for home finance, he held some concerns around the investor and apartment markets, given factors such as a reduction in international students.

“It (a housing price bubble) is not the immediate conclusion we are drawing,” he said. “According to market analysis, most capital cities are still off their peaks. Stimulus will end and another driver of housing activity, being the level of investors, are currently at historical lows according to our mortgage index.

“The high levels of market activity is a consequence of the quick and effective response to the pandemic from federal and state governments and the policy makers, combined with record low interest rates.”

Originally published as Banks and lenders offering mortgage cashbacks and incentives as demand rises