Office vacancies hit 24-year high as Covid-19 slashes demand for space

Office vacancies have soared to their highest level in almost a quarter of a century as COVID-19 has slashed demand for space.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Office vacancies have soared to their highest level in almost a quarter of a century as COVID-19 has slashed demand for space at the same time as a wave of new city towers is being completed.

The office market vacancy rate increased from 9.6 per cent to 11.7 per cent — its highest level since January 1997 — in the six months to the end of January, according to the Property Council of Australia.

Landlords are scrambling to reposition their buildings to bring workers back to the city and expect that 2021 will see a pick-up in activity as corporate Australia gets staff back into offices.

Despite the pandemic-driven shift in vacancy levels, office owners say the year has started positively, with companies keen to strike deals after a period of paralysis during lockdowns.

At the top end, funds manager AMP Capital snared law firm Corrs Chambers Westgarth as a major tenant at its Quay Quarter Tower project at Sydney’s Circular Quay. It will lease almost 10,000sq m when the $3bn tower is completed next year.

Funds manager Colonial First State is also kicking off the hunt for a new home after private equity firm KKR took a 55 per cent stake in the company.

Landlords are dealing with vacancy across the country, with buildings in CBDs and suburbs coming under pressure, showing that problems are not confined to city centres.

Vacancy levels in the CBDs increased from 9.2 per cent to 11.1 per cent, the highest level since January 2015.

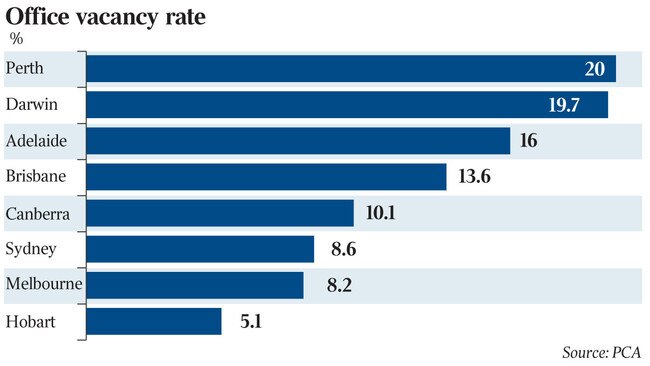

Melbourne’s CBD vacancy was 8.2 per cent, up from 5.8 per cent, and Sydney’s CBD rate was 8.6 per cent, up from 5.6 per cent.

All other major CBD markets are stuck with double-digit vacancy levels, including Canberra (10.1 per cent), Brisbane (13.6 per cent), Adelaide (16 per cent) and Perth at 20 per cent.

Net absorption of space for the national CBD office market was -89,477sq m, the lowest since July 2013.

Non-CBD markets recorded a larger increase in vacancy, from 10.4 per cent to 13.4 per cent, the highest level since 1995.

PCA chief executive Ken Morrison said that, while COVID-19 had reduced demand for office space, most of the increase in vacancy related to new office buildings coming into the market.

“While it was not a surprise to see office vacancies increase in the middle of a pandemic, it is the new supply of office space that is responsible for three-quarters of this impact, not reduced tenant demand,” Mr Morrison said.

While the industry sees COVID-19 as reducing demand for office space as businesses downsize, the longer-term impact of work from home and more permanent changes to industries wrought by the pandemic still loom over the future of offices.

Mr Morrison also pointed to the broader impact on suburban properties as corporate Australia reorganises.

“Despite talk of a flight from the CBD in response to COVID-19, non-CBD markets also saw notable increases in vacancy, indicating that widespread health restrictions across all workplaces and the economic downturn caused by the pandemic were strong prevailing influences, rather than an aversion to CBD offices,” he said.

Net absorption of space ran at the lowest since July 2013 at -158,26sq m over the six months to January. But the country’s largest listed landlords remain optimistic.

Charter Hall office CEO Carmel Hourigan said the landlord was starting to see positive signs over recent weeks, saying “there seems to be pick-up in activity”.

“The general economy is probably in a better position than we thought last year,” she said.

Dexus general manager, research, Peter Studley is optimistic about the outlook. “After an uncertain year for office markets, an improvement in many of the key leading indicators signals a period of strengthening demand ahead,” he said.

JLL head of office leasing, Australia, Tim O’Connor said the firm started to see an increase in leasing inquiry and activity across most areas over the latter part of 2020 and this had continued into 2021. But most inquiry was coming as leases expired and was concentrated at the smaller end.

“We expect to see inquiry orientated towards assets with strong health and safety features,” Mr O’Connor said.

“The office leasing market will follow a K-shape recovery with high occupancy rates for prime grade assets and vacancy pressures cascaded down to lower-quality buildings.”

Savills national head, office leasing, Graham Postma said demand and transaction levels around the country were hit by COVID-19, but sentiment and confidence returned in the last quarter with positive signs evident in the early part of this year.

Mr Postma noted the trend towards working from home, but said there was a “strong push” by federal and state governments and private employers to support a return to office-based working, albeit with increased acceptance of flexible working arrangements.

CBRE head of office leasing, Pacific, Mark Curtain, said the impacts of COVID were weighing on vacancy rates across Australia but he is optimistic about this year. Big companies including Amazon have committed to new towers, prompting hopes of more companies returning to offices.

“These long-term lease commitments are an important sign to the market that office-based working remains the preference for most organisations going forward,” he said.

He predicted there would be more generous workspace ratios so staff could meet social distancing rules.

Mr Curtain said Sydney and Melbourne would see vacancy rates increase further during 2021, albeit the rate of growth will slow considerably.

Sublease space being unloaded by companies as they restructure is also a major factor in Sydney and Melbourne, which is having a wider impact.

“Rising vacancy is expected to continue pushing incentives up, which will drive further declines in prime effective rents,” he said.

Brisbane is expected to rebound this year on the back of growth in the resources, health and public sectors.

Perth’s market is being driven by the resource sector, fuelled by record iron ore prices. The city has been hit by increasing sublease space, but it is unlikely to reach rates seen in Sydney and Melbourne.

Canberra has strong demand as a result of federal government activity and was the only market where rents and incentives held firm through 2020.

More Coverage

Originally published as Office vacancies hit 24-year high as Covid-19 slashes demand for space