‘Gap is closing’: Sign RBA will cut interest rate within weeks

A number of telltale signs have emerged indicating the Reserve Bank is planning a major, surprising pivot within a few short weeks.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

The RBA has begun its pivot to interest rate cuts.

Over the past few months, the central bank’s communications have swung from forward guidance of no easing in the foreseeable to poker-faced neutrality.

The next step in the process is to add an easing and bias, then cut the following meeting.

There is every chance of these two steps transpiring in November and December.

CPI time

At the end of October, the consumer price index (CPI) for the third quarter will be released.

All signs point to a weak reading at the headline and trimmed mean levels.

For headline inflation, energy rebates are still pouring out in many states and wider prices have been softening meaningfully for six months.

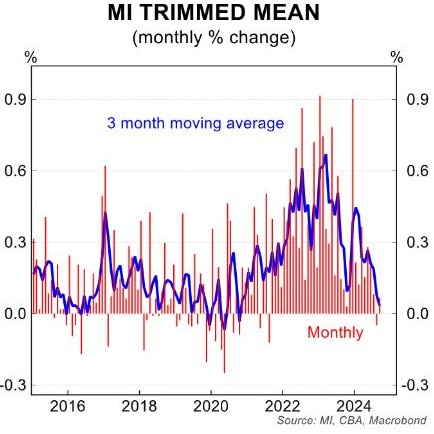

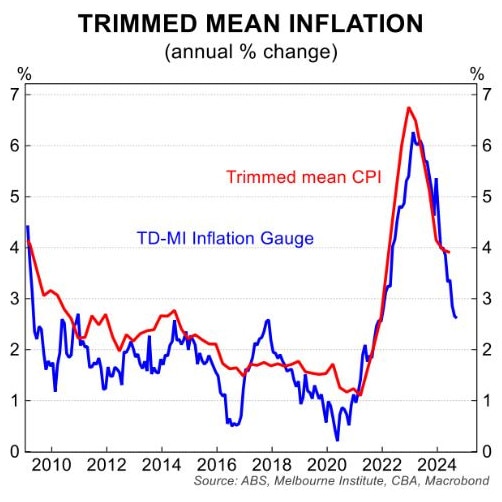

Even better for the Reserve Bank of Australia (RBA), trimmed mean inflation – which eliminates short-term impacts like the rebates – has been in free-fall in alternative measures such as the Melbourne Institute’s monthly gauge, which printed just 0.2 per cent for the third quarter.

Annual inflation in the gauge is dropping like a stone and is well within the RBA’s 2-3 per cent range.

It appears that the gap between headline and trimmed inflation is closing, and the RBA will be drawn back into alignment with fiscal authorities.

Besides, there are more energy rebates to come in 2025 and they eventually lower broader inflation.

The administered pricing effect

The RBA has been at pains to make clear that it will not count the energy rebates as disinflation.

But that argument will lose currency in 2025.

Roughly 20 per cent of the CPI is made up of what are called “administered prices”.

These are prices for those goods and services that are set by government fiat.

They include items like the beer and tobacco excise, health and education costs and even pensions and award wages.

All of these prices are linked to headline, not trimmed-mean CPI, and all will reset much lower in 2025 thanks to the energy rebates.

Housing fading finally

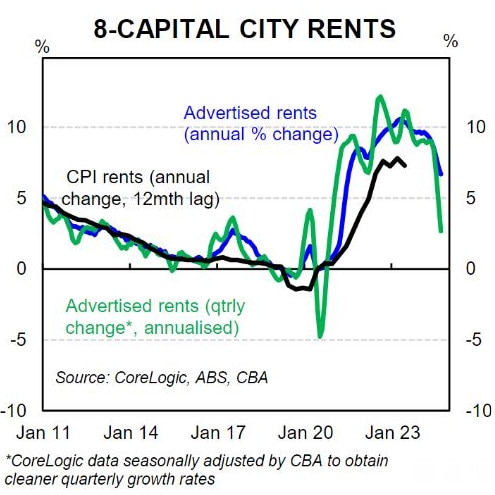

Another of the most serious inflationary problems for the past two years is rental inflation.

This is 6 per cent of the CPI baskets that have risen 40 per cent thanks to the Albanese government’s overzealous immigration policy.

Rents are fading now, too, not because much pressure has come off at the border, but because they have smashed into the affordability ceiling.

As the old saying goes, unlike house prices, “you can’t leverage rents”. People can afford them or not and, right now, they can’t.

Don’t fatten the pig on market day

Finally, wage growth has stalled. Having peaked above 4 per cent, it is now at 3.5 per cent and still pulling back.

This is a benign level of wage growth, much lower than the peaks in other developed economies, owing to the greater role of mass immigration in the Australian economy.

This is already a wage growth rate consistent with the RBA inflation target and it does not want to risk a repeat of the pre-Covid years, when wage growth all but disappeared.

Inflation expectations have also pulled back as well, indicating workers are well aware of their loss of pricing power.

To put it bluntly, low unemployment and firm job growth are not inflationary when the jobs are all created for migrants, which has been the case in Australia for two years.

This also mitigates against the RBA’s number one worry about weak productivity growth causing inflation.

How can it be when the economy grows mostly via a permanent labour supply shock?

The RBA needs to pivot and cut for Christmas – or it will find itself chasing an inflation undershoot in the new year.

David Llewellyn-Smith is Chief Strategist at the MB Fund and MB Super. David is the founding publisher and editor of MacroBusiness and was the founding publisher and global economy editor of The Diplomat, the Asia Pacific’s leading geopolitics and economics portal. He is the co-author of The Great Crash of 2008 with Ross Garnaut and was the editor of the second Garnaut Climate Change Review.

Originally published as ‘Gap is closing’: Sign RBA will cut interest rate within weeks