‘Complete bust’: China’s desperate $850b stimulus move as economy tanks

China has resorted to some desperate moves in an attempt to save its tanking economy, which threatens to take down Australia with it.

Economy

Don't miss out on the headlines from Economy. Followed categories will be added to My News.

For the past several weeks, the investment world has been agog at the wildest rally since 2008 in Chinese equities.

Triggered by a new round of stimulus, the price surge reached as high as 60 per cent in a week in the Hong Kong technology bourse.

But yesterday, the same crashed the most in a single day since 2008, down -15 per cent.

What gives?

Policy-driven market

We very occasionally witness such booms and bust in developed market stocks, but it happens more regularly in China because it is more a policy-driven than profits-driven market.

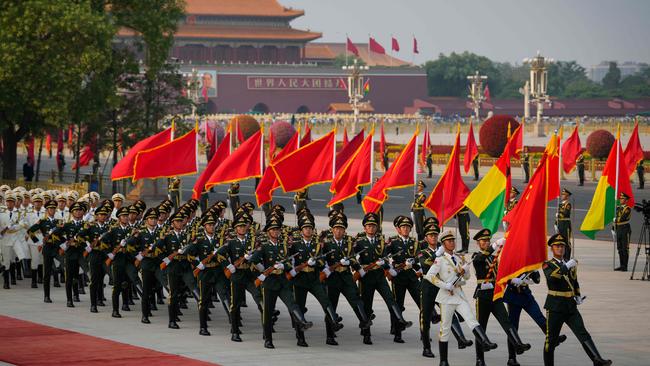

Chinese stocks rise and fall on the instructions of the Chinese Communist Party and, in particular, Xi Jinping, not the basis of capital allocation decisions.

Given Xi is a dictator, that narrows the knowledge you need for the direction of stocks to whatever he is thinking.

This makes investment in China a ludicrous game of guessing what the dictator had for breakfast or which side of the bed he got out of.

It is uninvestable in traditional terms, until Xi makes his thoughts known, and for a while markets go crazy trying to follow his instructions – only to give up again shortly afterwards.

Policy-driven economy

A similar argument can be made about the broader Chinese economy.

Gone are the days of automatic growth based upon favourable catch-up dynamics like demographics, urbanisation, market share gains in exports and liberalisation.

These days, demographics and urbanisation are exhausted, leading to a perpetual property bust.

Exports are under attack from developed markets fed up with Chinese mercantilism.

Liberalisation is in hard reverse as the CCP takes ever stronger control of the economy.

Chinese growth has stalled and it only gets a kick along when, like stocks, Xi gets out of the right side of the bed.

Stimmies not what these used to be

But even Xi’s good days are a far cry from the heady days of Australian mining booms.

The latest round of stimulus has an impressive 4 trillion yuan price tag, but virtually none of it will aid Aussie commodities.

800 billion yuan for stocks. 850 billion yuan bank liquidity. 150 billion yuan mortgage cuts. 2 trillion yuan for local government debt swaps and household handouts.

$850 billion Australian dollars of the good stuff.

Except, look closely and there is nothing there: nobody wants to borrow, households will save handouts, local governments are out of projects, the stock market adds nothing to real activity.

It is all about asset prices. Inflating stock prices and stabilising housing prices.

And the latter even comes with a warning from Beijing that no new boom in construction will be tolerated.

Fiscal missing

Manic markets had hoped that a meeting this week of the National Development and Reform Commission (NDRC) would add a slab of direct fiscal spending to the mix.

Various excited investment banks were forecasting anything up to 10 trillion yuan in new major projects, the kind of investment that used to drive commodity demand crazy.

The NDRC is the infrastructure project manager in China, so any old style major building initiative goes through it.

Instead, the NDRC announced nothing. No new spending. No new projects. There was some acceleration of existing projects, but they are all well underway anyway.

There is virtually nothing in the stimulus to drive a pick-up in steel demand and production, and it is a complete bust for iron ore demand.

This is what popped the stock bubble that had been inflating for the past fortnight.

Perhaps profits do matter, after all.

Hope

There are more meetings in Beijing ahead.

The Politburo gathers later this month and could unleash more spending. Likewise, a key economic committee.

If markets go into hard reverse, that might pressure Beijing for more real economy spending.

But unless you have some kind of unique peephole into Xi Jinping’s brain and mood, it looks more and more like this is just another incremental stimulus on the Chinese road to nowhere.

It’s a bazooka but not as we know it

The fading Chinese economy has passed President Xi Jinping’s pain threshold and Beijing has unleashed a new round of stimulus.

It aims to stabilise the imploding property market, send the stock market into outer space and rescue the economy with the wealth effects.

This is a very different approach to traditional stimulus and the beneficiaries will also be different.

Traditional versus new stimulus

Traditionally, Chinese stimulus is more fiscal in nature than monetary.

Beijing does not like to have a falling currency, because it risks trade blowback and plans to turn the renminbi into a reserve currency.

However, with the Federal Reserve slashing interest rates and kicking the US dollar lower, Beijing has been liberated to undertake a more monetary stimulus than is the norm.

It has cut mortgage rates by 50 basis points and is printing money for various governments to buy stocks.

It is also helping fund property developers who can’t get finance, though Beijing has been equally clear that it does not wish to see another round of crazy construction.

Asset prices

So far, Chinese stocks have been the biggest winners, flying higher out of a bear market.

It may be that this rally has some way to go. However, investors should be aware that when going through a similar housing crash, Japan undertook similar stimulus moves for many years and asset prices always ultimately returned to the bearish trend.

Moreover, Chinese households don’t hold many stocks so any lift is unlikely to have much effect on consumption.

More important will be whether the stimulus can stabilise property.

This is, or was, a $60 trillion asset class that is deflating at 7 per cent per year. It comprises 85 per cent of household wealth, so it’s one hell of a headwind.

The mortgage rate cuts will undoubtedly lift activity for a little while, but not for any enduring period.

Real interest rates are still very high amid deflation, so there is no incentive to speculate and plenty of reasons to deleverage.

Whether the property market can stabilise hangs on many more rate cuts, but they will have to come in lock-step with the Federal Reserve, so will not be fast enough.

China needs zero interest rates and quantitative easing to stabilise housing.

Commodities

Commodities like iron ore haven’t waited around to wonder if they will benefit fundamentally. Their prices have flown to the moon.

Yet, as the stimulus currently stands, they will not benefit much.

Only about $140 billion has been suggested for fiscal stimulus not yet confirmed. Some of this is promised as cash to households. So it won’t trigger much building.

Another $140 billion is going to local governments’ financial repair, but how much of this will build new infrastructure isn’t clear, either.

So far, this stimulus has been a bust for fundamental demand for iron ore. The hope is that it is only the first down payment on more.

How much more?

The question is, how much more?

To truly stabilise a $60 trillion asset market that has lost all confidence and is suffering from an immense glut, Beijing will need to roll out $2 trillion of stimulus.

It will need to buy up all the empty apartments and rent them out cheaply, though even this comes with the problem of falling prices and less construction for years.

It will also need to give local governments a lot more money and, in truth, they have run out of good projects to build, so what does that fix?

Most importantly, if it wants the consumer to pick up the growth slack, then Beijing will need to do structural reform that shifts national income from itself via state-owned enterprises to households via privatisations.

There is no sign of that happening and, frankly, it is hard to believe that the Chinese Communist Party wants to loosen its grip on that dough and hand households the power.

In short, this is another kick of the Chinese can, unless Beijing changes radically.

David Llewellyn-Smith is Chief Strategist at the MB Fund and MB Super. David is the founding publisher and editor of MacroBusiness and was the founding publisher and global economy editor of The Diplomat, the Asia Pacific’s leading geopolitics and economics portal. He is the co-author of The Great Crash of 2008 with Ross Garnaut and was the editor of the second Garnaut Climate Change Review.

More Coverage

Originally published as ‘Complete bust’: China’s desperate $850b stimulus move as economy tanks