How the Chinese property market will impact Australia in 2022

It’s a huge risk to the Australian economy going into 2022 and this financial disaster shows no sign of stopping.

Economy

Don't miss out on the headlines from Economy. Followed categories will be added to My News.

As we head toward the conclusion of a challenging 2021, the Australian economy is radically different to how it was when we entered the pandemic.

Key industries such as tourism and education have been supplanted by even greater levels of resources exports, leaving Australia more reliant than ever on China.

In recent weeks Treasurer Josh Frydenberg warned that the Chinese property market poses a risk to the global economy and that he is watching the sector closely.

With the property construction sector and associated industries accounting for roughly 30 per cent of all economic activity in China, the Treasurer is right to be concerned.

Its going to be fascinating to see how Xi and the CCP manage the property sector slowdown in 2022, considering real estate related activities are a greater proportion of GDP than the Spanish or American economies during their respective housing booms. pic.twitter.com/5gh1ZyA1am

— Avid Commentator 🇦🇺 (@AvidCommentator) December 22, 2021

The Evergrande factor

Over the past few months the mega Chinese property developer Evergrande has become a household name for many, as its woes started alarm bells ringing for markets and governments around the globe.

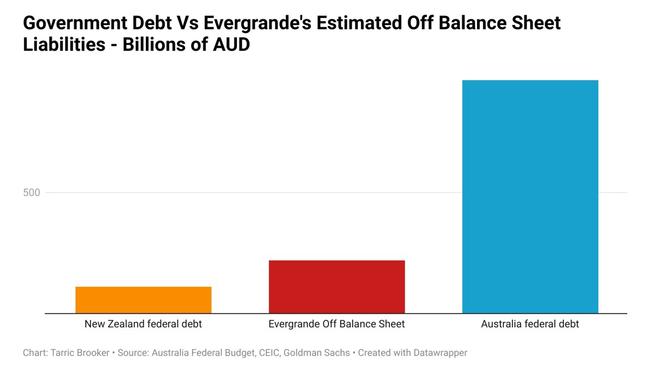

To put Evergrande’s immense size into perspective, if the developers estimated on and off balance sheet obligations are all counted, it is a greater amount than all Australian federal government debt outstanding prior to the pandemic.

In early December, Evergrande formally defaulted on its debts and began what promises to be an extremely protracted restructuring process.

While Evergrande’s concrete and publicly known liabilities are immense, coming in at more than $US300 billion, the greatest threats arguably stem from what is going on behind the scenes.

Shadow banking – China’s financial underworld

In China when a company can’t get traditional finance from a bank or the bond market, it can resort to looking to the shadow banking sector for capital.

This can take a number of different forms, but suffice to say that the scale of this shadowy form of finance in China is immense. For example, in September Goldman Sachs estimated Evergrande alone has roughly 1 trillion Yuan (~$220 billion AUD) in off balance sheet and contingent liabilities.

How much hidden and/or off balance sheet debt is actually held by companies in the Chinese property sector and those connected with it remains a mystery, but one would imagine that the figure is immense.

The risks of an iron fist approach

Unlike in much of the Western world where even some of the largest and most damaging corporate failures are often left largely unpunished, in China the consequences for this type failure can be immense and in some cases fatal.

While the merits of this approach versus the at times apathetic response of Western judiciaries and policymakers remains a source of debate, there are some very clear downsides.

This brings us to an unlikely historical analogy that comes from ancient China.

In 209BC two army officers of the Qin dynasty, Chen Sheng and Wu Guang were running late due to flooding that had resulted from a severe rainstorm. Under the laws of ruling dynasty Chen and Wu would be executed for their failure to arrive on time, despite it being entirely beyond their control.

Rather than attempting to make the case regarding the mitigating circumstances and running the high risk of being executed, Chen and Wu instead decided they had nothing to lose and started an uprising against the crown.

After years of President Xi and the Chinese Communist Party leadership condemning dodgy dealings and ramming home how much it wanted to avoid systemic risk, there is little incentive for parties engaged in shady deals to come forward about potential issues unless they absolutely have to.

Like Chen and Wu over 2200 years ago, taking a hard line can incentivise individuals to take a course of action that is the polar opposite of the interests of the Chinese government.

A mountain of unknowns

Between President Xi’s goal to reduce systemic risk by reigning in the property sector and the incentive for elements of the shadow banking sector to obscure the impact of bad debts, it’s possible that issues could brew over a long period before bubbling to the surface.

The truth is practically no one fully understands the true breadth of off balance sheet liabilities and the scale of connections between the Chinese shadow banking sector and the more formal elements of the financial system.

Then there is the damage that is occurring to the Chinese property sector every day the CCP’s crackdown continues.

With property in China increasingly treated as a speculative investment rather than a home, the impact of the Evergrande saga on confidence has occurred rapidly.

Across most of China’s large cities, new and existing property prices are falling for the first time since 2015.

China 70 cities MoM prices changes of Secondary Residential Prices

— Sunny’s (@sunchartist) December 15, 2021

3 cities Prices up

4 cities prices unchanged

63 cities prices were down pic.twitter.com/vM0GN7KIbH

At the same time local governments have become increasingly reliant on effectively buying land releases from themselves in order to keep up a steady stream of ongoing revenue.

Australia, the coming year and Chinese property

Treasurer Josh Frydenberg isn’t the only one who is concerned about the potential issues that could stem from the woes of the Chinese property sector.

In October, US Secretary of State Antony Blinken warned that Evergrande’s downfall could affect “literally the entire world” and that China should act “responsibly” in managing the ongoing crisis.

Around the world many are waiting to see what happens next in the Evergrande story, as the fate of the global economic recovery from the pandemic potentially hangs in the balance.

Predicting what happens from here is challenging to say the least, but there are some things we know with a reasonable degree of certainty.

The Evergrande saga is likely to drag on for months, perhaps even years to come and Chinese President Xi Jinping will continue to desire to reduce systemic risk in order to ensure a stable China.

Beyond that we can only speculate on the fate of the Chinese property sector and everything from a crisis induced recession to a commodity price boom is a potential scenario on the table.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator

Originally published as How the Chinese property market will impact Australia in 2022