House prices: Why now is the time to buy a mansion – if you can stomach it

There’s one type of Aussie property that’s dropped more than others – and now is the time to buy it and bag a bargain.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

The riskiest part of the housing market is not what you think.

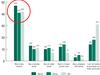

Check out the following chart, which shows prices at the top end of the market are falling fastest. Buying an expensive home three months ago turns out to have been a bad move!

For example, the most expensive homes have fallen by 7.5 per cent in Sydney, while cheaper homes are down by a smaller amount: 2.8 per cent. A similar pattern applies around the country.

Housing prices are falling because interest rates are rising. The RBA has hiked rates from 0.1 per cent to 2.35 per cent and that is smashing the housing market. They’re expected to keep lifting rates too, so the falls probably haven’t stopped.

But why are expensive homes plummeting?

Turns out the most expensive part of the market doesn’t just fall hardest in bad times, it also rises most in good times.

As the next chart shows, it is the most volatile – more like buying bitcoin – while buying a cheaper house is safer, more like buying an index fund. Expensive houses tumble in the bad times, then rocket up when times are good. The amenity is nice, but the price action is a roller coaster!

Timing is everything

There is useful information in the above graph - information you can use if you want to buy or sell a house. Imagine you want to sell a house at its highest possible point, just before prices start falling. It’s too late to do so with an expensive house. But if you own a cheaper house in certain cities, there might still be time.

If you want to time the market, look at the purple line. It usually goes below zero before the other two lines. That’s when expensive houses start falling in price. They do so when cheaper houses are still rising – but usually cheaper houses start to fall in price (the line goes below zero) soon after.

The purple line sometimes rises back over zero before the other lines too. That means a return to growth in expensive houses can be a signal that cheaper houses will rise in price soon. The top of the market is like a forecast of what the rest of the market will do.

Keeping an eye on the top of the market can help you. It suggests when expensive homes start growing in price again, you won’t have long left to buy a cheaper home at the bottom of the market.

Do expensive houses pay off?

In the world of investing, risk and reward go hand in hand. Expensive houses are no exception. They go up more, they go down more, but overall it doesn’t balance out. The ups are bigger than the downs. That means the price gap between cheaper homes and more expensive homes is getting bigger and bigger.

As the next graph shows, between 2005-06 and 2016-17, expensive houses rose in price by 73 per cent while cheaper houses rose in price much more slowly. The same pattern can be seen for units.

When to trade up

If you want to move somewhere fancy, do so when the market is in the doldrums! You will save a fortune – mansions are on super special, but the house you’re selling will not have gone down much.

Imagine a $2 million home and a $500,000 home. They start off $1.5 million dollars different in price. Then the expensive house falls by 10 per cent, while the cheaper house falls by 5 per cent. You’re now comparing a $1.8m house and a $475,000 house, so the price difference is now $1.325 million. The cost of upgrading just went down! If you upgrade in the bad times, you save money.

Sure enough, when you look at the statistics on borrowing, it is people buying their next house that are still in the market, while first home buyers have gone missing. Ugraders are trying to make hay when the sun shines.

But will you be able to find a fancy house to buy? The flipside of the above opportunity for trading up is a price penalty for trading down. Empty nesters in lovely family homes won’t want to put their house on the market and move into a smaller place when the big house is down in price but the small house isn’t! They’d rather trade down in a hot market.

That is why there are fewer homes up for auction than this time last year in just about every corner of the country (the exception is Melbourne which was in lockdown for a big part of spring selling season in 2021).

Buying a risky asset into an upturn can be the best financial move of your life. You just have to have the stomach to buy one in a downturn – and be able to find one to buy.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.

Originally published as House prices: Why now is the time to buy a mansion – if you can stomach it