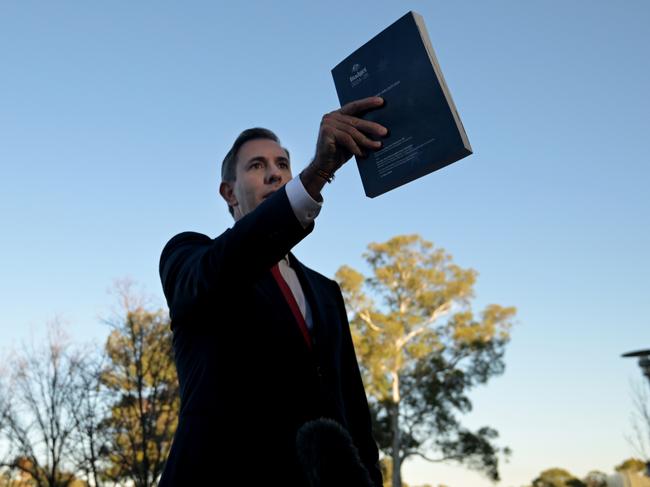

‘End of the year’: Treasurer’s big call on mortgage interest rates

While unveiling a big-spending budget aimed at helping Aussies cope with the cost-of-living crisis, Jim Chalmers made an unexpected prediction.

Fed Budget

Don't miss out on the headlines from Fed Budget. Followed categories will be added to My News.

Australia is on track to win its brutal and long-running war against inflation earlier than expected, Treasurer Jim Chalmers has predicted, paving the way for interest rate cuts.

Two years after the Reserve Bank began hiking the official cash rate, slamming mortgage holders with 13 increases and adding thousands of dollars to the cost of repayments, Dr Chalmers said relief is on the horizon.

“Annual inflation has more than halved from its peak in 2022 and it’s now lower than anticipated in the mid-year update,” he said in his budget speech to parliament on Tuesday night.

“But we know people are still under the pump.

“That’s why we designed our cost-of-living policies to ease these pressures and take another three-quarters of a percentage point off inflation this year, and half a percentage point next year.”

That paves the way for inflation being brought back under control sooner than expected, he added.

Official projections from Treasury were for inflation to return to the RBA’s target range of 2-3 per cent by mid-2025.

“Treasury is now forecasting inflation could return to target earlier, perhaps even by the end of this year,” Dr Chalmers said.

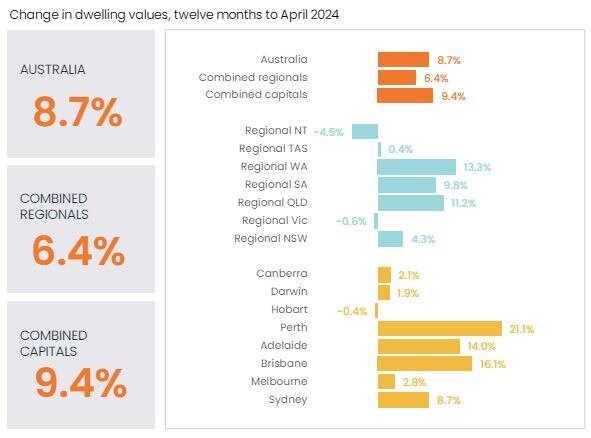

Real Estate Institute of Australia president Leanne Pilkington said the beginning of lower interest rates will indirectly boost housing supply – one of the government’s top priorities.

Modelling by the industry group indicated a 50 basis point fall in rates would boost net housing supply by 54,000 dwellings.

The thinking is that cheaper costs and renewed confidence would drive demand for new dwellings.

“With housing affordability declining even below global financial crisis lows … this indicator (interest rates) will be the one that counts for everyday Australians,” Ms Pilkington said.

Reining in inflation would give the RBA board confidence to examine its approach to the cash rate, particularly amid flat economic conditions and slowly rising unemployment.

Dr Chalmers said economic growth is forecast to be just 1.34 per cent this financial year, before lifting modestly to 2 per cent next year.

“Slower growth means a softer labour market, with unemployment expected to rise slightly to 4.5 per cent next year, even as we create tens of thousands of new jobs,” he said.

“I want Australians to know that despite everything coming at us, we are among the best placed economies to manage these uncertainties and maximise our opportunities.

“We have an envied combination of moderating inflation, record new jobs, near-record participation, real wages growth, the lowest-ever gender pay gap, and expanding business investment.”

The government is spending big on a range of measures to help Aussies struggling amid the cost-of-living and housing crises, from energy rebates to cheaper medications.

A major announcement that few pundits expected was a 10 per cent increase to the Commonwealth Rent Assistance payment, at a cost of $1.9 billion a year.

That’s on top of last year’s 15 per cent hike to the supplement, which is available to eligible recipients of welfare payments like Jobseeker.

“It’s the first back-to-back increase to Commonwealth Rent Assistance in more than 30 years,” Dr Chalmers said.

“And more much-needed help for young people and renters of all ages doing it tough.”

An estimated one million households will benefit from the increase, he said.

In something of an acknowledgment of the pressure put on rental markets by a record number of international arrivals over the past few years, he also flagged changes to foreign student provisions.

“If universities want to take more international students, they must build more student accommodation,” Dr Chalmers said.

“We will limit how many international students can be enrolled by each university based on a formula, including how much housing they build.”

Originally published as ‘End of the year’: Treasurer’s big call on mortgage interest rates