Collapse of indebted developer China Evergrande Group could cause global disaster

A Chinese real estate juggernaut is facing ruin, sparking fears the embattled company could become the “Chinese Lehman Brothers” and cause a global disaster.

Economy

Don't miss out on the headlines from Economy. Followed categories will be added to My News.

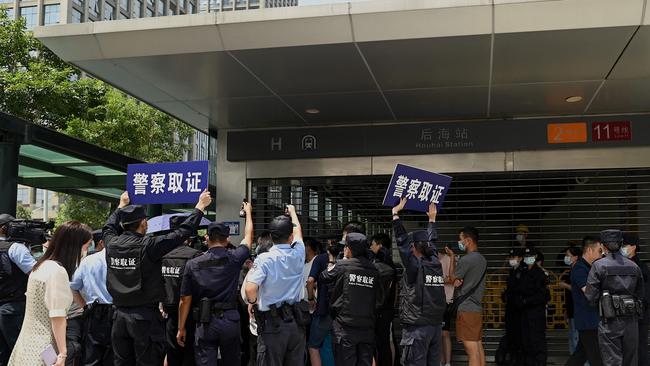

A Chinese property behemoth is on the brink of total collapse, sparking fears it could have dire consequences for global markets.

The China Evergrande Group went from global titan to the world’s most indebted real estate developer, racking up a staggering $A432 billion in debt.

Its shares plummeted by more than 10 per cent in trading in Hong Kong on Monday, and is down 72 per cent in Hong Kong this year.

And the growing crisis is now sending shockwaves through global markets.

What is Evergrande?

Founded in 1996 and originally known as the Hengda Group, the company is one of the biggest in China.

It claims to own more than “1300 projects in more than 280 cities in China”.

It is the 122nd largest group in the world by revenue, based on the 2021 Fortune Global 500 List, and is based in China’s Guangdong Province.

Over the years, it has expanded well beyond real estate, and now has interests in broad areas including electric vehicles, internet and media, and food.

Why is it in trouble?

The firm’s troubles began as China’s real estate market soared, with demand for homes in cities such as Beijing and Shanghai sending prices skyrocketing.

The company took out a string of loans and expanded rapidly, snapping up assets and making the most of China’s thriving economy.

But when property prices began to drop in smaller cities, and when the Chinese government rolled out measures to curtail over-the-top property borrowing, it left Evergrande in the lurch, with mountains of debt.

The company has repeatedly warned investors it could default on its debts, and Hedge Fund Telemetry LLC president Thomas Thornton has described the property developer as being in a “death spiral”.

So what does that mean for China?

Firstly, the consequences could be catastrophic for everyday, mum-and-dad homebuyers and investors who bought property before developments started. Companies that work with Evergrande could also face disaster.

And the ramifications for China’s financial system could also be dire, given the firm owes money to around 170 national banks and dozens of other financial companies, sparking fears of a credit crunch.

In a nutshell, “Evergrande’s collapse would be the biggest test that China’s financial system has faced in years,” CNBC reported Mark Williams, chief Asia economist at Capital Economics, as saying this week.

And what about the rest of the world?

While at first glance it might seem like a Chinese problem, many experts have referred to the Evergrande nightmare as “China’s Lehman Brothers moment” – a reference to the financial giant that went bankrupt in 2008, which led to the global financial crisis.

“Investors are not sure whether Chinese authorities will be able to contain the fallout from a possible disorderly collapse of the heavily indebted company,” Thinkmarkets analyst Fawad Razaqzada said of the crisis.

There are now fears the potential collapse of Evergrande could cause a “contagion” and create problems for the broader global economy, with Tim Anderson, managing director at TJM Investments, saying the situation “raises the question if there are similar companies and similar situations investors haven’t looked at”, according to the New York Post.

Those fears have already impacted Europe and Wall Street, with the Dow Jones dropping by 971 points on Monday after fears over China’s property market prompted a worldwide sell-off.

The unfolding situation has also sent Hong Kong property companies plunging.

Impact on Australia

Aside form the general impact on global markets, Evergrande’s crisis could have another potentially devastating impact on Australia.

If it were to collapse, it would cause a significant drop in construction, meaning the demand for iron ore would fall, as would iron ore prices, given the AFR has estimated China’s construction industry accounts for about half of the steel used in the country.

On Monday, Australia’s share market faced its worst day since February this year, with iron ore prices plummeting.

The benchmark S&P/ASX200 closed 2.1 per cent and 155.5 points lower on Monday afternoon, with around $50 billion wiped.

Originally published as Collapse of indebted developer China Evergrande Group could cause global disaster