Detective’s alarming warning on awful crime

A veteran police detective has revealed how cops are being frustrated and overwhelmed by a serious crime and their hands are being tied to even investigate it.

Costs

Don't miss out on the headlines from Costs. Followed categories will be added to My News.

A veteran police officer has slammed Australian banks, accusing them of being “totally uncooperative” when it comes to assisting in identifying scam offenders and stopping stolen money being “skipped” through accounts.

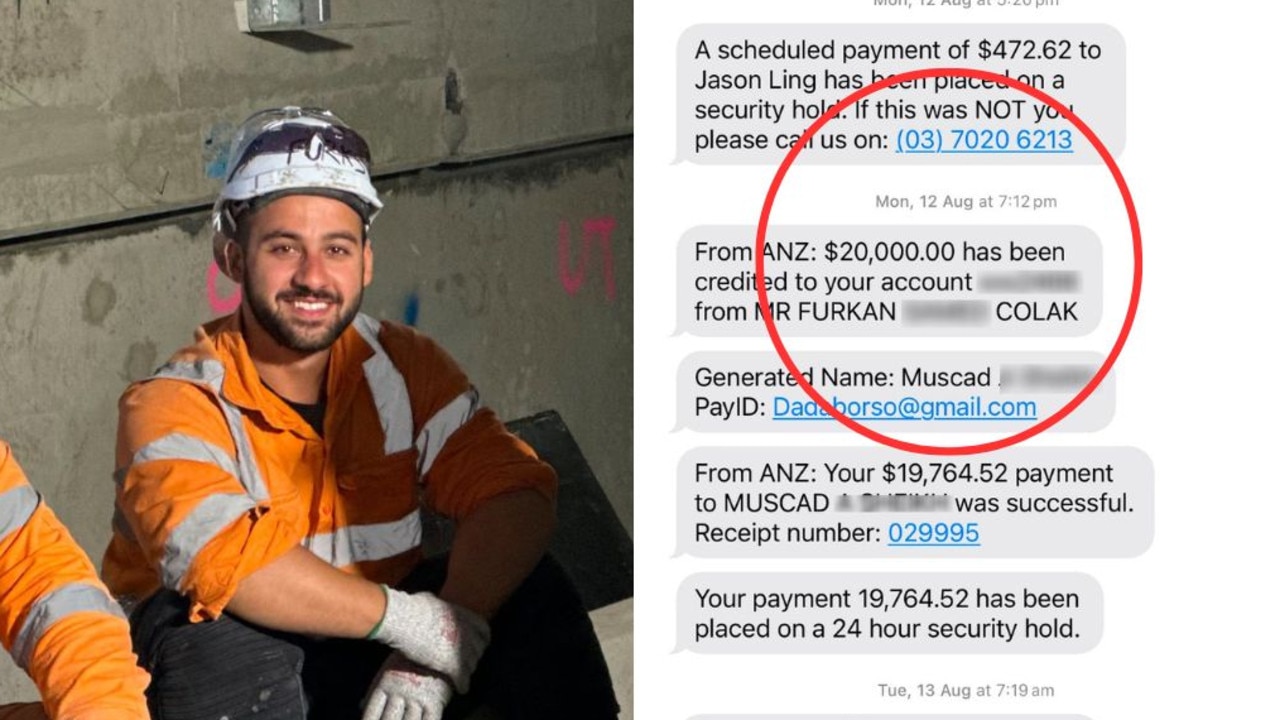

The detective, who can’t be named as he is still serving on the force, said his team deals with cybercrime reports from scam victims daily.

“I see this every day. Literally every day a new files arrive,” the detective told news.com.au.

“There’s an average of 250 to 300 outstanding online reports that we can’t get onto and that’s on top of people reporting to the police station that have been defrauded and that would easily run into 150 per year.”

Those reports are just for his Victorian station alone, with victims losing anywhere from $5000 to six figure sums, he said.

The experienced officer felt compelled to share police’s experience after he saw the launch of news.com.au’s campaign People Before Profit, which is calling on the federal government to make it mandatory for banks to compensate scam victims – just like in the UK.

In October last year, the UK introduced world leading legislation making compensation mandatory for scam victims within five business days except in cases of gross negligence.

IT’S TIME BANKS PUT PEOPLE BEFORE PROFITS. SIGN THE PETITION HERE

The Victorian-based detective said investigators are often left frustrated by Australian banks refusing to share crucial information – citing privacy policies.

“We have to go through the rigamorale of doing a search warrant on a bank as they won’t give us anything for privacy reasons,” the detective said.

“Eventually we get something from the bank, we get documents and that trail leads me to take out another warrant. So we are chasing our tails the whole time as banks are uncooperative and telcos too, in assisting us or the victim.

“We are unlikely to catch offenders as they are overseas but it’s about stopping that movement of money.”

Part of the job is to recover proceeds of crime but “it becomes very difficult to do that”, he added.

“The best outcome for a victim of a major fraud is that in the first instance we have the ability to cut that money train and seize the funds and put it back in accounts,” the detective said.

“But we get no assistance and the only thing we can do is prosecute.

“It’s just devastating when people lose all that money and we are hamstrung by privacy polices of the banks and telcos.

“They are just not doing enough and to be honest we feel like we are the enemy or annoying them by calling them. And we are pointing out their mistakes and they just don’t like it.”

But Australian Banking Association CEO Anna Bligh said it was the first she had ever heard of anyone in the police make those accusations.

“I know that every bank has very big financial crime teams because fraud and scams are not the only financial crimes that happen,” she said.

“They work with police on missing persons, murders, all sorts of things that are absolutely critical and I know from talking to our financial crime teams that they are talking to the police every single day on these sorts of issues.”

With $2.7 billion lost to scammers in one year in Australia, the detective said scams were impossible to tackle without banks helping the investigation.

“We are frustrated and overwhelmed by the lack of co-operation from not only the banks but the telco companies in trying to get a result for these victims,” he said.

“The dam wall is leaking and we are using a mop to clean up the mess.”

He added when it’s the bank’s money on the line, the senior detective claimed there is a massive “backflip”.

“When banks gets ripped off they will jump up and down and scream blue murder,” he said.

“I wouldn’t normally do something like this but we are over it. We are getting smashed. It’s not just here – it’s right across Australia as we get files from interstate as well.”

Ms Bligh said Australian banks have a “very good working relationships” with police. She described the detective’s comments as “very unfortunate”.

“Banks are required under the privacy legislation to protect your confidential information and there will be times when they ask for a search warrant because without a search warrant they’re actually not allowed under the Privacy Act to give the information,” she noted.

“Your information is protected under the Privacy Act and the police can’t just walk in and ask for it. They have to actually have some legal instrument that allows the banks under the privacy legislation passed by the parliament to be able to do it … It imposes very strict obligations on corporate Australia to protect your information.”

Having worked in the police force for almost 40 years, the senior detective said he has seen a huge change in how the banks operate.

“There was a time when I first started as a detective that each bank had an investigations section and police had a really good relationship with teams within the banking systems. We worked together a lot and we were not only protecting customers but the banks as well,” he revealed.

“All banks have closed those investigations unit within the banks. They have their fraud teams but seriously they are not trained in law enforcement. They are basically there to hand over documents once a warrant has been given. They are just not helpful and to find them is a nightmare.

“There is no relationship between banks and police and banks don’t seem to want them. They just need to help instead of being a hindrance, they make enough money.”

Ms Bligh added it would have been a very different working experience 40 years ago as the privacy legislation would not have been the same or might not have even existed at all.

She said banks would like to provide the information without a search warrant but have to comply with the privacy legislation.

“Because it doesn’t just apply to scams, for example the information where they believe an older person might be the victim of financial abuse,” she said.

The detective added that the privacy legislation has exemptions to disclose personal information to Victorian police where it’s in public interest.

“I imagine if someone is defrauded out of $70,000 or $100,000 it is in the public interest,” he said.

But Ms Bligh said that banks can only provide the information without a search warrant where they reasonably believe that someone is a risk of physical harm.

She said financial harm didn’t fall under this exemption.

“We have been lobbying the government in their changes to the Privacy Act to include financial harm but they are prohibited without some legal instrument that would override it from providing that information,” she noted.

sarah.sharples@news.com.au

Originally published as Detective’s alarming warning on awful crime