Young tradie loses $58k in sophisticated spoofing scam

A 26-year-old Aussie tradie has issued a warning after losing $58,000 to a scam that anyone could fall for.

Costs

Don't miss out on the headlines from Costs. Followed categories will be added to My News.

A young Aussie tradie has issued a warning after losing $58,000 to a scam that anyone could fall for.

Furkan Colak, from Melbourne, was in the process of trying to buy a house, while also saving up for his dad to have knee surgery when he got an alarming text message seemingly from his bank.

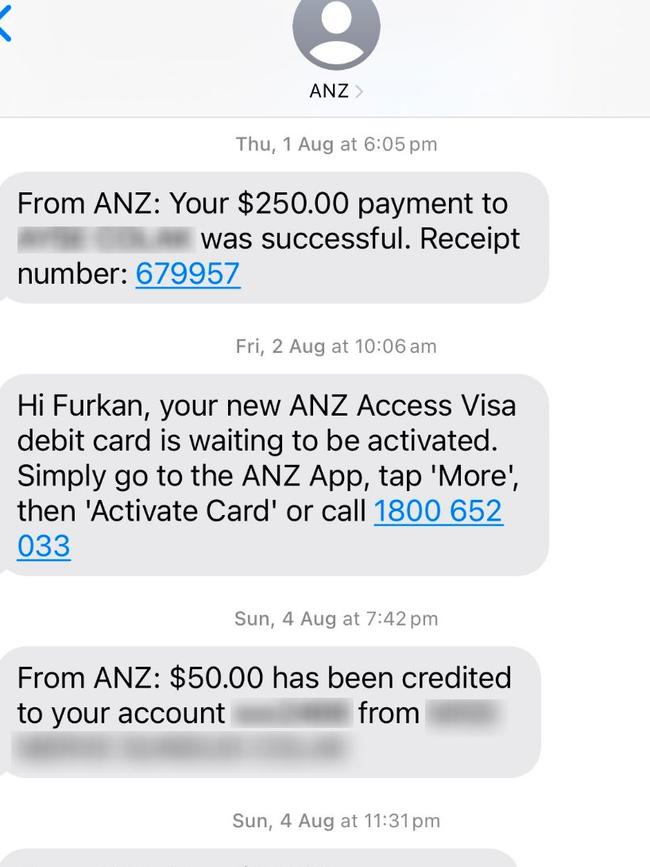

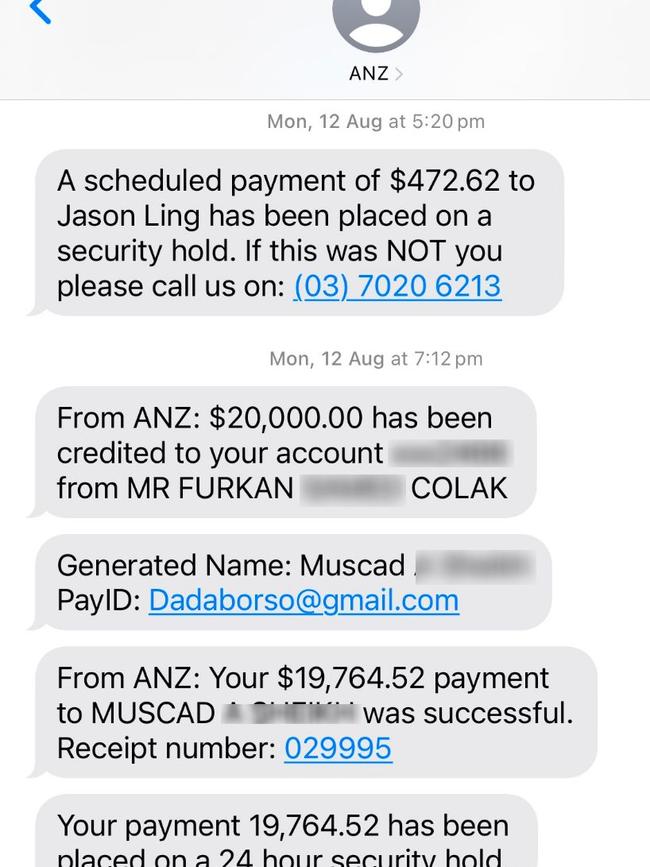

“A scheduled payment of $472.62 to Jason Ling has been placed on a security hold,” it read.

“If this was not you please call us on 03 7020 6213”.

It appeared in a pre-existing text message chain he had with his bank, ANZ, in August last year.

Little did the 26-year-old realise that scammers had used sophisticated technology to ‘spoof’ their number into the bank’s thread and that the entire text was a fabrication.

“Because it’s come from an official ANZ message, I thought it was legitimate,” Mr Colak told news.com.au.

“That’s the only reason I fell for it, because it (appeared to) came from ANZ.”

Mr Colak is lending his support to news.com.au’s campaign People Before Profit, calling on the federal government to make it mandatory for banks to compensate scam victims – just like in the UK.

In October last year, the UK introduced world leading legislation making compensation mandatory for scam victims within five business days unless in cases of gross negligence.

IT’S TIME BANKS PUT PEOPLE BEFORE PROFIT. SIGN THE PETITION HERE.

Racing to save his money, Mr Colak rang the number provided.

The scammers had gone to great lengths to not arouse suspicion, with the tradie recalling that he had to wait on hold for a while.

“It was a few minutes hold, it wasn’t a two second hold,” he said.

They even played the same music that ANZ played while waiting on the line.

When he finally got through, someone with a British accent answered and told him a device from Perth was trying to log into his account.

“When I was speaking to the scammers at the time, my mother actually said ‘walk into the branch and speak to them’,” Mr Colak said.

“I said, no it’s legitimate because it’s coming from the thread.”

Further legitimising the scam was the fact the caller knew the amount of money he had in there.

The scammers told Mr Colak they knew he had a NAB account with a “significant” sum of money in there – gaining more trust with the young tradie.

They told him that he should increase his daily limit and transfer the maximum amount of funds he could to save his money. By this point, believing he was speaking to a bank representative, Mr Colak complied.

“I did tell them I’m not comfortable with this and maybe I’ll walk into the bank,” Mr Colak said.

But the scammers convinced him to stay on the line, telling him they had randomly generated a new PayID for him to transfer his funds to.

He soon received a text message appearing to be from ANZ about this, dissuading him of some of his concerns.

“They said ‘once you’ve got that account it’ll automatically bounce back into your new account’,” he said,

The person on the other end of the phone also told him the funds would be placed on a 24-hour hold – and he then received a text message purportedly from ANZ confirming this.

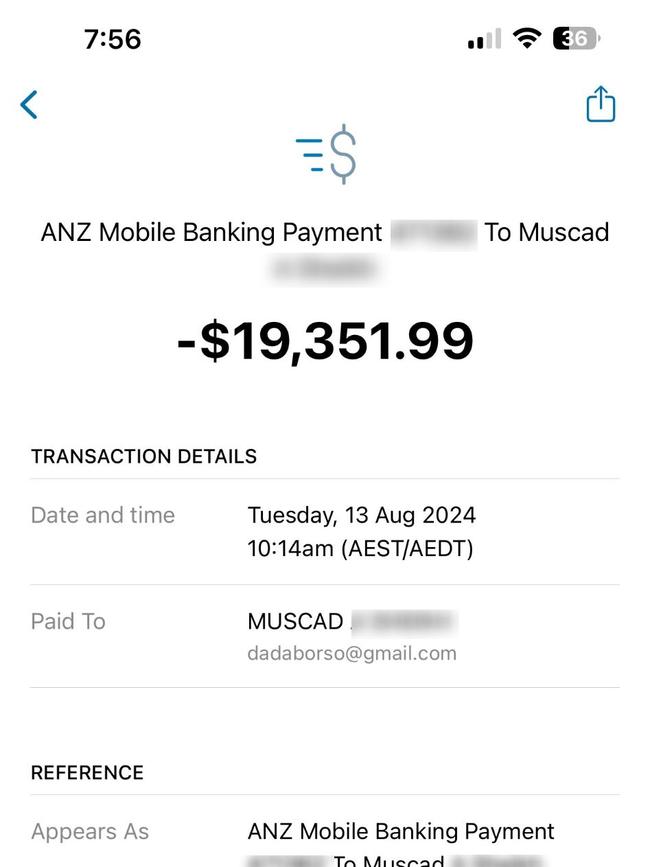

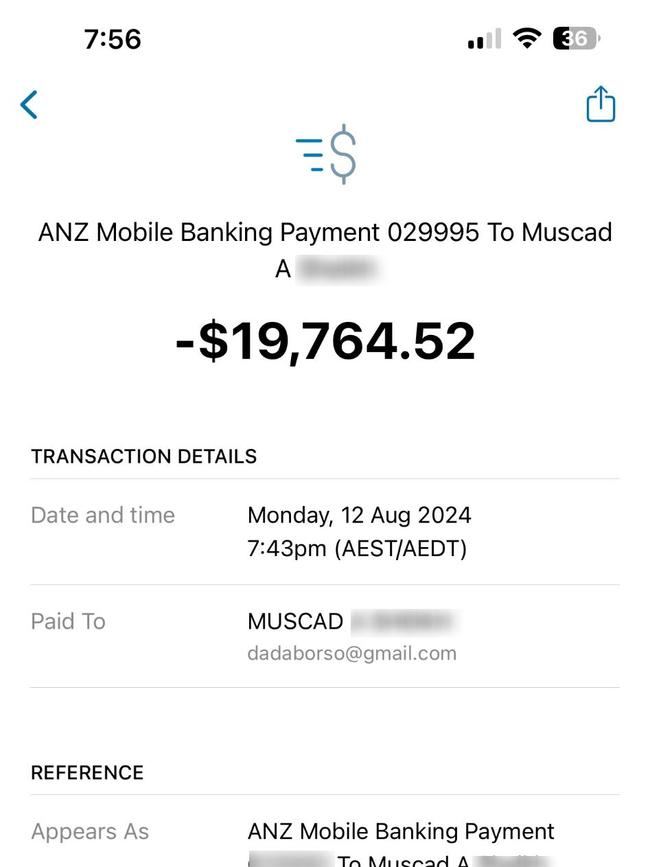

Over three consecutive days, Mr Colak made three payments totalling $58,262.

That is “pretty much” his life savings, he said.

The scammers upped their game, trying to convince him that he should download a software which he thought sounded like malware.

They also started mentioning cryptocurrency to him, and it was in that moment he twigged it was actually a scam.

Mr Colak urgently rang ANZ – this time on their correct phone number – but when he got through to a customer service agent, his call cut off.

“There was probably about 15 to 20 minutes that I lost,” he said.

Fed up, he decided to head into his local branch.

And in a creepy twist, while he was explaining his situation to the bank teller, the scammers called him.

The female bank employee picked up the phone and accused them of being scammers.

Mr Colak said the scammer’s demeanour instantly switched. He could hear at least two of them giggling.

Suddenly, the voice booming down the other end of the phone was an Australian accent. He believes that they had been using an AI voice modulator to make themselves sound British but switched it off once they realised the jig was up.

The scammers said to the bank teller “You sound cute, what’s your accent?”

Mr Colak said he was “shaking” the rest of the day.

He even went to a doctor and was referred to a psychologist over the ordeal.

“It comes to the point where you’re almost over it and then you think what you could have done with the money,” he said.

ANZ was not able to recover any of his money. They said they would not be reimbursing him as he had made the transfers himself.

ANZ would not comment to news.com.au specifically on this case but acknowledges scams are an “insidious problem” in the community.

alex.turner-cohen@news.com.au

Originally published as Young tradie loses $58k in sophisticated spoofing scam