Creditors claiming millions got zip from Matthew Perrin’s bankruptcy estate, but $1m back from failed family companies

FORMER biz whiz Matthew Perrin is more than law-breaker – not only did he abuse the trust of his wife and family, but insolvency experts reveal he left a trail of burned creditors.

QLD Business

Don't miss out on the headlines from QLD Business. Followed categories will be added to My News.

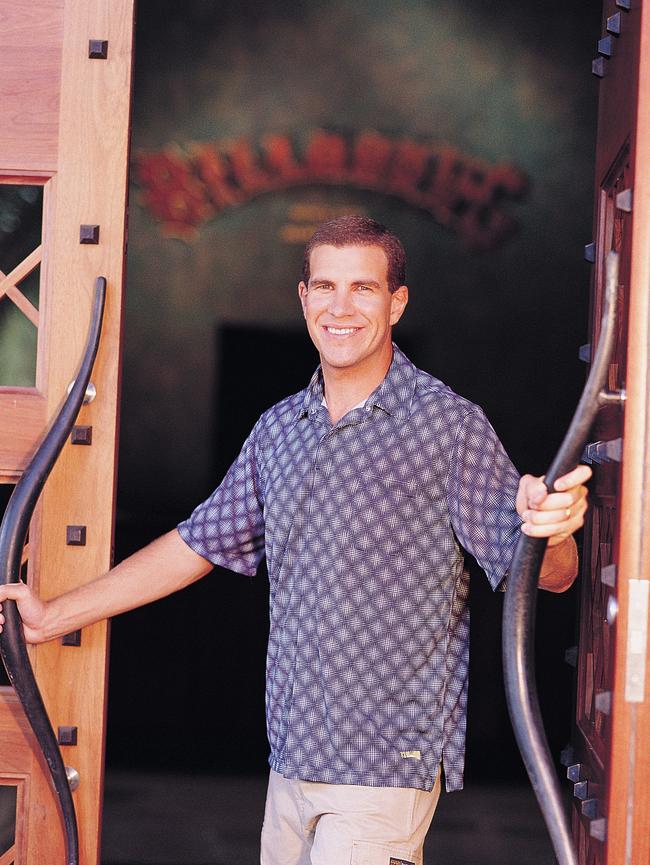

FORMER surf gear entrepreneur Matthew Perrin not only broke the law, but he also left creditors burned for millions of dollars.

Interviews this week with the insolvency experts who scoured the financial wreck of the former chief executive officer of Billabong painted a picture of creditors still owed money.

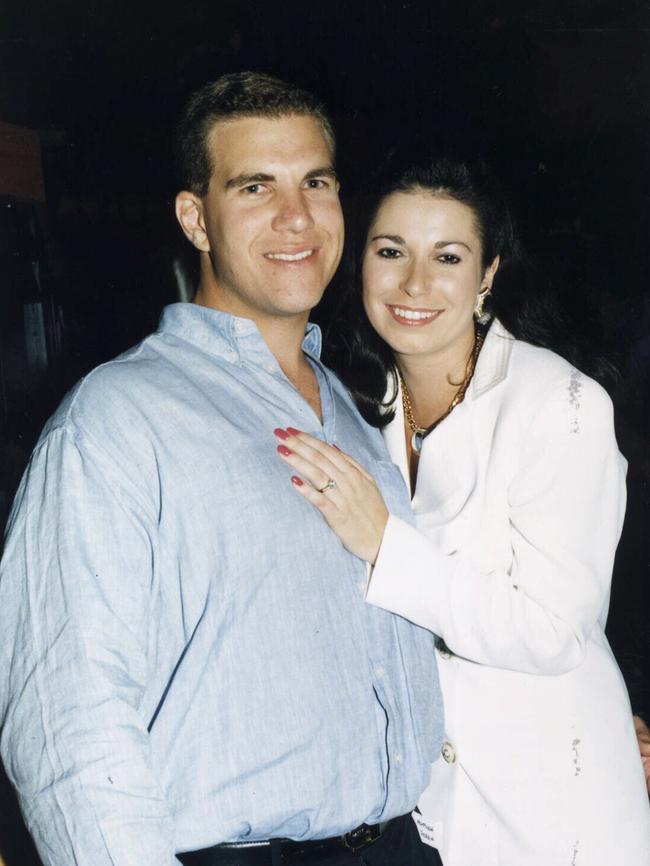

Perrin, who was found guilty of fraud and is scheduled on Friday to be sentenced, was with then wife Nicole once valued by BRW at almost $150 million. His trophies included a Mercedes CL500 worth $166,000, a $4.75 million Mermaid Beach investment apartment and 59 racehorses.

But he filed for bankruptcy in 2009, with creditors ultimately claiming $66 million, according to bankruptcy reports obtained by The Courier-Mail. Associated family companies also plunged into liquidation.

Perrin was discharged from bankruptcy three years later — the typical period. His estate remains open but current trustee Ann Fordyce of Pilot Partners said: “To date there has not been, and not likely to be, any return to creditors”.

His estate will be finalised once the liquidation of a Perrin family company was completed.

Perrin’s initial trustee, Graham Starkey, then of PA Lucas and Co, had mounted a public examination into Perrin’s financial demise. But Mr Starkey’s final report to creditors states subsequent legal action was “hampered by the unwillingness and inability of certain creditors and other parties to assist with relevant information and evidence”.

He was even looking at finding witnesses but they were in “diverse” locations including China and Mauritius. He declined to comment this week.

Some of Perrin’s bankruptcy creditors were also creditors of private Perrin family companies, and they have had some recoveries there. Julie Williams of Insolvency & Turnaround Solutions said creditors had so far received $1 million in distributions and another payment was to come.

Ms Williams attributed the failure of the two companies to investments in China, where Mr Perrin was involved in a shopping-centre venture. No recoveries of money had been made from China yet, she said.

MATTHEW PERRIN JAILED FOR EIGHT YEARS

SMARTEST MAN IN JAIL: HOW PERRIN LOST IT ALL

Court records show at least one Perrin bankruptcy creditor — and family company creditor, Chinese lender Citic, has also chased money from others involved in the shopping centre venture. Citic had sought $39 million from Perrin.

The sentencing on Friday relates to Perrin forging his wife’s signature on documents guaranteeing a bank loan.

But one other loose end has been an accusation during a 2009 liquidator hearing that Perrin separately was sent $5.4 million for a loan deal that was allegedly fake.

Perrin subsequently denied the claim, and corporate regulator the Australian Securities and Investments Commission this week declined to comment on whether it had investigated the allegation.