Matthew Perrin guilty: How surfwear mogul lost it all

HOW did Matthew Perrin - one of Queensland’s brightest entrepreneurs - go bankrupt, lose his wife and now his freedom? Read his alleged confession letter.

Crime & Justice

Don't miss out on the headlines from Crime & Justice. Followed categories will be added to My News.

- MATTHEW PERRIN: Billabong found stays strong for crying partner

- MATTHEW PERRIN: Billabong founder’s epic wipeout

- MATTHEW PERRIN: Ex-wife says she’ll get peace when he’s in jail

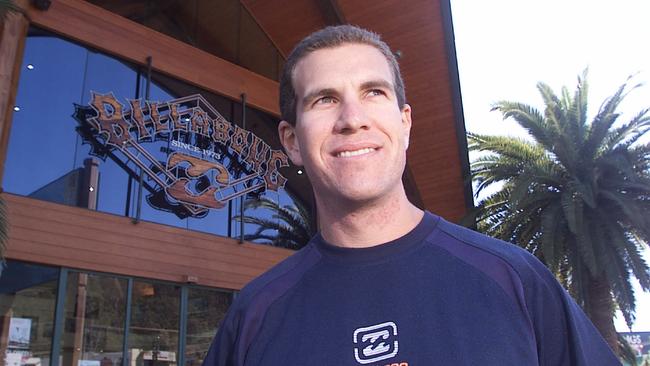

AT THE peak of his success, Matthew Perrin was envied for his good looks and self-made fortune.

Tall, clean-cut and confident, he was the “$150 million man” with the Midas touch in the trendy world of surfwear.

And things went brilliantly until it all started unravelling in 2009.

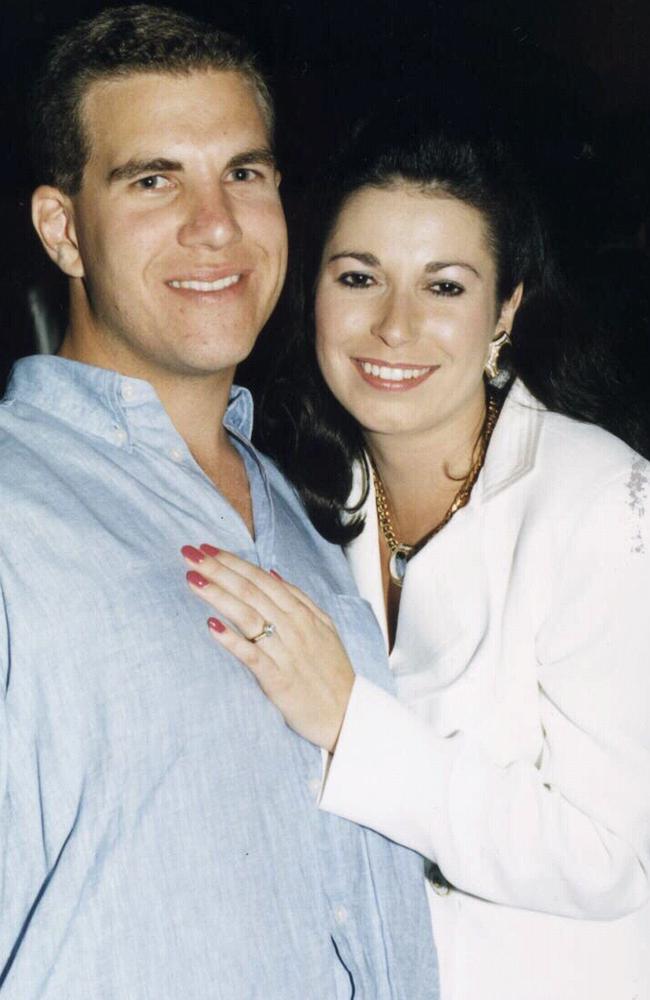

Perrin lost his fortune and his wife Nicole Bricknell left him, accusing him of betraying her and having an affair. Now he’s lost his freedom too.

The conviction means the jury believed that Perrin, a father of three, was lying when he testified he didn’t knowingly deceive the Commonwealth Bank by signing in 2008 for his wife and brother Fraser on loan documents worth $13 million.

He was alleged to have written a confession letter, which read: “During the past three years, I have made a lot of poor decisions. Originally, they related to poor investments, but that has developed into far deeper issues ... I have forged (my wife Nicole’s) signature on the mortgage.”

With words like these, one of the most gifted young entrepreneurs in Queensland’s history helped write himself into a notoriety reserved for other corporate scoundrels, such as Qintex’s Christopher Skase.

READ: EXTRACTS FROM ALLEGED CONFESSION LETTER

THE START

So how did a man who was often the smartest person in the room lose it all?

Perhaps he was occasionally blind to the consequences of some actions or thought he could dig himself out of a financial hole.

Only Perrin, who had pleaded his innocence, knows the truth, something he can think about while he spends time behind bars.

It’s an unimaginable future for Matthew David Perrin, who was born 44 years ago on the Gold Coast. He went to the elite Southport School before graduating from the University of Queensland with a degree in commerce and law.

Extremely smart, he was conferred a university medal in 1995. The young Perrin was also successful at wooing, meeting his future wife Nicole as teenagers in 1989. Their relationship came about from Perrin working for her father, renowned bookmaker Laurie Bricknell, as his clerk at the Saturday races.

Perrin entered the full-time workforce at the prestigious Allens law office, but soon became one of Queensland business’s big dogs.

He became the managing director of one of Queensland’s then retail success stories, Billabong, had a key role alongside Macquarie Bank in a $3.6 billion attempt to take over the London Stock Exchange, and worked with investment banks in Chinese mall operations.

Charlie Green, from Queensland stockbroking house Hunter Green Institutional Broking, said Perrin did a good job at Billabong. “He was young but he was talented,” Mr Green recalled.

One person who has done business with Perrin described him as methodical, going through work matters again and again to be clear. “He was very confident, very sure of himself,” the person says.

“He was an unbelievably smart guy,” recalled another person who worked with him. “He was very much ahead of his years in wisdom.”

During his successes, Perrin accumulated all the trappings of wealth, such as a Mercedes CL500 worth $130,000, a $4.75 million Mermaid Beach investment apartment, $4 million worth of racehorses and had $1 million worth of shares, and a jetty at the couple’s Gold Coast waterfront home to launch their watersports toys branded with the Billabong logo.

But, despite these impressive baubles, people who have worked with him remember a guy not given to ostentation.

Rather, Perrin had no problem mixing with people at a barbecue, a beer in hand. In short, a nice bloke.

Perrin worked with some big names in business. That includes Gary Pemberton, a former chairman of Qantas, with whom Perrin took Billabong to the stockmarket. Perrin also rubbed shoulders with the famous - borrowing money from Mick Doohan, the former motorcycle champion, whose business interests now extend to lending.

Then there were people from Queensland’s establishment: Perrin did business with the Thynne brothers, Grenville, Nathan and Ben, whose varied interests spanned hospitals to investment banking, and who had attended Brisbane Grammar School.

THE DOWNFALL

Billabong floated on the stockmarket in 2000 at $2.30 and the share price was $6.70 when Perrin announced his resignation as CEO in October 2002.

The end was in sight in August 2002, when he offloaded almost 8 million shares in Billabong at $8.30, reaping $66.4 million.

CEOs selling big amounts of stock spook markets but the worse sin was that his fellow board members did not know he was going to sell. He resigned soon after.

From there Perrin worked in various ventures but, in March 2009, wearing a grey T-shirt and jeans, Perrin shocked the business world by revealing he was bankrupt.

He had property heavily indebted to the bank, $30,000 in cash and $1400 of shares, according to his bankruptcy report.

That was outweighed by almost $42 million in debt. While the bankruptcy documents revealed some problems with bookies, he owed seven of them $1.7 million, the losses were largely blamed on China.

What went wrong in the Middle Kingdom has been subject to filing cabinets full of civil litigation. Perrin was involved in a venture with the Thynnes, hoping to break into Chinese shopping markets. This Global Mart mall idea started with three centres and was a food-retail concept, targeting second-tier cities with big growth prospects.

But the venture struggled; there were cash flow or funding problems and the business fell into receivership in 2009.

Nathan Thynne now attributes Global Mart’s problems to the global financial crisis. “A lot of big businesses got affected and we got affected,” he said.

Global Mart’s backers included investment banks Babcock & Brown and Allco, which failed in the GFC.

But Perrin, in civil court disputes, lashed out at Ben and Nathan’s actions. Nathan played a straight bat when The Courier-Mail asked about Perrin’s claims. “I’ve got no issues with Matthew. I’ve got no comment,” he said. Attempts to obtain comment from Ben Thynne were unsuccessful.

SHARP-DRESSED MAN

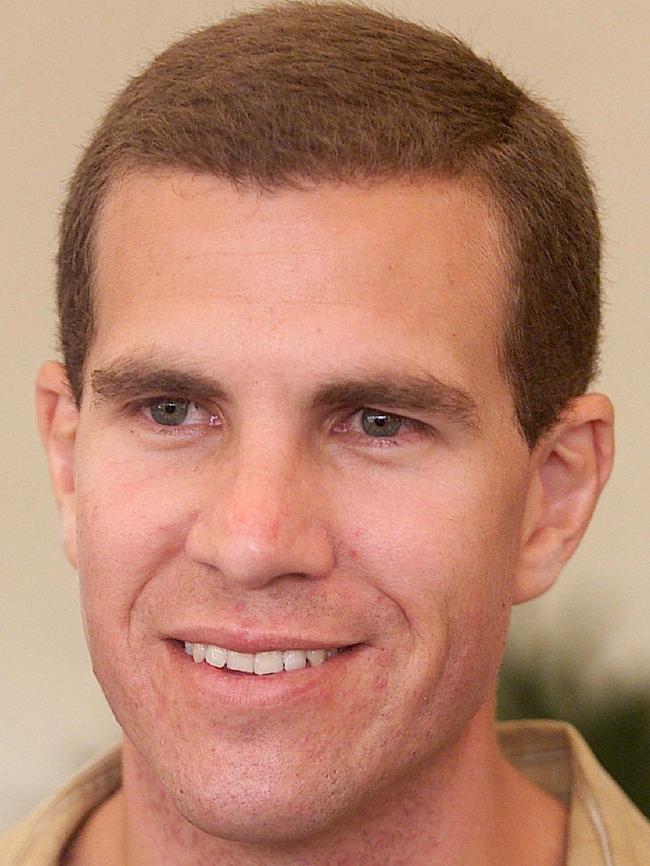

Perrin has always presented immaculately. His hair is closely cropped, he is tall and looks buff, saying he goes to the gym when stressed. His wardrobe includes sharp suits, emerald ties and brown suede shoes.

His demeanour on the stand is impressive too. He speaks slowly and deeply. He runs through issues thoroughly and his brains are on show.

For example, in one civil court hearing into a collapsed family company in 2009, evidence was being heard about millions of dollars in loans and withdrawals. Someone tried to hand Perrin, in the witness box, a calculator to work out the financial total. He refused, doing the maths longhand. “It’ll be quicker this way, don’t worry,” he said.

In fact, the one public crack in the demeanour was during a bankruptcy hearing in 2010, when he wept while describing a $34,500 ring he had bought for Nicole.

Their relationship had its ups and downs. While Perrin was married to Nicole, he was accused of having an affair with Belinda Otton. Nicole, in one civil dispute, had claimed she had found text messages from Ms Otton to Perrin’s phone saying things such as “call me” or the following furious dispatch: “It’s my birthday you f.....g bastard, you won’t take my calls.”

This latest criminal trial also had its share of heartbreaking moments. One came during proceedings, when Perrin was in a lift with his daughter. She said: “Daddy I love you”, and he said “I love you too”.

Even Laurie Bricknell said after the verdict: “There is no winner under these circumstances.” Mr Bricknell had testified in the trial but told The Courier-Mail “if anyone thinks they (the grandparents) want the father of their grandchildren ... in jail, they are totally wrong”.

THE CASE

This criminal case erupted in 2009 when Nicole fought an attempt by the Commonwealth Bank to take over their mortgaged house. Nicole argued her signature on the mortgage documents had been forged and this became the subject of a criminal investigation and then the trial.

The mortgage had helped Perrin borrow millions of dollars when he was trying to keep the Chinese venture afloat.

During the trial, Perrin’s barrister Andrew Hoare had argued Perrin had routinely signed his wife’s name with her consent. He also argued a “confession letter” was a fake and “a cynical exploitation” of a suicidal Perrin “to selfishly protect” Nicole’s interests.

Parts of a confession letter were submitted in the earlier civil trial and included the lines that he had forged the signature and that Nicole was unaware of this.

Crown Prosecutor Glenn Cash said the “massive risk” of forging a signature was typical for Perrin, who had earned his fortune in risky deals before. Perrin gambled “in the hope it would all work out” but “this time it failed catastrophically” because Perrin acted dishonestly, Mr Cash said.

One person who had done business with Perrin said: “It’s a shock that he got himself into that position.”

These charges are not the only time Perrin has been accused of wrongdoing. Serious allegations were made in a 2009 court hearing into one of Perrin’s collapsed companies, Christie Qld, held by liquidators Insolvency & Turnaround Solutions.

During those hearings, fund manager Nick Barbato claimed he had sent $5.4 million to Perrin for a loan deal that was allegedly fake.

The money was supposed to be part of a convertible note offer for the Chinese shopping mall deal. But the court heard the company secretary for the venture had said the money had never arrived and the convertible note offer was “wrong and illegal”.

Perrin, in a subsequent hearing, argued that documents proved funds had been sent, and the board had given directions for the issue of the convertible notes.

Perrin’s business future is now in tatters. He has been quiet professionally since emerging from bankruptcy in 2012, the typical three-year period for a bankruptcy. Company searches show Perrin registered then as a director of a private entity called Sleek 2012, which seemed to have an interest in property. But he resigned in July this year from Sleek.

Personally, he has not been alone, he has been in a relationship with Ms Otton. She has been at court, along with the Bricknell family.

Now Perrin must wait until next year to find out his sentence. He won’t be the smartest guy in the business room anymore, just the smartest guy in jail