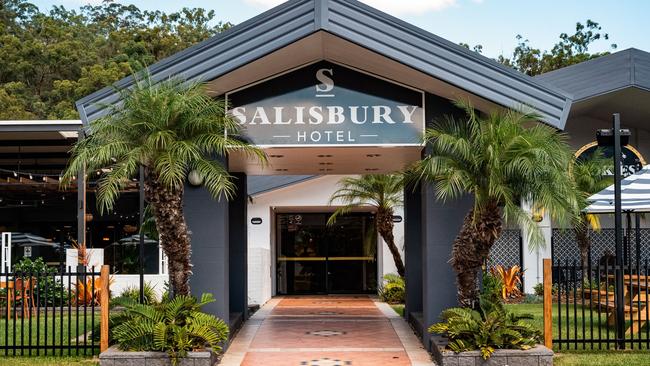

Australian Venue Co $1.6m renovation of the Salisbury Hotel brings it `back to the people’

It took a lot of listening but a Brisbane southside pub reckons it has a $1.6 million renovation right, with a few surprises to attract younger locals.

City Beat

Don't miss out on the headlines from City Beat. Followed categories will be added to My News.

One of Australia’s largest hotel operators’ multimillion-dollar renovation rollout of its suburban pub empire has chalked up another success.

Last year the 140-year-old Crown Hotel at Lutwyche reopened after a $2.4m “trendy” fit-out, and this year the Australian Venue Co (AVC) recently opened the doors at the Salisbury Hotel in Brisbane’s south after a $1.6 million reno – and we hear locals love it.

They should. AVC went out and asked the community what they wanted to see in their local pub.

They got the message and will cater for more younger families and students who have been moving into the area, adding a new beer garden that will hold 108 people and a refreshed sports bar, as well as accommodation.

The pub also now has weekly events and specials, such as “kids eat free” on Mondays, trivia night, Tradie Club and live Fridays and Sundays music.

Salisbury Hotel venue manager Tim O’Leary said the renovation focus was on the local community,

“We are investing in the Salisbury Hotel to ensure that the pub suits the local community,” he said.

“A pub should be the heart of the community and we have seen an uptick in younger families and students moving into the area. This has meant more demand for a casual local and we are delivering that with a great new outdoor space, as well as an energetic sports bar driven by round the clock sports and live entertainment.

“The Salisbury Hotel will also be supporting local charity TAG 5 through its Local Heroes program. The charity enhances the lives of people with a disability and we are pleased to be able to contribute to a cause that brings the community closer together.”

Shipping goes green

The Port of Brisbane is playing its part in making the world’s shipping fleet cleaner.

An ANL cargo ship powered by biofuel left Brisbane earlier this month on a 42-day service via Southeast Asia and then onto key Australia ports.

The vessel, supported by Woolworths through the supermarket group’s supply chain business Primary Connect, carried consumer goods from cotton, meat, beverages and dairy to machinery, furniture, fashion textiles and ceramics.

The trial voyage used a biofuel blend with feedstock supplied by Queensland-based EcoTech, while BP Marine and Port of Brisbane played a pivotal role in supplying and bunkering the fuel.

ANL aims to use 10 per cent of alternative fuels across its business operations and, by 2050, achieve net zero carbon.

ANL managing director Shane Walden reckons the voyage is a crucial step in not only the shipping company’s net zero carbon target but also the industry and region’s evolution to a cleaner and more sustainable way of working.

“While ocean freight is one of the most carbon-efficient ways of transporting cargo, we believe we have an opportunity and a responsibility to act for the planet,” he said.

Apartment market rebounds

IN the great Brisbane property bubble, apartments have been left behind – but not for long.

Research by Colliers International points to a dramatic price increase in the apartment market.

Despite Covid-19, floods and looming interest rises, the Brisbane median house price increased by 10.7 per cent to $890,000 in the March quarter: a staggering 49 per cent price differential with apartments, the greats different in two decades.

But Colliers director residential Andrew Roubicek believes Brisbane is in for a significant price increase in the apartment market. He said the compounding pressures on the construction sector was forcing developers of new stock to lift prices by as much as 20 per cent over the past 18 months.

“Buyers may see better value in the established apartment market in the short term, as opposed to buying new off the plan,” Roubicek said. “However, this will be a short-lived alternative as supply dries up and investors stake advantage of rental vacancy rates. This increase in demand will have a significant impact on the second-hand apartment, pushing up prices reflecting the price of a new apartment.”

More Coverage