Brisbane financial planner Ben Jayaweera accused of ripping about $5.9 million from investors

A DISGRACED Brisbane financial planner faces up to 12 years behind bars after the corporate cop charged him yesterday with ripping off about $5.9 million from investors.

QLD Business

Don't miss out on the headlines from QLD Business. Followed categories will be added to My News.

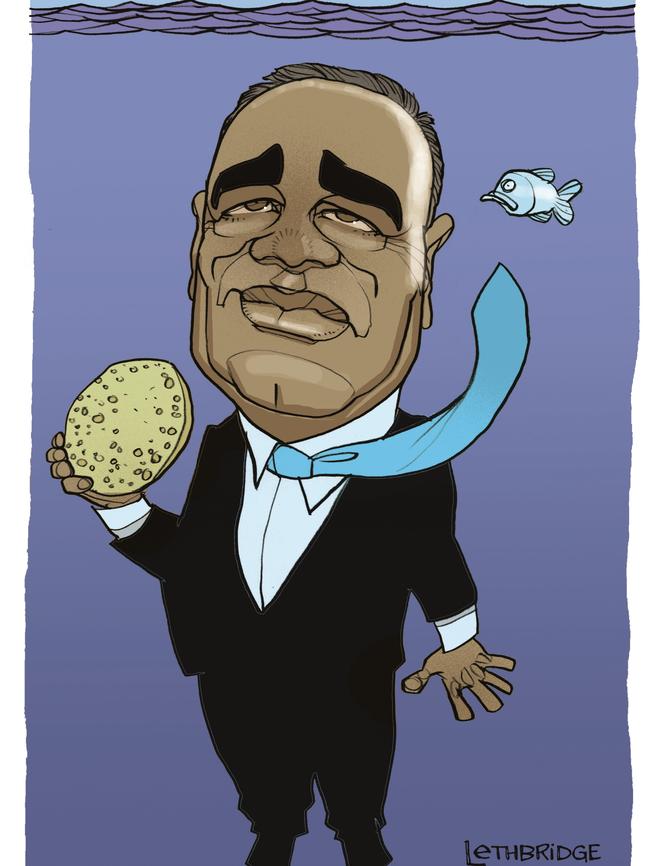

SOMETHING FISHY

A DISGRACED Brisbane financial planner faces up to 12 years behind bars after the corporate cop charged him on Friday with ripping off about $5.9 million from investors.

Ben Jayaweera did not enter a plea in Brisbane Magistrates Court to the six counts of fraud but later told City Beat that he would defend the case.

ASIC alleges that he used his now-defunct Growth Plus Financial Group to defraud numerous clients between September 2013 and October 2015.

The company operated an unregistered managed investment scheme which claimed to be a diversified fund.

In reality, about $16 million raised from 75 investors was diverted entirely to the Ocean Abalone Australia project in South Australia, which was operated by entities under Jayaweera’s control.

He told investors in early 2016 that he hoped to raise more than $25 million for the farming project and flagged potential returns of more than 20 per cent from the export-focused enterprise.

But those plans fell apart after the taxman secured court orders just weeks later to wind up Growth Plus, which had nearly $2 million in debts.

ASIC also permanently banned him from promoting financial products or providing advice.

Jayaweera, a former AMP financial planner originally from Sri Lanka, had been active in the financial service industry since 1983 and launched Growth Plus in 1986.

He remains free on bail and his case returns to court on July 13.

FLAT START

A BRISBANE asset management firm failed to make a splash on Friday when its investment trust kicked off trading on the ASX.

Investors paid $2 a share to get a piece of the Gryphon Capital Income Trust, which ended the day up just 1¢ up.

Parent company Gryphon Capital Investments raised $175.3 million from investors, well short of the $350 million target that it set as a maximum.

It was promoted as the first time that mums and dads could invest in a vehicle focused on a portfolio of asset-backed securities, including those based on mortgages, auto loans and credit cards.

Gryphon co-founder Ashley Burtenshaw said punters saw it as an alternative, low-risk and highly diversified product in a sector traditionally dominated by big institutional investors.

Among those who piled in was Queensland resources magnate Bob Bryan, who snapped up 475,000 shares and made the list of top 20 stakeholders.

But Gryphon had to go to great lengths to convince investors that its mortgage-backed securities were not “collateralised debt obligations,’’ those wicked little financial time bombs which precipitated the GFC.

It probably didn’t help that Burtenshaw and his co-founding partner, Steven Fleming, both previously held senior roles at now-defunct Babcock and Brown.

Gryphon’s head of operations, Michael Groom, and analyst Sergey Podzorov also worked at Babcock, which was once worth $9 billion but became a GFC casualty and collapsed in 2009.

Launched in 2014, Gryphon manages more than $1.9 billion of assets.

COLLECTIVE GIVING

IS THERE a Brisbane bizoid more focused on “collective giving’’ than Allan English? We can’t think of one.

The Silver Chef boss launched The Funding Network five years ago and since then it has raised more than $8 million for almost 200 non-profit groups and other social enterprises.

He expects a crowd of 150 to 200 at the Clayton Utz offices next Thursday for the annual pitch night, which will see three charities each compete for more than $15,000 in donations.

They focus on providing rescue animals to isolated people, peer mentoring for young mums and counselling for youth in poor or remote areas.