Ageing population drives $182 billion merger between QSuper and Sunsuper

It will create a new $182 billion financial giant right in our backyard but what is really driving the planned merger of Queensland’s iconic superannuation funds?

QLD Business

Don't miss out on the headlines from QLD Business. Followed categories will be added to My News.

THE planned merger of QSuper and Sunsuper to create a $182 billion Queensland-based financial giant may not result in lower fees but will help avoid the consequences of our rapidly ageing population.

What’s the impact of a potential QSuper and Sunsuper merger?

Superannuation funds QSuper and Sunsuper in merger talks

With almost half of QSuper members aged over 50, industry watchers say the 107-year old fund needs the influx of younger people provided by the merger with Sunsuper to avoid more funds eventually flowing out than in.

While both funds are among the best performers in the country, they need to establish a broader, younger membership base to stay competitive.

SuperRatings managing director Jeff Bresnahan said QSuper, which was originally founded to manage the retirement nest eggs of public servants, had many members either retired or approaching retirement. About 23 per cent of its members are aged over 60 while a good proportion of Sunsuper’s are still in their 30s.

“The risk for QSuper is that eventually there would be more outflows of funds than inflows,” said Mr Bresnahan.

“That is not an immediate reason to merge but it is one of the advantages of joining up with a fund that has a younger demographic.”

QSuper remains the default fund for State Government employees, but in 2017 was opened to the public, sparking a drive for new members.

Mr Bresnahan said Queenslanders hoping for reduced fees as a result of the merger may be disappointed.

“I think it is a misnomer that the bigger you get the more economies of scale you get,” he said. “That should not be a reason to merge.”

He said the merged fund would need to diversify its membership fairly quickly outside of Queensland to compete with other industry funds such as AustralianSuper.

While Sunsuper already has offices in Sydney, Melbourne and Perth, QSuper is largely Queensland- based. The combined fund will have almost two million members.

QSuper was earlier this year named the nation’s best superannuation performer over the past decade as it defied volatile times by investing in bonds and unlisted assets.

QSuper’s balanced fund returned 8.6 per cent annually over the past 10 years while Sunsuper returned 8.1 per cent per annum.

Pitcher Partners director of wealth management David Lane said AustralianSuper and the merged Sunsuper/QSuper would account for one third of Australian workers, a situation that was likely to attract the attention of the Australian Competition and Consumer Commission.

“By members, the combined group would come close to AustralianSuper’s 2.2 million members so it will be interesting if the ACCC does review it,” he said.

The ACCC yesterday declined to comment on whether it would launch an investigation into the proposed merger.

Mr Lane said the merger would allow the Queensland funds to market themselves more effectively on the national stage and cut back office expenses.

He said the country’s major industry super funds, combined under the “Industry Super” brand, manage a combined $358 billion.

“It is likely that the boards of QSuper and Sunsuper would be considering the economies of scale that the combined group could achieve to compete with these funds,” he said.

Mr Lane said that if the merger was successful it would likely increase pressure on smaller funds to consider merging in order to stay competitive with the large rivals.

The merger would likely provide cost savings through combined back-office and administration, and the adoption of enhanced technology.

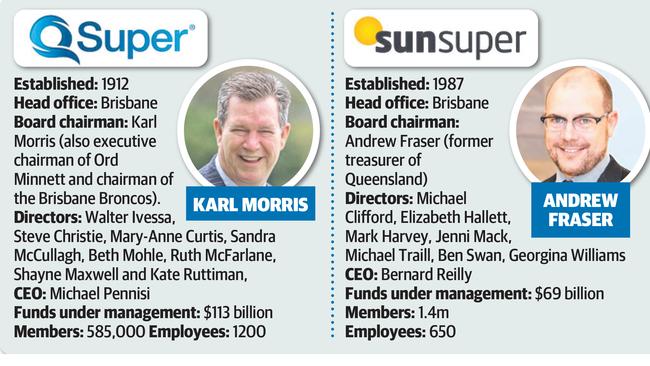

QSuper and Sunsuper have declined to elaborate on possible job losses at the funds that together employ 1850 workers or other details including a headquarters or a name for the combined organisation.

The merger will not require the approval of members of either fund, with their respective boards deciding as trustees whether to proceed in the best interests of members.

A spokesperson for Deputy Premier and Treasurer Jackie Trad said nothing proposed in the merger would alter the rights of QSuper members or change the Queensland Government’s legal obligations towards its employees.

Mr Bresnahan tipped a continued shake-up in the super sector.

“In 10 years, the super industry will look a bit like the banking sector in that there will be five or six major funds and a lot of smaller specialists.”