Queensland superannuation funds QSuper and Sunsuper in merger talks

A potential merger of Queensland’s two biggest super funds could create an industry giant, managing $182 billion in retirement savings for more than two million people.

QLD Business

Don't miss out on the headlines from QLD Business. Followed categories will be added to My News.

QUEENSLAND’S two biggest superannuation funds – QSuper and Sunsuper – are in merger talks that would create the country’s largest pension fund managing $182 billion in retirement savings for almost two million people.

QSuper and Sunsuper on Monday revealed they were in “preliminary, non-binding discussions” about a possible partnership that would create a pension fund goliath to take on southern state industry giants such as AustralianSuper and retail funds run by the big banks.

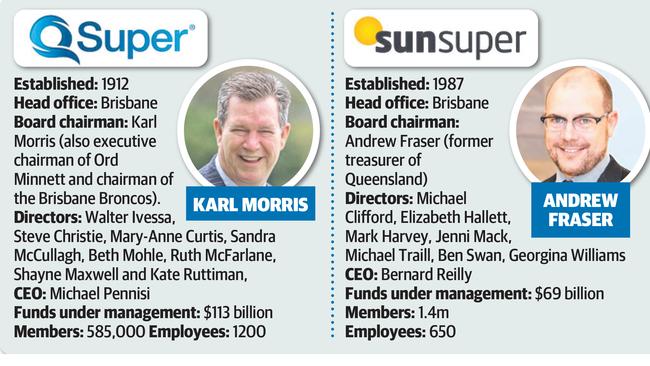

In a joint statement, QSuper chair Karl Morris and Sunsuper chair Andrew Fraser said both funds – which together employ 1850 people – had to consider whether a partnership would benefit members.

“Whether or not that consideration proceeds beyond preliminary discussions is dependent on many factors,” they said. “In the meantime, both Sunsuper and QSuper members may be assured they will be kept informed of any material decisions.”

Any merger would give Queensland workers the financial power to invest in more high-quality assets around the globe, but there are uncertainties about how a deal would impact on the 1850 employees employed by both funds. QSuper said on Monday it was too early to speculate on details of any merger.

The possible combination of the two super giants comes amid rising competition in the sector that has seen a wave of mergers and growing dissatisfaction with the performance of retail funds following the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry.

Founded in 1912 to manage the retirement nest eggs of public servants, QSuper now has 585,000 members with over $113 billion in funds under administration. Sunsuper began in 1987 and manages $69 billion for its 1.4 million members. QSuper, which lost the monopoly to operate the state’s public service pension fund in 2017, has in recent years faced competition from Sunsuper.

Both funds have cut fees and ramped up their marketing efforts as they attempted to keep their members.

Both QSuper and Sunsuper, which are both “profit for member” funds, are among the best performers in the country, last week picking up a swag of industry awards.

The announcement comes as the industry watchdog, the Australian Prudential Regulation Authority, has called on more super funds to merge to reduce complexity in the super system.

In April, VicSuper and First State Super – funds focused on state government employees in Victoria and NSW respectively – announced plans for a merger that would create a $110 billion fund. Meanwhile, Brisbane-based Club Super in September announced it would merge with larger rival Hostplus.

Pitcher Partners director of wealth management David Lane said a combined QSuper and Sunsuper would have the ability to compete with the biggest funds in southern states.

“Over the past five years, industry funds have performed well compared to the retail funds,” said Mr Lane.

“QSuper is one of the top performers and combining with Sunsuper would allow them to compete more on a national footing.”