One was a loan fraudster with a rock ‘n roll alias, another an influencer who ripped off the vulnerable. A third was a fanatical basketball fan desperate to save his team, the fourth a law firm executive living in “a fantasy world of the rich and famous”. Four very different frauds with one thing in common – each ended up in jail.

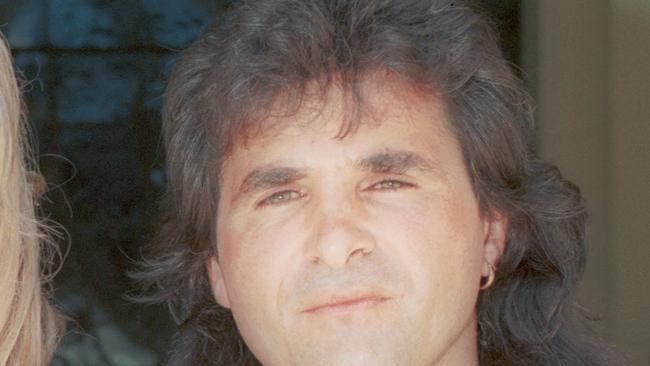

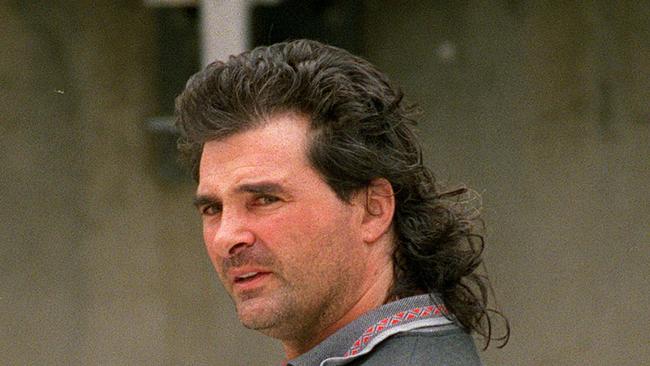

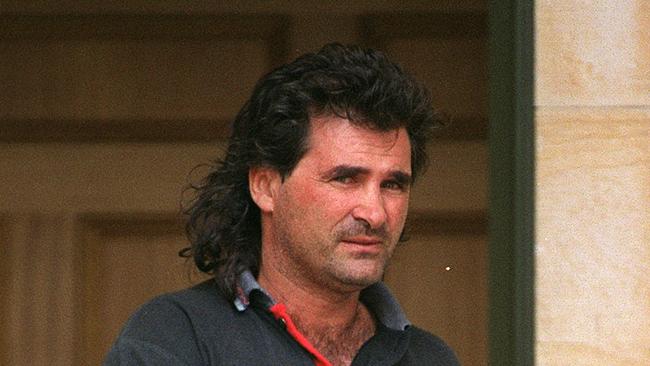

ROMEO PACIFICO

Legendary rock and roll guitarist Richie Sambora has a deep love affair with Adelaide – it’s the home of his ex-partner, Orianthi – but that wasn’t always the case.

In the mid-2000s, “Adelaide” was a dirty word to the Bon Jovi hit maker thanks to one of the most successful, and infamous, conmen to pass through its courts.

For more than 10 years, concrete pumper Romeo Pacifico used the Hall of Famer’s name to swindle $25.6 million from banks and businesses across the CBD.

Armed with little more than a stolen name, a forged signature and a counterfeit drivers licence, Pacifico built an empire of concrete trucks and led a lavish lifestyle.

That largesse included a fleet of cars that one would expect to see in the real Sambora’s garage.

Pacifico owned a 50-strong fleet of Ferraris, Porches, Harley Davidson motorcycles and even a $101,000 BMW 525i.

He housed them at his 12 residential and commercial properties, which formed just part of his multi million-dollar portfolio.

Pacifico’s success mystified his friends and family, whose suspicions he rebuffed with claims of investments gone right and lottery wins.

Unfortunately for Pacifico, the National Australia Bank had figured out the truth.

A lone collection agent – who never received public praise for his diligence – realised Pacifico, Sambora and yet another alias were one and the same person.

That third name? John Bongiovanni – a play on Sambora’s musical partner, John Bon Jovi.

A cross-reference of fraudulent documents, tax returns and loan slips confirmed the collection agent’s hypothesis and the bank pounced on the Pacifico empire.

SA Police were quickly involved, bolstered by an eyewitness statement from one of Pacifico’s own employees.

That worker had caught the boss photocopying his drivers licence, ahead of crafting yet more fake identities – “Leroy Himms” and “John Leppa”.

Police would eventually amass 4500 pieces of evidence, collated by two full-time detectives, two part-time detectives and a staff of intelligence officers and forensic accountants.

As the resulting civil and criminal cases landed in court, Pacifico’s name hit the headlines and the story reached the real Sambora, thousands of miles away in Los Angeles.

Interviewed by an Adelaide reporter about his band’s new album, Sambora – then married to actress Heather Locklear – has some choice words for his impersonator.

“I hope they lock his arse up,” he said.

“If he wanted to be me, he should have had Heather Locklear hanging off his arm… that’s impossible, because she’s hanging off mine.”

Tragically, Pacifico had betrayed others closer to home – his then-wife and his parents, whose signature had been forged on loans worth millions.

They too had to run the gauntlet of public scrutiny and cross-examination, some of it from a barrister with an international client.

Because his name had been used so extensively, the real Sambora had to retain counsel in Adelaide to defend his reputation until the mess could be untangled.

Eventually, Pacifico capitulated – he pleaded guilty to 19 counts of fraud worth $17.5 million, but agreed to be sentenced on the basis he’d stolen all $25 million.

In March 2008, Pacifico was jailed for 16 years with a 10-year non-parole period – his wife and parents, meanwhile, were evicted from their homes.

To this day, $8 million of the money stolen remains outstanding, while Pacifico insists the real blame lies with financial institutions and the media.

“It was a joke – a joke that went wrong,” he told a reporter from his prison cell.

Read more about this case: Romeo Pacifico livin’ life on a prayer

– Sean Fewster, Chief Court Reporter

TINA MCPHEE

Tina McPhee was ahead of her time – long before the term “influencer” had been coined, her Instagram account was the stuff of high society dreams.

From her champagne-coloured BMW convertible to her seemingly endless trips to Italy, France, New York and Dubai, McPhee was the envy of the South Australian public.

Although she was well known for being dressed head to toe in designer wear, it was a moment of public nudity that truly catapulted her to household name status.

Having become a fan of detox cleansing in 2011, McPhee launched the Juice Revolution brand – posing naked with her business partner to promote the venture.

McPhee may well have thought it an instance of prescient vulnerability, a real “the businesswoman stripped bare” moment to impress potential customers.

Instead, it was a signal that the covers had come off the secrets of her success – and each and every one of them was utterly criminal.

McPhee’s wealth was neither earned nor hers, but the result of the careful manipulation of truly vulnerable people.

In the mid-2000s, she was entrusted to manage estates for people who had, through no fault of their own, suffered physically and emotionally.

She had therefore had access to a $1.1 million compensation payment made to a hospital malpractice victim and a $1.9 million settlement awarded to a car crash survivor.

A mid-north family, meanwhile, had given her control of $400,000 belonging to four children who had been orphaned by the loss of their mother.

Over six years, McPhee would dip into those accounts 181 times, taking between $300 and $200,000 each time, until she had siphoned a total of $3.9 million.

She did so to keep face – her business was bringing in just $20,000 a year, far too little to plump her envy-inducing Instagram account or fuel her luxury ride.

All the while, those around her suffered.

McPhee’s business partner fought to keep the lights on even as the vulnerable from whom she stole bore the emotional fallout.

One victim suffered a nervous breakdown as she begged someone – anyone – to believe her claim Adelaide’s societal darling was robbing her blind.

Fortunately, an Adelaide law firm listened and launched an investigation, quickly uncovering McPhee’s criminal actions.

The socialite did her best to bluff, insisting it was “all a misunderstanding”, but the game was up and she knew it.

Arrested while she was working out at the city’s premier gym, McPhee was jailed for 13 years, with a 10-year non-parole period.

She filed an appeal, claiming she’d been dealt with more harshly than other fraudsters, and succeeded in earning a four-year discount on her penalty.

-Sean Fewster

CHRISTOPHER WAYNE FUSS

It was, he reasoned, perfectly justified – illegal, yes, but clearly for the greater good.

He wanted, for starters, to save the Adelaide 36ers from financial ruin and ensure top US import Julius Hodge hit the boards for his beloved team.

And at the end of the day, he rationalised, it hardly mattered the necessary funds were being siphoned from a university – because it was helping others.

Fuelled by that mindset, and armed with just two computer passwords, Christopher Wayne Fuss turned himself into a millionaire in less than two years.

His offending was anything but complex – all he did was use the two passwords and an EFTPOS machine to pour the university’s coffers into his own.

One password was his own, the other belonged to a colleague who had no idea his credentials were being used for crime.

Fuss rose from nameless Flinders University cashier to banner member of the “Save Our Sixers” consortium in the span of months.

He also set himself up as a “loan arranger”, offering his illegally-obtained money to others so they could improve their lives – while buying himself a luxury home.

Between January 2008 and January 2010, the self-proclaimed “financial wizard” repurposed $27 million of the university’s money, with its bursar none the wiser.

Fuss naively believed he could keep it that way.

Another aspect of his delusion was the belief he could earn enough interest to pay it all back, without having raised a single alarm.

It didn’t work, of course – by January 2010, Fuss was in the dock of the Adelaide Magistrates Court charged with 58 counts of fraud.

His arrest kicked off more than 12 months of forensic accounting and behind-the-scenes plea bargaining as Fuss and his legal team worked to save his neck.

In March 2011, Fuss pleaded guilty to a single charge that encapsulated all 58 incursions into criminality.

As he headed for sentencing in the District Court, the university announced it had recovered all but $1 million of the stolen funds.

If Fuss thought that might spare him jail time, he was wrong.

Three months later, Judge Mark Griffin told Fuss he had been “obviously deluded” in his plans, called him “naive and bizarre”.

He jailed him for nine years, with a five-year non-parole period.

“I find that there were elements of grandiose behaviour in your offending,” he said.

“I suspect you will never commit offences of this type again, mainly because no employer in their right mind would ever trust you again.”

In 2019, however, Fuss was back in the public eye once again – albeit under a different name.

Now calling himself “Chris Mills”, Fuss had taken up the role of “informal financial adviser” to the Largs Bay RSL Club.

The revelation of his criminal past upset the membership, despite president Peter Cates’ assurance the club knew all about it before taking him on.

“We made some investigations to confirm he was currently working with a bookkeeper and they said he is fantastic and very remorseful for what has happened in his past,” he said.

“What’s past is past… we made a decision to keep him and he’s been very good.”

Mr Cates was less impressed that the connection had made it to the media, saying whomever tipped off reporters needed “a damn good kick up the butt”.

– Sean Fewster

CRAIG RANEBERG

It was the love of the high life that drove Craig Raneberg to commit his many, many crimes. The opera and film lover liked to look the part. That he was one of the glitterati, flying here and there for lavish holidays, paying for grand, expensive dinners and showering friends with gifts.

In reality he was a conman and a thief.

Raneberg was chief financial officer at top-tier law firm Minter Ellison when he committed his crimes. Over seven years, Raneberg stole $2.7 million from the law firm’s partners, transferring their money to his own account.

Raneberg certainly had the connections. He had been a board member at the Adelaide Fringe and State Opera and worked at the SA Film Corporation.

Judge Geoffrey Muecke, in sentencing Raneberg to 10½ years in prison in 2012, with a non-parole period of six years and four months, said the fraudster was socially inept and wanted to appear wealthy.

“You stole to maintain a lifestyle of travel, accommodation and prolific spending which you would otherwise not have been able to maintain,’’ Judge Muecke said.

“It seems that profligacy and a fantasy world of the rich and famous was your addiction.’’

Raneberg would eventually plead guilty to 70 counts fraud. He took the money on a near-fortnightly basis between 2003 and 2011. The smallest amount he took was $1500, the largest was $43,000.

Somehow his offending went undetected until after Minter Ellison made him redundant in 2011. But before he left the company, and fled to Bangkok, he wiped the company’s financial records to try to hide his offending.

The saga began when Raneberg transferred money – using an online password he had access to – that he used to pay for a holiday to the US. It started a pattern. Over the following years, Raneberg regularly travelled to the US, United Kingdom, Gold Coast, Port Douglas, Melbourne and Sydney. His most regular destination was Bangkok, which he visited as many as 20 times. Raneberg would fly business and first class, stay at up-market hotels and took a lot of spending money with him.

But there was more. His friends were also gifted air tickets and expensive presents.

Then it all came tumbling down. Minter Ellison made him redundant and he retreated to his safe haven of Bangkok in June 2011. Two months later his fraud was reported to police. But life on the run ended when he flew to Sydney in October that year to renew his Thai visa. His name was flagged as he went through Customs at Sydney Airport, triggering an “arrest on sight’’ alert.

Raneberg went to jail for his crimes, but Minter Ellison’s partners weren’t able to recover the lost money. The money had all been blown by Raneberg’s pursuit of the lavish and the opulent.

As Raneberg’s lawyer David Mullen told the court: “There is no grand house. No Ferrari, no Swiss bank account.’’

Before his sentencing, Raneberg, then 47, apologised in a letter to the District Court for the many, many times he had stolen from his employer.

“While, it’s rightly unlikely to be accepted, I am writing to apologise … for the impact of those crimes on people and the business,’’ the letter says.

“No doubt many people feel a mixture of emotions including shock, anger, betrayal or even sadness … what I did was and is inexcusable (and) rightly I am facing significant punishment. “Hopefully that will be a consolation to some degree for you all … I do not expect to be easily forgiven for what I have done, nor do I deserve it.’’

– Michael McGuire