From a former Olympian who ripped off blue-chip investors to a fraudster who lived the high life in his Springfield mansion, these callous swindlers prove that you can have dollars without sense – or morals.

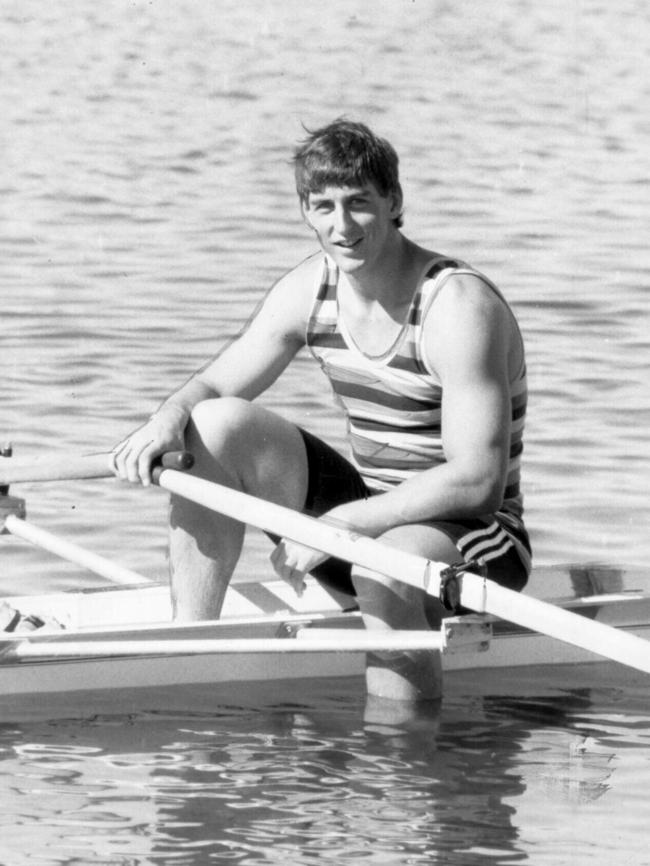

HAMISH BOYD MCLACHLAN

He represented his country in the Olympic Games, but all Hamish Boyd McLachlan truly wanted in life was the respect of his father.

Unfortunately, being a gifted rower did nothing to prepare McLachlan for life in his father’s firm, Thompson Brindal.

Nor did it give him any special insight into how to best navigate the formidable task of managing RetireInvest clients on behalf of the firm.

McLachlan had, by his own admission, long considered himself “academically hopeless” – but the family’s good name was on the line, and he had to perform.

The best way to do that, he decided, was to make himself and his friends look good, regardless of what that did to the RetireInvest clients.

On 53 occasions between 1989 and 1997, McLachlan transferred all the losing options out of his personal stock portfolio into those of his clients.

He did the same for several other people and organisations he personally valued – including the Adelaide Rowing Club – without their knowledge or consent.

In all, McLachlan dumped $556,526 worth of losers onto those who had entrusted him with their retirement.

He might have climbed to the top of the podium on paper but, internally, McLachlan was anything but an elite athlete.

As the guilt of his actions weighed upon his conscience, he slunk into depression and began overeating, eventually resulting in a battle with obesity.

Nonetheless, he protested his innocence when SA Police and the forensic accountants came calling, opting to stand trial in the District Court in 2003.

The evidence was, of course, overwhelming and McLachlan was found guilty of 55 counts of improperly using his position to gain a financial advantage.

In sentencing, Judge Anthony Bishop noted the offending was driven by “crippling self-doubt” and an “overwhelming desire” for McLachlan Sr’s approval.

However, His Honour said none of that mattered.

“The gravity of your criminal conduct is indicated by the sustained nature of the offending, the large amount of money involved, your gross breach of trust (and) your motive of self-interest, profit or greed – with no semblance of need,” he said.

“No sentence, other than imprisonment, is appropriate here.”

He jailed McLachlan for nine years, with a five-year non-parole period.

An indemnity fund kicked in to cover the retirees’ losses, prompting McLachlan to take one last swing at leniency.

His appeal was a non-starter, with the state’s highest court ruling his penalty was well within the acceptable range for such serious fraud.

What McLachlan’s father made of his criminal antics has never been publicly revealed.

– Sean Fewster, Chief Court Reporter

ROBERT WAYNE COLLINS

Signing on as an investor can be daunting – particular when the deal seems too good to be true – so a well-respected, even famous, referee often soothes the jitters.

Seeing names like US Secretary of State John Kerry, Swiss Bank president Alex Bowler and Sultan Bin Mohammed of Saudi Arabia, then, would feel like a cast-iron guarantee.

It’s precisely that sort of thinking upon which career fraudster and conman Robert Wayne Collins capitalised in February 2014, netting him $400,000.

Collins duped 11 people into helping him reopen a non-existent bank that was going to fund infrastructure projects and other charitable causes in Papua New Guinea.

He later tricked those same people into handing over more money with promises of “blue chip, cream of the crop, high return” investment properties in New York City.

There were, of course, those among the 11 victims who smelled a rat and went searching to confirm Collins’ bona fides.

He was one step ahead of them, sadly, having crafted elaborate and professional-looking websites bolstering his claims and imaginary links to Kerry and his famous peers.

Fortunately, those websites fell apart under sustained scrutiny – as did Collins’ flimsy excuses for the lack of progress in Papua New Guinea – and his deceptions were revealed.

Although they alerted SA Police, the 11 investors chose instead to pursue Collins through the civil courts, asserting “misrepresentation and fraud”.

In December 2015, they won a landmark compensation judgment that required Collins to repay every last cent he had stolen, as well as interest and court costs.

Collins intended to appeal but ran into a new roadblock – SA Police had finished their own investigations, and charged him with numerous counts of fraud.

During an at times odd set of legal proceedings – during which Collins was accused of having falsified his own character references – the full extent of his criminal past came out.

Collins, the District Court heard, had spent 17 years in jail since 1973, and had committed fraud offences consistently over the course of 47 years.

Judge Liesl Chapman dubbed it “a trail of emotional and financial destruction”, saying Collins had used his victims’ money to pay off his mortgage, go on holiday and buy a Mercedes Benz.

He had, she said, stolen one victim’s $100,000 inheritance and spent all but $4000 of it in just five days.

“Your offending was premeditated, calculated, shameless and deliberate … I find you have no prospects of rehabilitation,” she said.

She jailed him for four years, leaving him ineligible to seek parole until sometime after his 81st birthday.

– Sean Fewster

GEORGE JOHN NOWAK

A year before declaring himself penniless in July 2014, former accountant George John Nowak, 61, was living the high life in a sprawling $4 million-plus Springfield five-bedroom mansion, complete with a ‘man-cave’, swimming pool and tennis court.

Turns out most of the opulence, including a Maserati, were being paid for through Nowak’s systematic and persistent deception of “mum and dad investors” who had trusted him with their retirement savings.

Nowak was the founder of the Charterhill group of companies, which was placed under external control in January 2014 as his web of deceit unravelled.

Corporate regulator ASIC started investigating the management and activities of the Charterhill Group which had been operating as a ‘one-stop shop’, providing advice to clients on the establishment of self-managed superannuation funds (SMSFs), rollover of existing super funds into an SMSF, sourcing and purchase of investment properties, property management, insurance and taxation.

Sentencing Nowak to 10 years in prison in April this year after he pleaded guilty to 18 fraud charges involving $1.2 million of lost retirement savings, Judge Sophie David described the offending as being of the utmost seriousness.

“Your offending has had a devastating impact on the victims,” she said.

“You did so to fund a lavish lifestyle.”

There were 16 victims, who had been robbed of their life’s savings and future dreams since 2012 – four of them alone had lost about $400,000.

Nowak had failed to hold the funds in a designated account and did not apply funds towards the intended property purchases.

The court heard Mr Nowak had instead used the funds to pay for company expenses and his personal expenses, including credit card repayments, lease of vehicles, including a Maserati and towards a multimillion-dollar home in Springfield.

He received a non-parole period of six years and three months for his guilty plea.

-Valerina Changarathil