Westpac SaferPay feature saves Queensland couple from losing $350,000 to scammer

A Queensland couple thought they were investing their cash safely, but when their bank got involved, they learned how close they’d been to losing a small fortune.

A Queensland couple who thought they were handing over their hard earned savings to invest in corporate bonds have escaped making a horrifying mistake of sending $350,000 to a scammer with the help of their bank.

Ricky and Elaine, who have asked to not have their surname published, had been researching corporate bonds to invest in after selling their home.

But after selecting one that seemed legitimate, their future success quickly became a living nightmare when they had transferred their cash over to a scammer masquerading as an investment company called Investment Gateway.

After inquiring about the company, Ricky began emailing and speaking on the phone directly with a man who identified himself as Mark Edwards.

A quick Google search appeared to show Mark Edwards to be a reputable investor who had been featured in several stories about the stockmarket.

“I didn’t do anything till I did all my research,” Ricky told NewsWire.

“I got the company details and put them into ASIC and it was listed some time since 2003, it had been going for quite some time, and I looked at their other financial institutions.”

Ricky said the bonds were attached to Commonwealth Bank, and again when he googled the code it appeared on the London Stock Exchange and checked all of his boxes.

Eventually, the couple decided to send their money through to the company to buy the bonds they’d been promised.

It was late on a Friday and Ricky was on the phone with “Mr Edwards” who was talking him through the website he’d sent him to secure escrow.

“We did that part of the procedure but it was like leading a lamb to slaughter,” Ricky said.

“They managed to separate you from being concerned about where your money goes to worrying about the task about securing the bonds.”

Ricky said once the couple chose which escrow to use, everything started happening “quite quickly” before entering the final step of sending through the money.

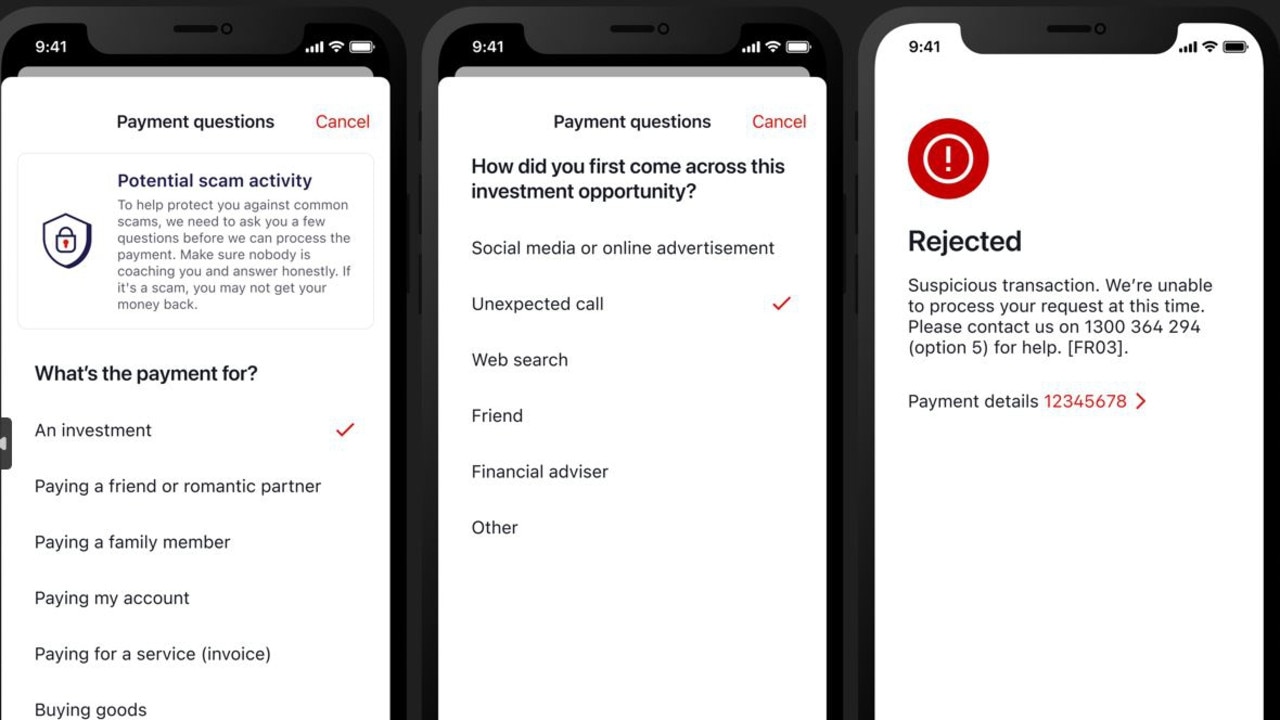

“It came time to put the transfer the money and it got to Westpac and Westpac asked all these questions,” he said.

“While he was on the line he kept saying ‘you’re bound to get all these questions’.

“While he was talking, I’d googled the (escrow) company and it’s a real company.”

After the transfer was completed, Ricky said he discovered the escrow company had only been set up four days before the deal.

While trying to call “Mr Edwards” repeatedly with no answer, Ricky kept searching online for more details about the escrow company where he’d just sent his money.

“I looked at the BSB but it was for the ANZ bank in Byron Bay,” he said.

“If it looked like a real corporate company in Melbourne, why did it have a Tuncurry address while using a Byron Bay bank.”

That’s when it clicked.

“I’d been scammed,” Ricky said.

“I’m one of the most careful guys you can come across, and he still got me.

“It was almost like telephone numbers, you forgot the real value of it.”

Ricky and his wife were “nervous all night” while they waited to call Westpac at 8am on Saturday morning.

“We rung up Westpac and the lady on the end of the phone was so good and said ‘the money is coming back into your account’ and they would have called us if we hadn’t called them,” he said.

“I was so relieved.

“I’d have lost my money if it wasn’t for that.”

The couple’s hard earned cash had been protected by Westpac’s SaferPay capability which puts a 24-hour hold on transfers the bank flags as a potential scam.

Westpac Head of Fraud Prevention Ben Young said the SaferPay capability allows people to avoid “considerable heartache”.

“Through the series of questions asked as part of Westpac’s SaferPay capability, the transfer was flagged as being a result of a potential scam and put on hold,” Mr Young said.

“Stories like Ricky and Elaine’s are becoming increasingly common as scammers become more and more innovative.

“Sophisticated investment scams are on the rise – even savvy people who have done thorough research can lose hundreds of thousands of dollars to scammers.

“Before you invest a large sum of money, discuss the opportunity with a trusted friend or family member, and consult with an expert before making a decision.

“And check before you invest with moneysmart.gov.au.”

Ricky warned others to always know who they’re dealing with when sending money, and encouraged people to meet them in person.

“You work hard all your life and as soon as you make a bit of cash, someone tries to scam it out of you,” he said.

“You don’t know how hard they work at it.

“You just never know who you think you're talking to but the amount of stuff they can make up on the internet is so easy.

“Never transfer send money to a company or person you’ve never met before.

“Meet them in the flesh like a bank manager or go into their offices

“He had all the words, all the swagger about investing.

“But even though it’s a real bond, that company wasn’t real.

“They went to great lengths to make me think it was real.

“They set up a company four days before knowing they were going to scam me.

“He knew I was a bit nervous and knew I was sceptical but he still got the chance.”

Despite having his money secured, Ricky said the ordeal wasn’t over and when Monday came around, “Mr Edwards” came calling.

“He had the audacity to call me back,” Ricky said.

“When I questioned him, he said ‘I assure you I’m real’.”

Originally published as Westpac SaferPay feature saves Queensland couple from losing $350,000 to scammer