Valuer-General’s figures: Search what your Adelaide suburb is now worth

The latest Valuer-General’s figures lay bare the growing abyss between SA’s haves and the have-nots – with a whopping boost to home values in 12 months. Search your suburb here.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

Adelaide’s median home value has increased by a whopping $85,000 over the past 12 months, highlighting the growing abyss between the haves and the have nots in South Australia.

According to the latest Valuer-General’s quarterly figures, metropolitan Adelaide’s median house value sits at $785,000 – up $25,000 or 3.29 per cent over the past three months and a massive 12.14 per cent or $85,000 over the past 12 months.

This works out to an increase of $1634.61 per week – just $100.79 less than the $1,735.40 weekly wage of an average full-time South Australian worker, according to Forbes.

The growth in median home value in the past year is just $5240.80 less than the $90,240.80 an average full-time worker would have earned.

SA’s statewide figure is up too, with median house values up 4.93 per cent – or $32,250 – for the quarter and 13.32 per cent – or $83,250 – over the past 12 months to $708,250.

Real Estate Institute of South Australia chief executive officer Andrea Heading said while it was great to see an increase in the median price, she was pleased to see it occur while the number of sales was also increasing.

According to the data, there were 6,528 sales for this year’s second quarter, up from 5586 in the previous quarter and 6165 during last year’s second quarter.

“While the increases in the median price demonstrated that buyers were still willing to pay premium prices, the increase in the volume of sales also showed that more people were entering into the real estate market and were willing to pay transparent prices,” she said.

According to the report, the median metropolitan unit value is also up 7.57 per cent or $40,250 over the past quarter, and 17.94 per cent, or $87,000, over the past 12 months to a $572,000 median.

The median-priced unit and apartment values in the CBD rose by $26,500 over the past three months and $40,000 over the past 12 months to $486,500.

“We commend the State Government on taking the issue of housing supply seriously and we look forward to continuing our dialogue with them in addressing this and the complementary issue of housing affordability,” Ms Heading said.

Of suburbs to have recorded at least 10 sales for this year and last’s first quarters, Royal Park recorded the greatest percentage increase, with the median up 53.46 per cent, or $319,612, to $917,500.

This is from 11 sales last quarter and 18 in the previous quarter – experts consider 10 sales to be sufficient in calculating a statistically reliable average – and represents a daily increase of $875.64, or $36.48 an hour, over the past 12 months.

South Australian Council of Social Service chief executive officer Ross Womersley said

anybody that isn’t in the housing market was “being left behind at a rate of knots”.

READ MORE

SA’s mortgage-free hotspots revealed

Shock amount parents are giving kids to buy a home

Land lords: Elite Adelaide schools’ $12bn real estate empire

Why voters aren’t buying it in SA’s marginal seats

Ghost towns: SA’s vacant homes help fuel rental crisis

“Part of the reason for that is because we simply don’t have enough supply, and we particularly don’t have enough supply of rental properties, and if you’re serious about wanting to purchase into the market it just looks absolutely absurd, I suspect, to many young people, in particular,” he said.

“I think we made a real error of judgment when we tied the housing system into a wealth creation system, and until we start to undo some of the things that make housing into an interesting investment rather than housing as a place that we call home, we’re going to continue to see this continuing rise in the value of properties that leaves a whole lot of people in circumstances where they can never imagine having a safe affordable home.

“You are genuinely talking about an increase in the value of an average property that is equivalent to yet another year of the average wage.”

Seller voices concern for young buyers

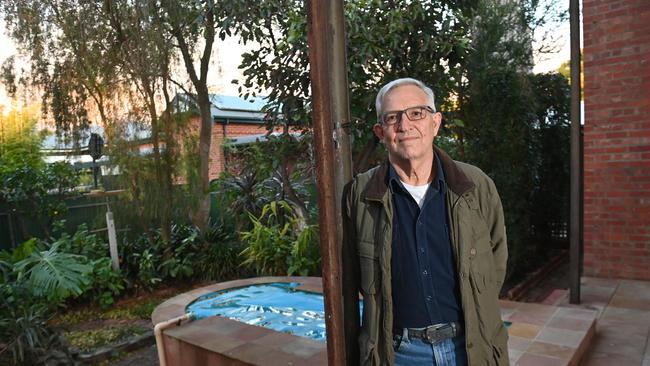

Retiree Corbet Stain, 68, has just sold his Malvern home of 33 years, and says while he has happily benefited from the state’s runaway home value growth in recent years, he has far greater concerns about what it means for those trying to enter the market.

The former engineering worker said he felt for today’s first homebuyers.

“I would I would prefer to see the houses not going up in prices,” he said.

“I remember my first house was $32,000 back in 1976.

“I was earning $8000 a year, so it was four times my annual income, but the interest rates were massive back then – I think around 13 or 14 per cent or something like that, but it was easier to get the deposit together.

“I think these days it’s so much more difficult for younger people because the actual value of the property is so much more than their income and they have a much harder time to getting the deposit together.”

Mr Stain recently sold his unique 114a Cheltenham St home – formerly Municipal Tramways Trust Converter Station Number 4 – at auction for $1.755m.

“We bought it at auction in 1991 for $185,000 grand and over the years I would have spent easily a couple hundred thousand in renovations and updates,” he said

“I did most of the work myself and my brother has always helped me – we help each other because we’re both handy.

“I’ve always I’ve always sort of worked on the formula of house prices doubling every 10 years and it has never been too far wrong providing you keep it up to date over the years.

“But obviously the growth we’ve seen recently has been significant and that has me very concerned for young people trying to save.”

Just give us a break …

For today’s hopeful homebuyers, particularly younger buyers trying to get a headstart on their financial independence, the latest Valuer-General’s figures will come as a further slap in the face.

Living through a cost of living crisis in a property market with stock shortages in both the sales and rental sectors, there’s no denying they are doing it tough.

It’s a view Carlos Toro, 20, holds, saying soaring house prices were delaying his ambitions of home ownership.

The Tea Tree Gully area resident said he had been working towards buying his own home for some time, but rising property values were keeping him out of the market.

“It’s getting harder and harder every year to be able to buy a home and the unfortunate thing is that most young people aren’t financially literate,” he says.

“Their parents aren’t telling them to put away money and save and to even have a start to be able to even think about owning a home

“I find a lot of teenagers and young adults get into the habit of spending and going out, and with everything going up and interest rates rising, that type of behaviour doesn’t help whatsoever.”

Mr Toro says his original goal was to own his own home some time next year, but now he’s had to adjust to a change of plan.

“With prices rising like they have, I’m going to have to put a big pause on it.”

Mr Toro, who works at a sneaker store, owns a strawberry and chocolate stall in Rundle Mall and also studies, said it was getting increasingly hard for young people.

“It’s disappointing because I’m smart with my money but for others I feel sad that they’re not going to be able to achieve certain things by certain ages,” he said.

“It would be great to see house prices stabilise.”