Property prices continue to slide, but it could be short lived

Property prices continued to slide in January across nearly every capital city, but buyers are being urged to act quickly as the downturn could be short-lived.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

Australia’ housing market is continuing its slide for the first time in almost two years, as interest rate pain continues to impact the property market.

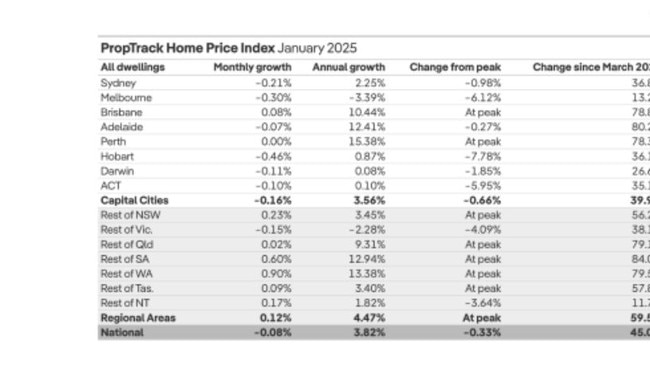

Data released by PropTrack shows national house prices were down 0.08 per cent in January, falling for the second consecutive month, following house price increases every month since February 2024.

The small decline follows a 0.17 per cent decrease in property prices in the month prior, although zooming out the data shows national house prices are still up 45 per cent since March 2020.

REA Group senior economist Eleanor Creagh said the softer end to 2024 carried over into the new year.

“While housing demand remained resilient to persistent affordability constraints, the pace of home price growth slowed throughout 2024, culminating in small falls over the past two months,” Ms Creagh said.

“This softening in growth has occurred alongside a surge in stock for sale, giving buyers more choice and reducing the urgency to transact.

“Affordability challenges, weaker economic conditions and the sustained higher interest rate environment have also been contributors to slowing – and reversing – growth,” she said.

All four of Australia’s largest banks now believe there will be a rate cut in February when the Reserve Bank board holds its meeting on February 17-18, following the trimmed mean inflation rate coming in at 3.2 per cent compared with RBA expectations of 3.4 per cent.

“We now expect the RBA to cut the cash rate by 25 basis points in February,” NAB chief economist Alan Oster wrote in a note.

“The Q4 CPI confirms that inflation has moderated more quickly than the RBA expected and sets up a likely downward revision to the inflation profile in the February statement on monetary policy.

“This now makes February the most likely starting point for a gradual easing in interest rates.”

The falls in house prices were led by capital city declines falling by 0.16 per cent in January, offsetting regional price rises of 0.12 per cent over the same period.

The falls were led by Hobart down 0.46 per cent, followed by Australia’s two largest cities, with Melbourne and Sydney down 0.30 and 0.231 per cent respectively.

Perth remained flat and Adelaide slid marginally, down 0.07 per cent.

Brisbane is the only capital city to record high price rises in January, although it only lifted 0.08 per cent in the month.

Perth, Adelaide and Brisbane are still Australia’s top three performing capital cities rising 15.38, 12.41 and 10.44 per cent respectively.

For would be homeowners Ms Creagh says the slowing house prices could be short-lived with the market likely to be spurred on by reduced rates throughout the year.

“As interest rates move lower this year boosting borrowing capacities, improving affordability and buyer confidence are expected to drive renewed demand and price growth,” she said.

Although Ms Creagh does not think the runaway house prices will repeat again.

“ However, the stretched starting point for affordability will likely dampen the uplift in prices compared to prior easing cycles, resulting in the pace of home price growth trailing the strong performance of recent years,” Ms Creagh said.