Nick Xenophon vows election brawl over sell-off of S.Kidman’s SA cattle empire to China

THE proposed sale of Australia’s biggest cattle station is “an election battleline” which could swing crucial support of SA senator Nick Xenophon to decide which party takes office at the next election.

SA News

Don't miss out on the headlines from SA News. Followed categories will be added to My News.

- ISSUES: Election history in the making

- LIVE BLOG: Election is about truth, says PM

- $370m takeover offer for S.Kidman & Co

- MEETING: Arrium creditors hear of $4bn debt burden

THE proposed sale of Australia’s biggest cattle station is “an election battleline” which could swing the crucial support of influential South Australian senator Nick Xenophon and help decide which party takes office at the next election.

Declaring that the sale “isn’t just selling the farm, it’s selling Australia’s largest farm”, Senator Xenophon said his potential support for one of the major parties could “absolutely’’ be contingent on blocking the Kidman deal.

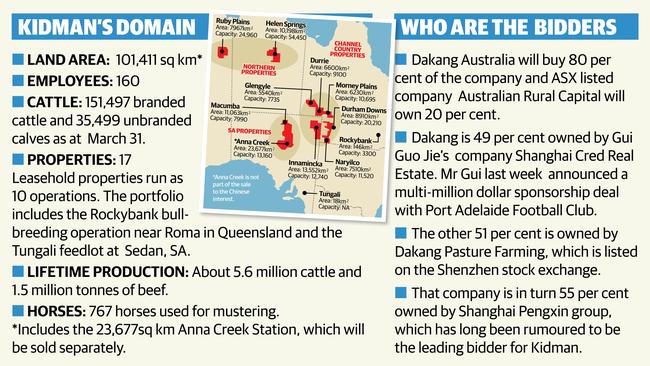

The board of South Australian cattle company S. Kidman and Co. announced yesterday that Chinese company Dakang Australia — linked to billionaire Gui Guojie who last week sponsored Port Adelaide Football club to the tune of $3 million — and Australian Rural Capital, have agreed to buy the cattle empire for $370.7 million.

The deal, which would lead to 80 per cent Chinese ownership of the company and Kidman’s massive landholdings, is subject to approval from the Foreign Investment Review board, and the Treasurer.

But with the deal’s acceptance date set at August 5 — more than a month after an expected double dissolution election on July 2 — Senator Xenophon has vowed to campaign on the sale, as well as a broader overhaul of Australia’s foreign ownership laws.

“This will be an election battle line — make no mistake about it, this will be an election issue,’’ Senator Xenophon said.

The support of his Nick Xenophon Team (NXT) candidates could be crucial in electorates across the nation in the looming election.

The major parties are not diverging widely on their attitudes to foreign ownership however, or on the claimed need to overhaul the current regime, which allows thresholds as high as $1.09 billion for investors from Chile, New Zealand and United States buying Australian farming land.

The cut-off for privately owned Chinese interests is $15 million.

Senator Xenophon has long pushed for more transparent foreign ownership laws, and he said there should be more stringent national interest tests on major foreign land or business acquisitions.

“The major parties are out of kilter with community attitudes,’’ he said.

“What I think this shows is that the rules are stacked against local Australian investors. I’m pushing for an overhaul of foreign investment rules to have a clearer national interest test.

“That needs to consider whether there’s a local, viable bid in place. This isn’t just selling the farm, it’s selling Australia’s largest farm.’’

Transport magnate Lindsay Fox’s company Linfox was linked to the deal, however, the Kidman Board had indicated Australian bids were always welcome and would be considered alongside foreign bids. Linfox did not return calls yesterday.

A spokesman for Treasurer Scott Morrison said yesterday the Government had already “significantly strengthened Australia’s foreign investment framework”.

Measures introduced by the Coalition Government included:

A NEW agricultural land foreign ownership register and reduction of the screening threshold for proposed foreign purchases of agricultural land by private investors to $15 million.

FIRB screening of direct interests in agribusinesses valued at $55 million or more

FIRB assessment of the sale of critical state-owned infrastructure assets to private foreign investors.

FORCED sales of 27 properties, worth more than $76 million, illegally acquired by foreign nationals.

The Treasurer’s spokesman said a decision on the Kidman sale would not be rushed.

“The Government will not be making a hasty decision on this very significant matter,’’ he said.

“The Government will not make a decision until we are entirely satisfied with the national interest issues that relate to this transaction.

“The Government will continue to follow the established statutory processes that are provided for to ensure the protection of the national interest.”

Opposition treasury spokesman Chris Bowen said the Government’s treatment of foreign investment was “dysfunctional’’, but he did not spell out how a Labor Government might change the existing framework.

“It’s got to the point where it’s turning away foreign investment and jobs in Australia,’’ Mr Bowen said.

“Ultimately, the final call on the Kidman & Co sale is a matter for the Treasurer under the national interest test.

“Nick Xenophon needs to explain why his candidate for Mayo has supported a ban on all new foreign investment — a policy that would be devastating for jobs in South Australia.”

Kidman & Co has been up for sale for just more than a year. The Federal Government stopped any full sale of the Kidman assets from going ahead on November 19 last year, citing national interest grounds. It is understood this was because Anna Creek station, on the southwest corner of Lake Eyre, is on the Woomera weapons testing range.

Anna Creek was later carved out of the deal, and will be sold to the neighbouring Williams Cattle Company.

Dakang Australia, which will own 80 per cent of Kidman if the deal announced yesterday goes through, is 49 per cent owned by Port sponsor Mr Gui’s company, Shanghai Cred Real Estate.

Dakang Pasture Farming, which is listed on the Shenzhen stock exchange owns 51 per cent. That company is in turn 55 per cent owned by Shanghai Pengxin group, which has long been rumoured to be the leading bidder for Kidman.

Australian Rural Capital chairman James Jackson, who is also chairman of Elders, said the consortium would continue to grow the business, and would invest $46.3 million over the first year of ownership.

“The consortium is supportive of the current strategy and direction of Kidman and intends the business to be continued in its present form, with the new owners providing opportunities to grow the business, both within Australia and ultimately internationally,’’ he said.

“We expect to be working very closely with the existing Kidman management and drawing on the commodity and trading expertise of ARC to realise the full potential of the business.”

“We expect our initial investments to provide an additional 50 remote regional jobs in the first year of ownership.

“We intend to continue investing where it is required to improve productivity and performance, apply our insights into the rapidly growing Chinese market, and bring proven know-how in the development of integrated supply chains and marketing models.

“With the benefit of shareholders who are committed to long and productive partnerships, we hope to increase both Kidman’s export and domestic capacity and generate additional regional employment.”

The consortium said it intended for the head office to remain in Adelaide.

For the deal to go through, it would need to be accepted by 90 per cent of Kidman’s 58 shareholders.

The Kidman business owns 160,000 cattle and 101,000sq km of leasehold land run as 17 properties in South Australia, Western Australia, Queensland and the Northern Territory.

It is the largest leaseholder of Australian pastoral land and has turned over an average of about 50,000 tonnes of beef a year, the majority of which is exported.

A spokeswoman for Nationals Leader and Agriculture Minister Barnaby Joyce referred inquiries to the Treasurer’s office, and said Mr Joyce’s views on the Kidman sale did not diverge from the Treasurer’s.