Administrator calls on big four banks for another $200m to preserve Arrium

SA Treasurer Tom Koutsantonis says Arrium administrator KordaMentha’s $200 million request to the banks to keep the operations going is “an appropriate ask”.

SA News

Don't miss out on the headlines from SA News. Followed categories will be added to My News.

- SAVED: Offshore Patrol Vehicles build an SA lifeline

- FOREIGN STEEL: New RAH has some of it

- BHP: Olympic Dam expansion could help Whyalla

- ARRIUM: Union-selected KordaMentha takes charge

SA Treasurer Tom Koutsantonis says Arrium administrator KordaMentha’s $200 million request to the banks to keep the operations going is “an appropriate ask”.

“The Australian banks have got what they wanted; they have pushed Arrium into administration.

“If they want to see the company continue to trade and minimise their losses as creditors, it’s important that Arrium have working capital,” he told reporters on the sidelines of a mining conference in Adelaide today.

“That working capital should absolutely and naturally come from the Australian banks because they are the ones that pushed the company into administration.”

He said the situation with Arrium had “stabilised”.

“Now we are focused on how do we get Arrium spun out of administration and back into trading as normal.

“This is a company that’s got 85 per cent of the Australian market share; it’s a very imp Australian company and it’s important that we have this ready to go before the Federal election commences.”

Mr Koutsantonis will be in Whyalla on Friday, meeting with “vulnerable” trade creditors to see what support the government can offer.

On the workers, he said there would be no more redundancies and wages are being paid as normal.

“Obviously July 2 is becoming a hard deadline for the Commonwealth election.

“Whyalla, rightly, and the Australian steel industry should be front and centre of this election campaign.

“It’s important that whatever capital investments we are looking at are front and centre right in the middle of this Federal election campaign so Australians can judge which political party has the most to offer for the people of Whyalla and the Australian steel industry.”

KordaMentha calls on banks for $200m

ADMINISTRATOR Mark Mentha is negotiating with Australia’s big four banks about securing an additional $200 million, following the first creditors’ meeting of embattled mining and steelmaking group Arrium.

Coming on top of the $1 billion already owed collectively to NAB, CBA, Westpac and ANZ — all of which were elected to a committee of creditors at Tuesday’s meeting — it is understood that the money would allow KordaMentha to effectively enforce its “business as usual” approach.

Since assuming control of the administration last week KordaMentha, and Grant Thornton before them, has reassured worried stakeholders that normal business operations will continue while it sorts through the company’s dire financial situation.

Arrium, which has 3000 employees and contractors in Whyalla and 10,000 suppliers across Australia, has debts of around $4 billion. An estimated $2.8 billion of this is to financiers, with the remainder comprising debts to suppliers and employee entitlements.

Given the complexity of the administration, it is expected that an extension will be sought for the second creditors’ meeting.

Likely to be held in early June, this will see a detailed state of affairs and recommended strategies presented to creditors.

About 150 Arrium workers, contractors and suppliers gathered at Whyalla’s Westland Hotel to listen to a simulcast of the creditors’ meeting, which was held in Sydney.

Chairing the first creditors’ meeting from Sydney was Mr Mentha, with audio simulcast into Whyalla and Newcastle.

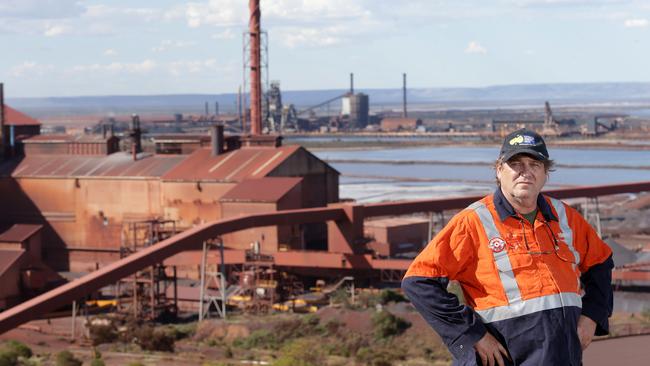

Before the meeting, OneSteel worker of 38 years, Paul Pacini, laid much of the blame on the company’s current financial state on government procurement policies.

“The Federal Government needs a bullet up the arse,” he said, flanked by nodding Australian Workers’ Union officials.

“The work they’re doing now is just about winning votes.”

Mr Mentha said that Arrium, which has 3000 employees and contractors in Whyalla and 10,000 suppliers across Australia, has estimated debts of $4 billion.

In response to questions from concerned suppliers, Mr Mentha said the administrator was “fully aware” of the hardship caused by the non-payment of debts, especially to small businesses that rely almost solely on Arrium.

“We need to take a deep breath, step back. We’re not punting on this, we’re taking a methodical approach,” he said.

“We’ve already addressed spotfires (with suppliers) so they don’t become bushfires.”

The administrator’s appointment has been formalised and a committee of creditors has now been established:

* Steve Cook (representing non-union workers),

* AWU,

* ACTU,

* BIS Industries,

* Morgan Lewis (agent for US note holders),

* Westpac,

* NAB,

* CBA,

* ANZ,

* Morgan Stanley,

* SA Government,

* K&S Freighters,

* Lucas Group,

* Commonwealth of Australia, and

* BBVA Group.

Arrium victims cling to hope

THE “business as usual” mantra adopted by the administrators of Arrium may need tweaking following yesterday’s first creditors’ meeting.

Held in Sydney and simulcast to about 150 worried workers, contractors and suppliers at Whyalla’s Westland Hotel, KordaMentha partner Mark Mentha was questioned on the accuracy of the phrase given suppliers and contractors – many of them small businesses – have not, in most cases, been paid in months.

Since assuming control of Arrium last week KordaMentha, and Grant Thornton before it, has reassured worried stakeholders that it’s business as usual while the company’s dire financial situation is sorted through.

However, Sydney-based Hal Longhurst from Acclaim Hydraulics challenged Mr Mentha, saying such a statement was factually incorrect.

“Business as usual means I deliver goods and services, and I don’t get paid,” he said.

In response, Mr Mentha said he was “fully aware” of the hardship caused by the non-payment of debts, particularly to small businesses relying largely on Arrium business.

“It’s business as much as usual. We’ve already addressed spot fires (with suppliers) so they don’t become bushfires,” he said.

Arrium has debts of about $4 billion, with an estimated $2.8 billion owed to financiers and the remainder relating to suppliers’ debts and employee entitlements.

Following yesterday’s meeting, Mr Mentha said he was in negotiations with Australia’s big four banks about securing an additional $200 million in funding that would allow KordaMentha to effectively enforce its stated approach.

“So far, we have been able to manage cash flows within the requirements, but there may come a point where we need to manage trading in respect to some critical supplies, or to manage capex requirements,” he said.

One of the affected companies is Gadaleta Steel Fabrication, which employs about 90 people. It is owed more than $1 million by Arrium.

In addition to its fabrication work, GSF provides an around-the-clock maintenance service to the company and chief financial officer Di Davis said this would continue, despite the money owed.

Failure to do so would only increase the chances of Arrium not surviving, she said.

“Obviously we have to pay the bills at the end of the day, so we’re expecting to speak to the administrator this week to see where things are at,” she said.

“We started feeling something was not quite right when the (Arrium) payments were getting very hit and miss. We normally trade on 60 days with them, but in the end it was going well beyond that.

“There were a lot of excuses why the invoices weren’t being paid – orders not being updated and things like that. Everyone hopes Arrium can trade its way out and I like to think it will, but it’s a bit early to say.”

Prior to the creditors’ meeting, steelworker Paul Pacini laid much of the blame for Arrium’s financial woes on government procurement policies.

“The Federal Government needs a bullet up the a--e,” he said. “The work they’re doing now is just about winning votes.”

A committee of creditors was finalised at yesterday’s meeting. It includes representatives from NAB, CBA, NAB, Westpac, the SA and federal governments, and the Australian Workers’ Union.

The date for the second creditors’ meeting has not been set, with it likely to be held in early June.

Modernising steelworks is important

Ahead of the first creditors’ meeting, the union representing Whyalla workers said it wants the Federal Government to explore co-investment opportunities.

Modernising Arrium’s steelworks so it can supply steel to future shipbuilding projects would enhance the company’s chances of survival, according to the union that represents the majority of its Whyalla workers.

In response to Prime Minister Malcolm Turnbull’s announcement that the construction of 12 offshore patrol vessels will begin in Adelaide in 2018, the Australian Workers’ Union wants a co-investment arrangement to be urgently explored by the Federal Government. National secretary Scott McDine is calling it a “golden opportunity”.

“In the case that Australian steelmaking operations, like the Whyalla steelworks, would require an upgrade to manufacture the grade of steel required, the Government should look to enter into a co-investment arrangement,” he said.

“Co-investment arrangements have been a great success in the past and have enabled economically beneficial sites to stay open and thrive.”

Both the state and federal governments have said that any Arrium support measures must be based on innovation and efficiency improvements.

The PM also announced WA-based Austal as the preferred builder of 21 steel-hulled Pacific Patrol Boats, which will replace the existing aluminium-hull fleet. It is understood that Australia doesn’t currently make the high-tensile steel required for the PPBs.

However, Mr McDine said Australian projects being predominantly built with foreign steel must not be allowed to continue.

“This kind of approach is putting entire steelmaking communities at risk,” he said.

Defence Minister Marise Payne confirmed local steel requirements for the offshore patrol vessels and Future Frigates.

KordaMentha has reached an agreement with Morgan Stanley after the bank launched court proceedings in the US that sought to have its $US75 million loan immediately repaid.

It is understood that KordaMentha has assured Morgan Stanley that it will not draw money from Arrium’s profitable Moly-Cop entities — which the bank loaned to — for the payment of its fees.

luke.griffiths@news.com.au